Container shipping rates spike as Red Sea crisis draws first blood

Maersk, the world’s second-largest ocean carrier, gambled that a U.S.-led military force, Operation Prosperity Guardian, would allow safe passage through the Red Sea. That gamble has failed.

On Tuesday, Maersk said it will suspend Red Sea transits indefinitely and reroute ships around Africa’s Cape of Good Hope. The decision followed attacks on the container ship Maersk Hangzhou, which was struck by a Houthi rebel missile on Saturday and threatened by four Houthi boats on Sunday.

Armed guards on the Maersk Hangzhou exchanged fire with the Houthis, whose boats approached within 70 feet of the container ship before U.S. military helicopters intervened. After the Houthis fired on U.S. forces, the helicopters took out three of the four boats, killing 10 Houthi rebels.

The attacks in the Red Sea continue. U.S. Central Command confirmed that the Houthis fired two anti-ballistic missiles on Tuesday that landed in the vicinity of passing commercial ships. The Houthi spokesperson confirmed Wednesday that the missiles were targeting the container ship CMA CGM Tage.

As supply chain issues mount and missile launches persist, there is increasing talk of ground strikes in Yemen by the U.S.-led coalition. The Pentagon has detailed plans on striking Houthi drone and missile bases, according to The New York Times. U.K. Defense Secretary Grant Shapps warned in an editorial in The Telegraph on Monday: “We won’t hesitate to take further action to deter threats to freedom of navigation in the Red Sea.”

Intensified military action in the Red Sea is causing container shipping spot rates and some container shipping stocks to surge.

For cargo importers, the outlook is now clear: higher freight costs and longer delays. For liner profits, sentiment is increasingly bullish — but there are uncertainties.

Spot rates and surcharges are rising fast, but liner costs are also increasing due to much higher fuel consumption from longer voyages, as well as other expenses (offset by savings on canal tolls). Meanwhile, quarterly liner cargo volumes could be hard-hit in the near term as ships are tied up in diversions.

Maersk had 38 vessels scheduled to transit the Red Sea en route to Europe and the U.S. East Coast prior to Tuesday’s announcement, plus another 25 ships with routes labeled “to be determined.” These vessels will now presumably take the longer route.

Spot rate indexes spike

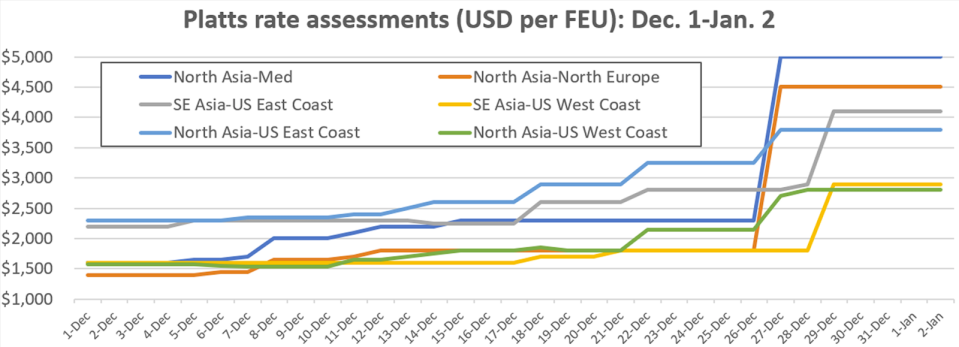

Different spot rate indexes use different methodologies and come up with different rate assessments, but they all point to the same steep upward trend.

The Shanghai Containerized Freight Index (SCFI) spiked 40% in the week ending Friday, to 1,760 points, its highest level since October 2022. The SCFI has more than doubled since this October.

Linerlytica said Monday that the latest week marked only the fourth time since 2009 that the SCFI increased 40% or more in a single week.

“All long-haul routes recorded strong rate gains, led by Asia-Europe trades, with the elevated rates expected to hold through January and February as capacity will remain tight in the next six weeks,” said Linerlytica, which noted that 12% of global capacity is already being diverted and those numbers “will continue to rise after the latest Houthi attack.”

Platts, a division of S&P Global (NYSE: SPGI), put Tuesday’s spot rates on the North Asia-Mediterranean route at $5,000 per forty-foot equivalent unit, more than double rates of $2,300 per FEU on Dec. 26 and more than triple rates of $1,600 at the beginning of December.

