Copart's (CPRT) Q1 Earnings Mark Fourth Consecutive Beat

Copart, Inc. CPRT reported first-quarter fiscal 2024 (ended Oct 31, 2023) adjusted earnings per share of 34 cents, beating the Zacks Consensus Estimate of 32 cents on better-than-expected service revenues. The bottom line also increased 36% year over year. The online auto auction leader generated revenues of $1.02 billion, beating the Zacks Consensus Estimate of $978 million. The top line also increased by 14.2% from the year-ago reported figure.

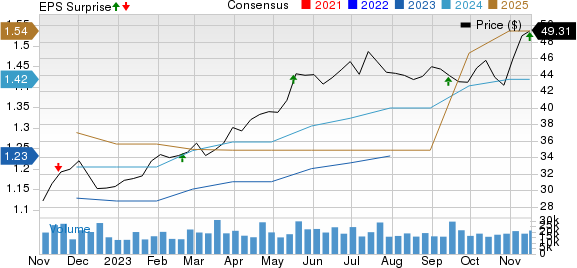

Copart, Inc. Price, Consensus and EPS Surprise

Copart, Inc. price-consensus-eps-surprise-chart | Copart, Inc. Quote

Key Stats

CPRT’s fiscal first-quarter service revenues came in at $859.5 million, up from $726.8 million recorded in the year-ago period, outpacing our estimate of $804.8 million. Service revenues accounted for 84.2% of total revenues. Vehicle sales totaled $160.8 million in the quarter, down from the prior year’s level of $166.5 million and short of our estimate of $164 million.

While yard operations expenses rose 9.2% year over year to $367.8 million, the cost of vehicle sales was down 2.1% to $147.9 million. Yard depreciation and amortization came in at $39.1 million, up 13.8% year over year. Yard stock-based compensation increased 7.7% to $1.5 million.

Gross profit was up 25.6% year over year to $464 million. General and administrative expenses rose 29.4% from the prior-year quarter to $57.6 million. Total operating expenses flared up 7.4% to $625 million.

Operating income rose to $395.4 million from $311 million recorded in the year-ago quarter amid high sales despite the rise in expenses. Net income also shot up 35.3% year over year to $332.5 million.

Copart had cash, cash equivalents and restricted cash of $2.58 billion as of Oct 31, 2023, compared with $957 million as of Jul 31, 2023. Long-term debt and other liabilities declined to $9.4 million at the end of the reported quarter from $10.9 million as of Jul 31, 2023.

Net cash from operating activities during the quarter totaled $375.2 million, up from $311.6 million in the year-ago quarter. Capex during the quarter was $162.2 million, up 6.3% year over year.

Zacks Rank & Other Key Picks

CPRT currently carries a Zacks Rank #2 (Buy).

A few other top-ranked players in the auto space include Toyota TM, PACCAR PCAR and O’Reilly Automotive ORLY. While TM sports a Zacks Rank #1 (Strong Buy) currently, PCAR and ORLY carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TM’s fiscal 2024 sales and EPS implies year-over-year growth of 10.5% and 29.7%, respectively. The earnings estimate for fiscal 2024 and 2025 has been revised upward by 46 cents and 26 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for PCAR’s 2023 sales and EPS implies year-over-year growth of 20% and 56%, respectively. The earnings estimate for 2023 and 2024 has been revised upward by 45 cents and 44 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for ORLY’s 2023 EPS and sales implies year-over-year growth of 14% and 10%, respectively. The earnings estimate for 2023 and 2024 has been revised upward by 6 cents and 4 cents, respectively, in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report