Copart's Triumph as a Long-Term Compounder

Warren Buffett (Trades, Portfolio) once said, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

This philosophy suggests investors are likely to fare better when they purchase outstanding businesses and then take a hands-off approach. This is why I find long-term compounders so intriguingquality businesses that have consistently achieved high growth rates over an extended period. One great example of such a company is Copart Inc. (NASDAQ:CPRT), the global leader in providing online auction and vehicle remarketing services, catering to used vehicle dealers, licensed vehicle dismantlers and the general public.

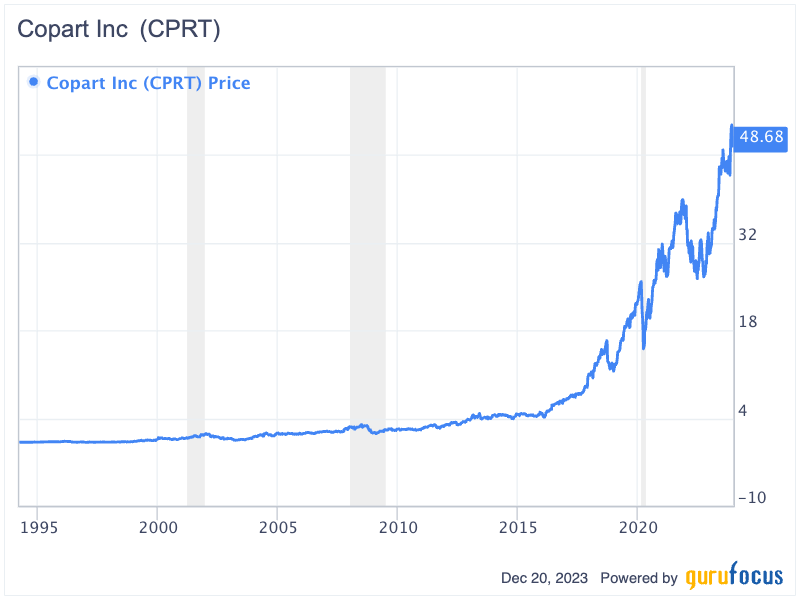

A long-term compounder

Since 1994, Copart's share price has shown a consistent upward trend, escalating from a mere 16 cents to $48.70 at the time of writing. This impressive growth has yielded a total return of over 30,350% for long-term investors, equivalent to an annual compounded return of 21.17% across 29 years. To put this into perspective, $1 invested in Copart in 1994 would have grown to nearly $305 today. In contrast, during the same period, a $1 investment in the S&P 500 would have resulted in only $16.54, reflecting an only 9.92% annual compounded return.

A sustainable moat

At first glance, investors might assume that Copart lacks a competitive advantage given that customers primarily purchase vehicle purchases on price, suggesting intense market competition. However, the company stands out with its innovative online vehicle auction platform, utilizing its Virtual Bidding Third Generation (VB3) technology. This platform primarily facilitates the sale of damaged or recovered stolen vehicles, and 80% of the sellers are insurance companies. Since the auction's success hinges on the bidding process, auctions attracting more bidders tend to achieve higher prices. This dynamic leads to a fabulous network effect, which is not easy for other companies to replicate: the variety of sellers and vehicles on Copart's platform draws a growing number of bidders, while the increasing bidder presence, in turn, attracts more insurance companies looking to sell their vehicles. This interplay between sellers and bidders enhances Copart's market position.

