ContextLogic Inc (WISH) Reports Sharp Revenue Decline and Narrowed Net Loss in Q4

Revenue: Q4 revenue plummeted by 57% YoY to $53 million.

Net Loss: Net loss improved to $68 million from $110 million in Q4 2022.

Adjusted EBITDA: Adjusted EBITDA loss reduced to $54 million from $95 million YoY.

Asset Sale: Agreement to sell ecommerce platform to Qoo10 for approximately $173 million.

Stock Performance: Purchase price represents a 44% premium to the stock price before the announcement.

Guidance: ContextLogic has discontinued providing guidance due to the pending transaction.

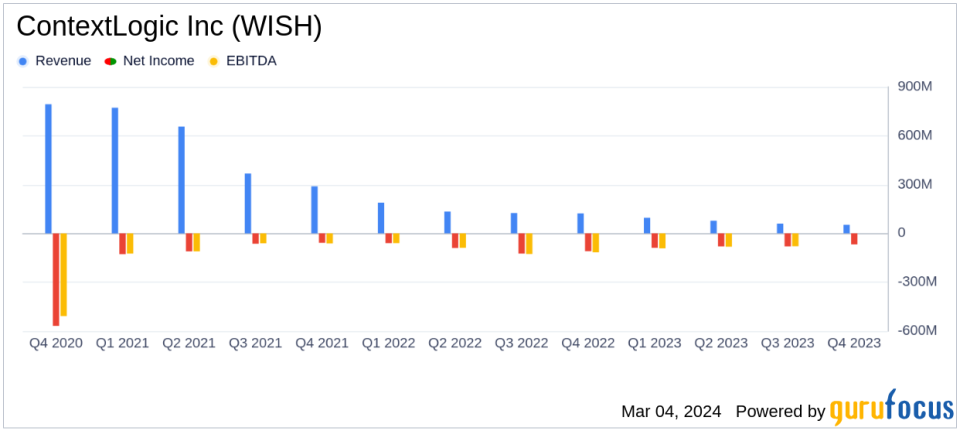

On March 4, 2024, ContextLogic Inc (NASDAQ:WISH), a prominent mobile ecommerce platform, disclosed its financial outcomes for the fourth quarter and fiscal year 2023 through an 8-K filing. The company, known for its personalized and diverse range of products, faced significant challenges in the quarter, with revenues taking a steep dive of 57% year-over-year (YoY) to $53 million. This decline was observed across all revenue streams, including Core Marketplace, Product Boost, and Logistics.

Financial Performance and Challenges

ContextLogic's net loss for the quarter showed improvement, narrowing to $68 million from a net loss of $110 million in the same period last year. This was reflected in a reduced net loss per share of $2.82, compared to $4.80 per share in the fourth quarter of fiscal 2022. Adjusted EBITDA also saw a decrease in losses, coming in at $54 million, down from a loss of $95 million YoY. The company's cash flow situation remained challenging, with $75 million used in operating activities.

The company's performance is critical as it operates in the highly competitive Retail - Cyclical sector, where consumer spending patterns and economic cycles can significantly impact revenue and profitability. The substantial drop in revenue and continued losses underscore the challenges ContextLogic faces in a rapidly evolving ecommerce landscape.

Financial Achievements and Importance

Despite the revenue decline, ContextLogic's ability to narrow its net loss and reduce its adjusted EBITDA loss are important achievements. These improvements suggest that the company is making progress in controlling costs and improving its operational efficiency, which is vital for its sustainability and potential return to profitability.

Key Financial Metrics

Important metrics from the financial statements include:

- Core Marketplace revenue decreased by 58% YoY to $15 million.- Product Boost revenue decreased by 50% YoY to $5 million.- Logistics revenue decreased by 57% YoY to $33 million.- The net loss as a percentage of revenue improved, decreasing to 128% from 89% YoY.- Adjusted EBITDA as a percentage of revenue improved, decreasing to 102% from 77% YoY.

These metrics are crucial as they provide insight into the company's core business segments and operational efficiency. The significant declines in revenue streams highlight the need for ContextLogic to revitalize its business model and find new growth drivers.

Asset Sale and Future Prospects

ContextLogic also announced a significant transaction, agreeing to sell substantially all of its operating assets and liabilities to Qoo10 for approximately $173 million in cash. This move is expected to provide the company with a debt-free balance sheet and the opportunity to monetize its Net Operating Loss (NOL) carryforwards, which amount to approximately $2.7 billion. The Board is exploring strategic alternatives to maximize shareholder value, including the potential involvement of a financial sponsor to realize the value of its tax assets.

The transaction with Qoo10 is anticipated to close in the second quarter of 2024, subject to shareholder approval and other customary closing conditions. Following the sale, ContextLogic will trade under a new ticker symbol.

In light of the pending transaction, ContextLogic will not host a conference call or live webcast for these financial results and has discontinued providing financial guidance.

Conclusion

ContextLogic's latest earnings report paints a picture of a company in transition, grappling with significant revenue declines but also making strides in reducing losses. The pending asset sale to Qoo10 could mark a new chapter for ContextLogic, potentially unlocking value for shareholders and setting the stage for a different strategic direction.

For more detailed information and analysis, investors and stakeholders are encouraged to review the full 8-K filing.

Investor Relations and Media contacts for ContextLogic can be reached at ir@wish.com and press@wish.com, respectively.

Explore the complete 8-K earnings release (here) from ContextLogic Inc for further details.

This article first appeared on GuruFocus.