Consumer Portfolio Services Inc Reports Mixed Results for Q4 and Full Year 2023

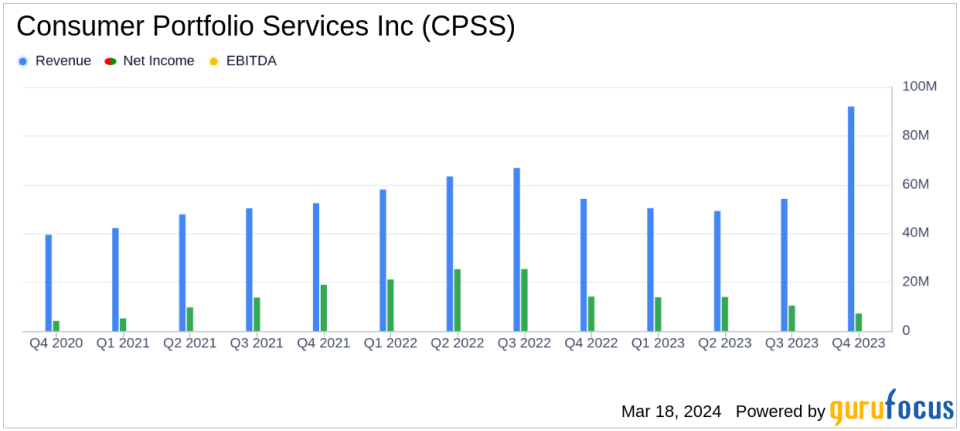

Quarterly Revenue Increase: Q4 revenue rose by 10.8% year-over-year to $92.0 million.

Net Income Decline: Q4 net income fell to $7.2 million, a decrease from $14.1 million in Q4 2022.

Annual Revenue Growth: Full year revenue increased by 6.8% to $352.0 million.

Full Year Net Income Drop: Annual net income decreased to $45.3 million from $86.0 million in the previous year.

Portfolio Expansion: Total managed portfolio grew to $3.195 billion, up from $3.001 billion at the end of 2022.

Increased Delinquencies: Delinquencies over 30 days rose to 14.55% of the total portfolio.

Charge-offs and Recoveries: Annualized net charge-offs increased to 7.74% from 5.83% in Q4 2022, with recovery rates at 34.3%.

On March 15, 2024, Consumer Portfolio Services Inc (NASDAQ:CPSS) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which specializes in providing indirect automobile financing to individuals with past credit problems or limited credit histories, reported a mixed set of results characterized by revenue growth but also increased expenses and a decline in net income.

Financial Performance Overview

For the fourth quarter of 2023, CPSS reported revenues of $92.0 million, marking an increase from the $83.0 million reported in the same quarter of the previous year. However, net income for the quarter was $7.2 million, or $0.29 per diluted share, a significant decrease from the $14.1 million, or $0.59 per diluted share, reported in Q4 2022. The company's total operating expenses for the quarter rose to $82.1 million from $64.7 million in the prior-year period, impacting the bottom line.

On an annual basis, CPSS saw its revenues grow to $352.0 million for the twelve months ended December 31, 2023, up from $329.7 million for the same period in 2022. Despite this increase, net income for the year dropped to $45.3 million, or $1.80 per diluted share, compared to $86.0 million, or $3.23 per diluted share, in the previous year. The increase in total expenses to $290.9 million from $213.5 million contributed to the decline in profitability.

Portfolio and Credit Quality

CPSS's receivables totaled $2.970 billion as of December 31, 2023, an increase from $2.795 billion at the end of 2022. The company's managed portfolio, including receivables serviced for third parties, grew to $3.195 billion. However, the company faced challenges with rising delinquencies, which stood at 14.55% of the total portfolio, up from 12.68% the previous year. Annualized net charge-offs also increased to 7.74% of the average portfolio compared to 5.83% in the fourth quarter of 2022.

Charles E. Bradley Jr., Chief Executive Officer of CPSS, commented on the results, stating,

We reported solid results for the fourth quarter and for the full year 2023. Strong loan originations led to continued revenue growth and brought our managed portfolio to new record high levels."

Looking Ahead

CPSS has scheduled a conference call to discuss its fourth quarter 2023 operating results on March 18, 2024. The company's performance in the upcoming quarters will be closely watched by investors, particularly in light of the increased operating expenses and credit losses that have impacted recent earnings.

Consumer Portfolio Services Inc's ability to manage its expenses and credit quality will be critical in maintaining its growth trajectory and profitability. Value investors and potential GuruFocus.com members interested in the credit services industry may find CPSS's evolving financial landscape to be of particular interest as they assess the company's potential as an investment opportunity.

Explore the complete 8-K earnings release (here) from Consumer Portfolio Services Inc for further details.

This article first appeared on GuruFocus.