Cooper Companies (COO) Q4 Earnings In Line, '23 Outlook Raised

The Cooper Companies, Inc. COO reported fourth-quarter fiscal 2024 adjusted earnings per share (EPS) of $3.47, which was in line with the Zacks Consensus Estimate. The bottom line rose 26% on a year-over-year basis.

GAAP EPS in the quarter improved 29% from the year-ago period’s level to $1.70, primarily due to moderating expense.

Full-year adjusted loss per share was $12.81, up 3% from the previous year’s level. The figure was in line with the Zacks Consensus Estimate.

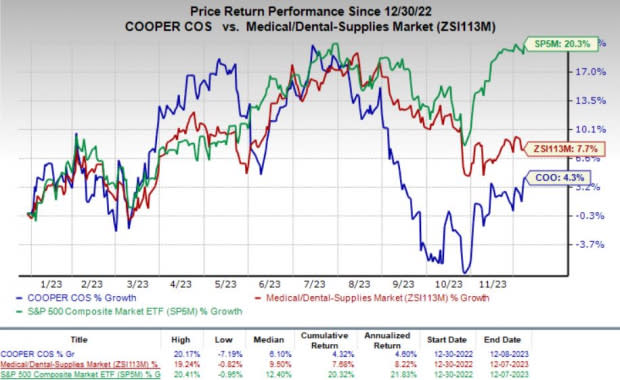

Shares of this currently Zacks Rank #3 (Hold) company have risen 4.3% year to date compared with the industry’s 7.6% growth. The S&P 500 Index has gained 20.3% in the same time frame.

Image Source: Zacks Investment Research

Revenue Details

Revenues totaled $927.1 million, which outpaced the Zacks Consensus Estimate by 0.8%. The top line improved 9% on a year-over-year basis and 8% at constant currency (cc).

The figure rose 9% organically. Strong revenue growth across all segments and geographies, driven by healthy demand for products and services, was partially offset by an unfavorable currency movement. CooperVision’s (“CVI”) growth was driven by COO’s daily silicone hydrogel portfolio while CooperSurgical’s (“CSI”) growth was led by its fertility business.

Full-year revenues totaled $3.59 billion, up 9% on a reported basis and 10% organically from the previous year’s reported number. The figure was in line with the Zacks Consensus Estimate.

At cc, full-year revenues were up 7.5%.

Fiscal Q4 Segment Details

CooperVision:The segment’s revenues totaled $622.9 million, up 9% at cc and 11% on a reported basis. Organically, sales were up 11%.

Per management, the segment witnessed an increase in revenues from single-use sphere lenses (30% of CVI), indicating an improvement of 7% at cc and 9% on a reported basis. Single-use sphere lens’ revenues totaled $184.2 million.

Toric (35% of CVI) revenues amounted to $216.9 million, up 16% at cc and 18% on a reported basis. Multifocal (13% of CVI) generated revenues of $79 million, up 19% at cc and 22% on a reported basis.

Non-single-use sphere lens’ (22% of CVI) revenues totaled $142.8 million, down 1% on a reported basis but up 4% organically from the year-ago quarter’s level.

Geographically, the segment witnessed a revenue improvement of $257.9 million in the Americas (41% of CVI), up 13% on a reported basis and at cc. EMEA revenues (36% of CVI) amounted to $225 million, up 10% year over year and 6% at cc.

Asia Pacific sales (22% of CVI) rose 8% year over year to $140 million. The figure was up 10% at cc and organically.

CooperSurgical:The segment reported revenues of $304.2 million, up 7% at cc and 6% on a year-over-year basis.Organically, sales were also up 7%.

Sub-segment Office and Surgical products (60% of CSI) generated $182.9 million in revenues, up 3% at cc as well as on a year-over-year basis. Fertility (40% of CSI) revenues totaled $121.3 million, up 12% reportedly year over year and 13% at cc.

Margin Analysis

The gross profit was $606.5 million, up 13% year over year. The adjusted gross margin came in at 65.4% of net revenues, expanding 210 basis points (bps) year over year.

Meanwhile, selling, general and administrative expenses increased 8.3% to $387.6 million. Research and development expenses rose 26.1% year over year to $36.7 million.

The operating income in the quarter totaled $135.7 million, up 31.1% year over year. The adjusted operating margin was 24%, up 200 basis points from the prior-year quarter’s figure.

Financial Position

COO exited the fourth quarter of fiscal 2023 with cash and cash equivalents of $120.8 million, up from $117.3 million at the end of the fiscal third quarter. Net cash provided by operating activities totaled $607.5 million.

Fiscal 2024 Guidance

Cooper Companies issued its financial guidance for fiscal 2024.

The company projects total revenues in the range of $3.809-$3.877 billion, indicating organic growth of 6-8%. The Zacks Consensus Estimate for the same is currently pegged at $3.85 billion.

CVI revenues are estimated in the $2.548-$2.594 billion range (organic growth of 7-9%). CSI revenues are projected in the band of $1.261-$1.283 billion, implying organic growth of 4-6%.

Adjusted EPS is anticipated in the band of $13.60-$14.00. The Zacks Consensus Estimate for the same is pegged at $13.97.

The Cooper Companies, Inc. Price, Consensus and EPS Surprise

The Cooper Companies, Inc. price-consensus-eps-surprise-chart | The Cooper Companies, Inc. Quote

Zacks Rank and Stocks to Consider

The Cooper Companies currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Biodesix BDSX and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 18.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DVA’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 36.55%. Its shares have risen 33.1% year to date compared with the industry’s 2.7% growth.

Biodesix, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 32.3% for 2024. BDSX’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 9.76%.

Biodesix’s shares have lost 36.5% year to date compared with the industry’s 10.7% decline.

Integer Holdings, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 31.7% year to date against the industry’s 4.7% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report