Copart Inc (CPRT) Reports Solid Growth in Q2 Fiscal 2024 Earnings

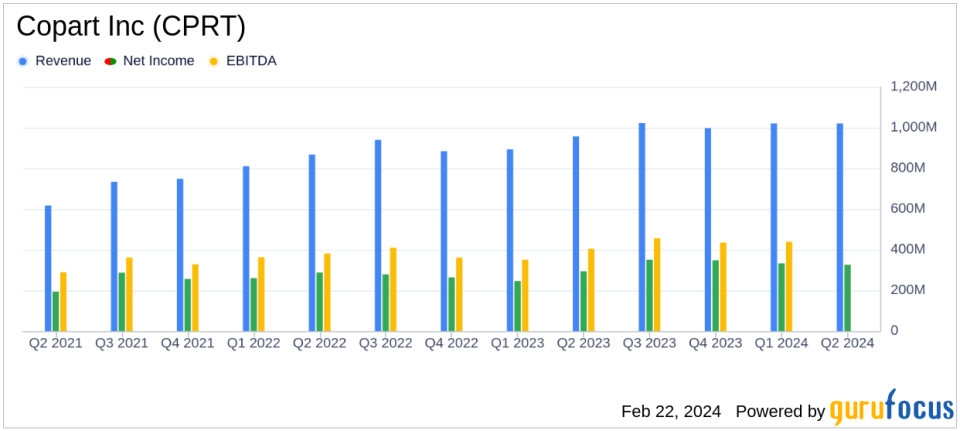

Revenue: Increased to $1.02 billion, up 6.6% from the same period last year.

Gross Profit: Rose to $464.2 million, an 8.8% increase year-over-year.

Net Income: Attributable to Copart Inc. was $325.6 million, marking a 10.9% increase.

Earnings Per Share: Fully diluted EPS grew by 10.0% to $0.33.

Balance Sheet: Cash and cash equivalents stood at $1.26 billion as of January 31, 2024.

On February 22, 2024, Copart Inc (NASDAQ:CPRT) released its 8-K filing, announcing financial results for the second quarter of fiscal year 2024. The Dallas-based online vehicle auction leader reported a revenue of $1.02 billion for the quarter ended January 31, 2024, which is a 6.6% increase from the same period last year. The company's gross profit also saw a healthy rise, reaching $464.2 million, an 8.8% year-over-year growth. Net income attributable to Copart Inc. experienced a significant boost, with a 10.9% increase to $325.6 million.

Copart operates a robust online salvage vehicle auction platform, connecting sellers with over 750,000 members globally. With a strong presence in 11 countries, the company facilitates more than 3.5 million vehicle transactions annually. The majority of Copart's vehicle volume comes from auto insurance companies, with vehicles deemed a total loss. Copart's services extend beyond auctions, offering transportation, storage, title transfer, and salvage value estimation, primarily on a consignment basis.

Financial Performance and Challenges

The reported increase in revenue and net income is a testament to Copart's strong market position and operational efficiency. The company's fully diluted earnings per share (EPS) for the quarter stood at $0.33, a 10.0% increase compared to $0.30 last year. For the six months ended January 31, 2024, Copart's revenue was $2.04 billion, a 10.3% increase, while net income attributable to Copart Inc. was $658.2 million, up by 22.0% from the previous year. The growth in EPS to $0.68 from $0.56 reflects the company's ability to translate revenue growth into bottom-line results, which is crucial for value investors seeking profitable and efficient operations.

Despite these positive results, the company faces challenges such as fluctuations in the supply of total loss vehicles and potential shifts in the regulatory environment that could impact operations. These challenges could lead to problems such as revenue volatility or increased operational costs. However, Copart's diversified service offerings and international presence provide a buffer against market-specific risks.

Key Financial Metrics

Examining the income statement, Copart's service revenues increased by 9.1% for the three months and 13.5% for the six months ended January 31, 2024. However, vehicle sales saw a decline of 5.1% and 4.3% for the respective periods. The balance sheet reflects a strong liquidity position, with cash, cash equivalents, and restricted cash totaling $1.26 billion. The company's investment in held-to-maturity securities also indicates a prudent approach to managing its cash reserves.

From the cash flow statement, net cash provided by operating activities for the six months was $537.0 million, demonstrating Copart's ability to generate cash from its core operations. The company's capital expenditures, including purchases of property and equipment, totaled $285.3 million, signifying ongoing investments to support future growth.

These financial metrics are important as they highlight Copart's operational efficiency, liquidity, and investment in growth. The company's ability to increase revenue and manage expenses effectively is crucial for sustaining profitability and ensuring long-term value creation for shareholders.

Analysis and Outlook

Copart's performance in the second quarter of fiscal 2024 indicates a solid trajectory for growth and profitability. The company's strategic investments in technology and expansion of its service offerings have contributed to its strong financial results. With a robust balance sheet and consistent cash flow generation, Copart is well-positioned to navigate the dynamic automotive and insurance industries.

Investors and potential GuruFocus.com members should consider Copart's proven track record of financial performance, its strategic position in the vehicle auction industry, and its ability to adapt to market changes as key factors when evaluating the company's investment potential.

For more detailed information and analysis on Copart Inc (NASDAQ:CPRT)'s financial results, visit GuruFocus.com and explore the wealth of resources available for value investors.

Explore the complete 8-K earnings release (here) from Copart Inc for further details.

This article first appeared on GuruFocus.