COPT Defense Properties Reports Solid Growth Amidst 2023 Challenges

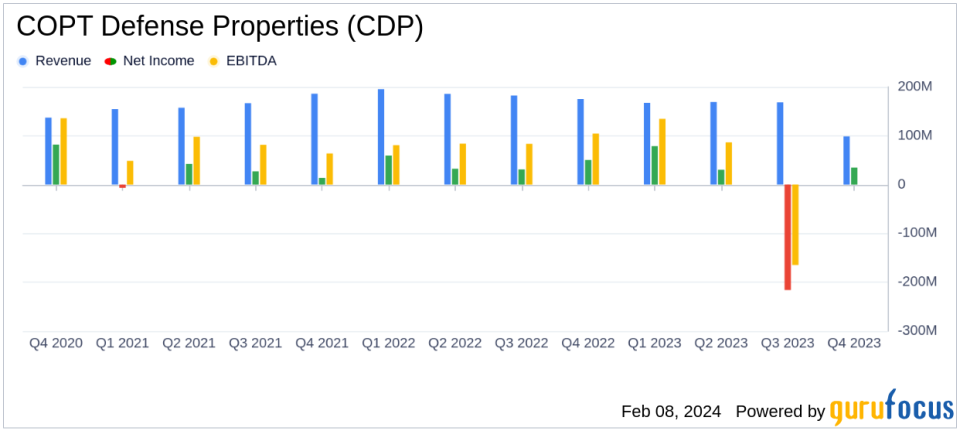

Net Income: Reported a net loss of $(74.347) million for the full year 2023, impacted by a significant impairment charge in Q3.

FFO per Share: FFO per share, as adjusted for comparability, increased by 2.5% to $2.42, reflecting consistent earnings growth.

Occupancy Rates: Defense/IT Portfolio reported high occupancy and leasing rates, with 96.2% occupied and 97.2% leased.

Same Property Cash NOI: Demonstrated a robust increase of 5.7%, marking the highest year-over-year annual increase in over 15 years.

Development Projects: Successfully placed 848,000 SF of developments into service, 98% leased, with an active pipeline of 817,000 SF, 91% leased.

Leasing Activity: Exceeded annual leasing goals with 2.9 million SF total leasing and a tenant retention rate of 80%.

On February 8, 2024, COPT Defense Properties (NYSE:CDP) released its 8-K filing, detailing the financial outcomes for the year ended December 31, 2023. The company, an S&P MidCap 400 Company and a self-managed real estate investment trust (REIT), specializes in owning, operating, and developing properties near key U.S. Government defense installations and missions. The majority of CDP's portfolio is leased to U.S. Government agencies and defense contractors requiring mission-critical and high-security property enhancements.

Financial Performance and Challenges

CDP's financial performance in 2023 was marked by solid growth in key areas, despite facing challenges. The company reported a net loss of $(74.347) million for the full year, primarily due to a $252.8 million impairment charge for certain assets in the Other segment. However, the company's adjusted funds from operations (AFFO) per share increased by 2.5% to $2.42, indicating a consistent earnings growth trajectory.

The Defense/IT Portfolio's high occupancy and leasing rates underscore the demand for CDP's specialized real estate. The same property cash net operating income (NOI) saw a significant increase, which is a testament to the company's operational efficiency and the strength of its portfolio in a competitive market.

Key Financial Metrics

CDP's financial achievements are particularly important for a REIT, as they reflect the company's ability to generate stable and growing income streams from its property portfolio. The following are key details from CDP's financial statements:

"We achieved several key operating and financial performance milestones in 2023. Our Defense/IT Portfolio was 96.2% occupied and 97.2% leased at year end, which are the highest rates reported since we began disclosing the segment in 2015. Our sector leading tenant retention rate of 79.4% was the third highest figure in the last 20 years. Same property cash NOI increased 5.7%, the highest reported level in over 15 years, while cash rent spreads on renewals were the highest since 2008." - Stephen E. Budorick, President & CEO of COPT Defense.

CDP's balance sheet shows total assets of $4.246 billion, with a debt to assets ratio of 56.9%. The net income to interest expense ratio stood at 1.7x, reflecting the company's ability to cover its interest obligations. The payout ratios based on diluted FFO and AFFO were 45.7% and 59.7%, respectively, indicating a disciplined approach to capital distribution.

Analysis of Company's Performance

Despite the net loss incurred due to the impairment charge, CDP's overall performance in 2023 was robust, with growth in FFO per share and strong leasing activity. The company's focus on the Defense/IT sector has proven to be a strategic advantage, providing resilience against broader market challenges. The increase in same property cash NOI and high occupancy rates are indicative of the company's strong market position and effective asset management.

CDP's investment in development projects aligns with its growth strategy, as evidenced by the successful placement of developments into service and a healthy pipeline of leased developments. The company's leasing activity exceeded goals, with significant vacancy leasing and high tenant retention, which are critical for long-term revenue stability.

Overall, CDP's financial results for 2023 demonstrate the company's ability to navigate market challenges and capitalize on opportunities within its niche market, positioning it well for continued growth in the future.

Explore the complete 8-K earnings release (here) from COPT Defense Properties for further details.

This article first appeared on GuruFocus.