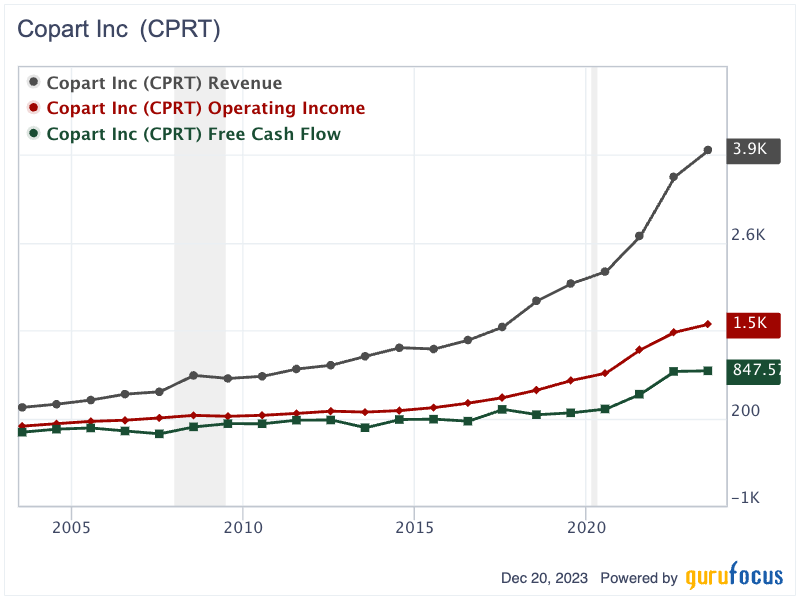

Consistent growth in revenue, profits and cash flow

Over the past 20 years, Copart has consistently grown its revenue and operating income. The company's revenue increased at a compounded annual rate of 12.8%, rising from $347.4 million in 2003 to $3.87 billion in 2023. During the same period, operating income significantly jumped from $90.75 million to $1.49 billion, reflecting a higher compounded annual return of 15%. While free cash flow experienced some fluctuations, it achieved the most remarkable growth, expanding more than 100-fold from $8 million to nearly $848 million. This increase translates to a compounded annual growth rate of 26.26% over the last two decades.

A remarkable return on invested capital with minimal debt

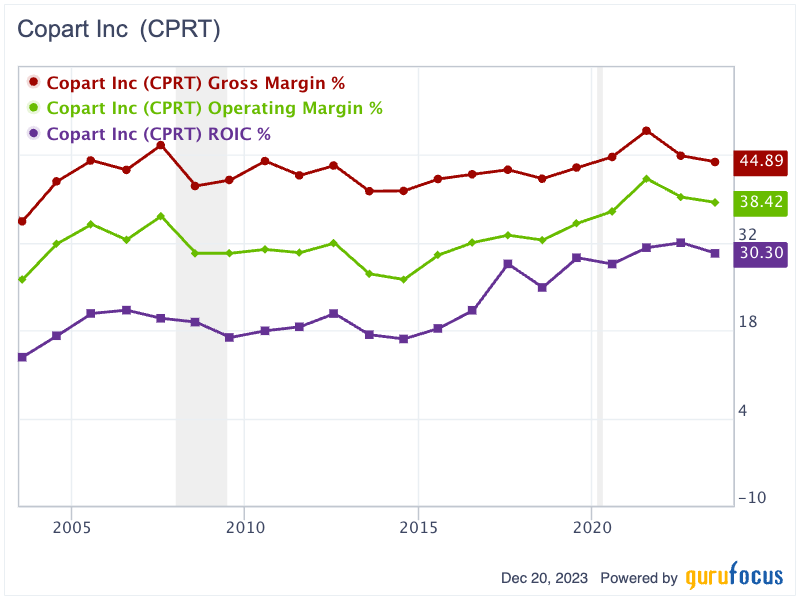

To identify exceptional businesses such as Copart, investors need to comprehend the business model and identify the company's competitive advantage, or "moat," which typically results in a high return on invested capital. Crucially, the ability to reinvest cash flow into the business and generate high returns are key factors in delivering substantial compounded returns to long-term shareholders.

Copart has significantly increased its return on invested capital over time. In 2013, the company's ROIC was 13.73%, which has since risen to 30.30% in 2023. This growth in ROIC can be attributed to improved gross and operating margins over time. Specifically, the gross margin increased from 35.4% to nearly 45%, while the operating margin rose from 26.1% to 38.4% during the same period.

