Cooper Companies (COO), Fulgent Unite to Boost Genetic Testing

The Cooper Companies’ COO wholly-owned subsidiary CooperSurgical and Fulgent Genetics recently announced their partnership to provide exclusive newborn genetic screening panels to Cord Blood Registry (CBR) families.

As a result of this collaboration, CBR by CooperSurgical brand will offer families a variety of genetic testing choices by utilizing Fulgent's Picture Genetics platform.

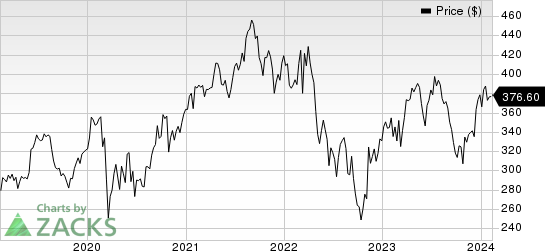

Price Performance

For the past six months, COO’s shares have lost 0.3% compared with the industry’s decline of 2.3%. The S&P 500 increased 12.0% in the same time frame.

Image Source: Zacks Investment Research

More on the News

The Cord Blood Registry by CooperSurgical is the world’s largest private newborn stem cell company, which provides solutions to parents regarding the preservation of their children’s stem cells from cord blood and cord tissue.

As a result of the collaboration with Fulgent Genetics, CBR is likely to offer multiple genetic testing options to its families.

CBR Snapshot genetic test, under which children can be screened for more than 250 genes linked to metabolic problems, blood disorders, malignancies, cardiovascular illnesses, and hearing/vision loss. Early discovery of these conditions can provide useful information and can be treated with medicine, diet, or other therapies.

CBR Portrait genetic test, which screens children for more than 600 genes, including all the genes included in CBR Snapshot and extra genes linked to immunodeficiency, cardiac problems, hearing loss, actionable epilepsy, and neonatal diabetes. Compared to CBR Snapshot, CBR Portrait has more than twice as many genes and could be able to pinpoint more uncommon causes of these illnesses.

CBR Landscape genetic test covers every gene in CBR Snapshot and CBR Portrait and adds genes linked to an even greater variety of hereditary disorders, screening children for approximately 1,500 genes.

Pharmacogenetic (PGx) testing is another component of CBR Landscape, which is a kind of genetic testing that can tell how someone metabolizes or breaks down specific medications. More than 100 drugs can have their potential for adverse effects detected by this test. It is among the most thorough genetic tests for children that are currently offered.

Only CBR clients can now access these Picture Genetic testing. In all three Picture tests, more than 30 genes linked to diseases that can be treated with fetal stem cells in the context of a stem cell transplant are assessed.

The collaboration is likely to bring in additional sales for Cooper Companies as its subsidiary brand widens its portfolio of genetic screening tests.

Industry Prospects

Per a report by Grand View Research, the global genetic testing market size was estimated to be $7.4 billion in 2022 and is expected to grow at 22% from 2023 to 2030.

The growing frequency of genetic abnormalities and growing awareness of newborn screening are two factors that are directly affecting the market growth of genetic testing.

The Cooper Companies, Inc. Price

The Cooper Companies, Inc. price | The Cooper Companies, Inc. Quote

Zacks Rank & Stocks to Consider

COO carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space are Universal Health Services UHS, Integer Holdings Corporation ITGR and Elevance Health, Inc ELV.

Universal Health Services, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 4.4% for 2024. UHS’s earnings surpassed estimates in all the trailing four quarters, delivering an average surprise of 5.47%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UHS’s shares have gained 1.9% in the past six months against the industry’s 5% decline.

Integer Holdings, presently carrying a Zacks Rank of 2, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 43.5% in the past year against the industry’s 3.7% decline.

Elevance Health, carrying a Zacks Rank of 2, reported fourth-quarter 2023 adjusted EPS of $5.62, beating the Zacks Consensus Estimate by 1.3%. Revenues of $42.45 billion outpaced the consensus mark by 1.5%.

Elevance Health has a long-term estimated growth rate of 12%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report