Platts assessed North Asia-North Europe rates at $4,500 per day on Tuesday, up 150% from Dec. 26 and 221% from Dec. 1.

Most Asia-U.S. East Coast services rerouted from the Panama Canal to the Suez Canal due to Panama’s drought, meaning that Red Sea attacks are affecting rates in this lane as well. And even though Asia-West Coast services are not directly affected, they too are feeling a knock-on effect, according to Platts’ data.

Platts put Southeast Asia-U.S. East Coast rates at $4,100 per FEU, up 86% since the beginning of December, and Southeast Asia-U.S. West Coast rates at $2,900 per FEU, up 81%.

It assessed North Asia-U.S. East Coast rates at $3,800 per FEU, up 65% versus the beginning of December, and North Asia-U.S. West Coast rates at $2,800 per FEU, up 78%.

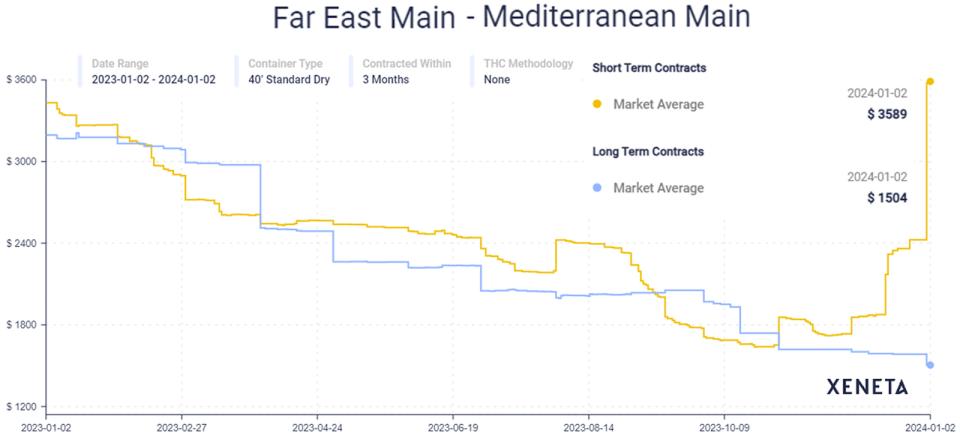

Xeneta tracks both short-term (spot) and long-term (contract) rates. According to its data, average short-term rates on the Far East-Mediterranean route had skyrocketed to $3,589 per FEU as of Tuesday, spiking 48% in just the past few days.

The short-term average in this lane is now more than twice the average long-term rates signed in the past three months of $1,504 per FEU.

The Freightos Baltic Daily Index (FBX) also shows the extreme impact of Red Sea disruptions. As of Tuesday, the FBX China-Mediterranean rate was at $5,157 per FEU, up 80% from the day before and 2.6 times higher than rates at the beginning of December.

Zim stock roller coaster continues

Trading shares of Zim (NYSE: ZIM) is the most popular way for stock pickers to bet on how spot shipping rates will affect future container liner earnings.

The Zim stock roller-coaster ride continued on Tuesday.

Between Dec. 1 and Dec. 22, Zim’s stock surged 60% as a result of sectorwide diversions around the Cape of Good Hope, a positive for spot rates. (Diversions reduce effective transport supply, pushing the balance of transport supply versus cargo demand in favor of liners.)

On Dec. 24, Maersk announced it would resume Red Sea transits under the protection of Operation Prosperity Guardian. When stock markets reopened after the Christmas holiday break on Dec. 26, Zim’s stock plunged as much as 18% in midday trading on more than quadruple average volume, on the assumption that fewer diversions would be negative for spot rates.

Then, on Tuesday, when markets reopened after the New Year’s holiday break, Zim’s stock jumped 13% on more than double the average volume as a result of the deadly military action over the weekend and Maersk’s decision that it will not transit the Red Sea, after all.

Click for more articles by Greg Miller

Related articles:

How safe is Red Sea? Different shipping lines have different answers

Red Sea fallout much greater for containers than tankers, bulkers

Red Sea chaos should boost tanker and container shipping rates

Why attacks on container ships caused container stocks to jump

Zim container ships divert as threat to Israel-linked vessels mounts

Yet another shipping ‘chokepoint’ risk as Yemen rebels attack

The post Container shipping rates spike as Red Sea crisis draws first blood appeared first on FreightWaves.