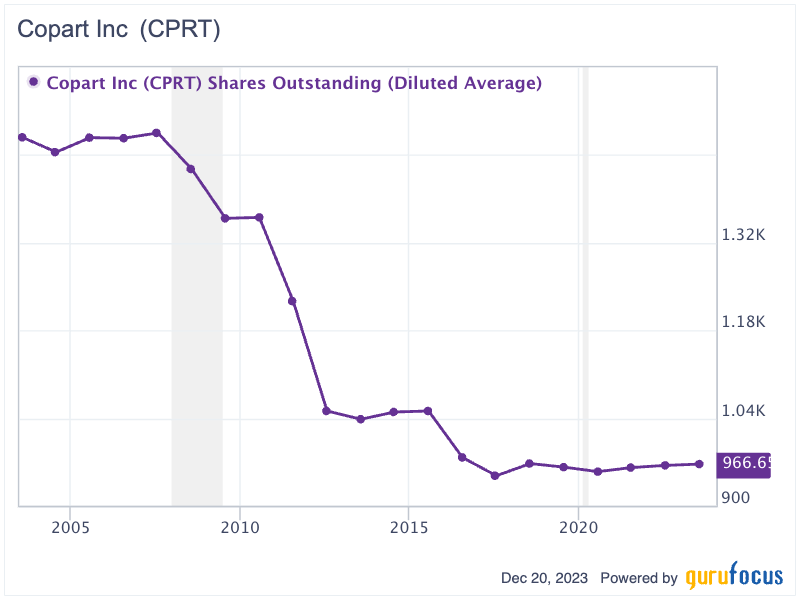

When Copart could not find good opportunities to reinvest its money, it chose to return value to shareholders through share buybacks. Remarkably, in the last 20 years, Copart has reduced its total shares outstanding by more than 35%, from 1.49 billion to just 966.6 million, further enhancing shareholder value.

Thanks to the company's low-debt approach, investors can have peace of mind when investing in Copart. As of October 2023, Copart's total shareholder equity stood at $6.4 billion. Its holdings in cash, cash equivalents and restricted cash amounted to $2.58 billion. The company's long-term debt and other liabilities totaled a mere $9.5 million, while operating and finance lease liabilities were only $123.5 million. This means Copart's debt constitutes just 1.5% of its equity, reflecting a solid financial position and minimizing investor risk.

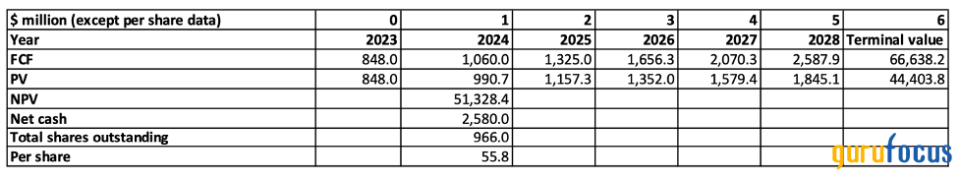

Copart is worth $56 per share

Let's conduct a discounted free cash flow valuation for Copart. My growth assumption is that free cash flow will grow at approximately 25% for the next five years, followed by a 3% terminal growth rate. Given Copart's minimal debt, strong cash flow generation and consistently high return on invested capital, a lower discount rate than usual can be justified. While I normally use a 10% discount rate for other businesses, a 7% rate seems more appropriate for Copart's analysis. Applying this 7% discount rate, Copart's valuation would be nearly $56 per share. Considering its current share price of $49 per share, Copart appears to be fairly valued at present.

Source: Author's table

Key takeaway

Copart's remarkable journey from a modest beginning to becoming a global leader in online vehicle auction and remarketing services exemplifies the wisdom in Buffett's investment philosophy. The stock appears to be fairly valued, trading close to its intrinsic worth as determined by my discounted free cash flow analysis.

However, the true allure lies not just in its current valuation, but in its potential for continued growth. Copart is poised to enhance its intrinsic value over time with a consistent track record of expanding revenue, profits and free cash flow, and achieving an impressive return on invested capital. Its robust business model, fortified by a significant competitive moat and a low-debt approach, provides a solid foundation for sustained growth. As the company continues to innovate and expand, its ability to generate higher returns for its shareholders is likely to increase, making Copart an attractive proposition for long-term investors seeking to benefit from the compounding power of a high-quality business.

This article first appeared on GuruFocus.