Corcept (CORT) Stock Rises on Upbeat Revenue Guidance for 2024

Shares of Corcept Therapeutics Incorporated CORT were up 13.1% on Jan 8 after the company provided upbeat revenue guidance for 2024. The company also issued encouraging preliminary results for the fourth quarter of 2023.

Corcept’s top line solely comprises product sales from its Cushing’s syndrome drug, Korlym.

Q4 Preliminary Results

For the fourth quarter of 2023, preliminary revenues were $135.4 million, reflecting an increase of 31% year over year. The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $128.4 million.

CORT’s cash and investments were $425.4 million as of Dec 31, 2023.

For full-year 2023, preliminary revenues were $482.4 million, up 20% on a year-over-year basis. The Zacks Consensus Estimate for full-year revenues is pegged at $475.3 million.

Along with providing preliminary results for 2023, the company also announced a share repurchase program. Corcept’s board of directors authorized the repurchase of up to $200 million of the company’s shares.

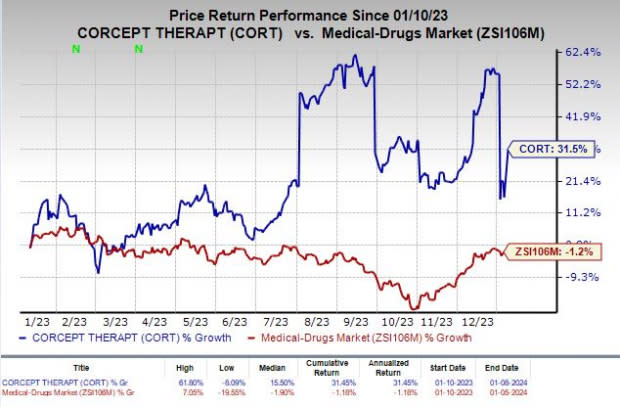

Shares of Corcept have rallied 31.5% in the past year against the industry’s decrease of 1.2%.

Image Source: Zacks Investment Research

2024 Guidance

Corcept expects total revenues in the range of $600–$630 million for full-year 2024. The Zacks Consensus Estimate for the metric is pegged at $499.8 million. Our model estimate for 2024 revenues stands at $517.7 million.

Apart from Korlym, Corcept does not have any approved product in its portfolio currently.

The company is evaluating its lead pipeline candidate, relacorilant in the phase III GRACE study to treat Cushing’s syndrome. A new drug application for relacorilant is expected to be submitted in the second quarter of 2024.

The phase III GRADIENT study is evaluating relacorilant for patients whose Cushing’s syndrome is caused by adrenal adenoma. The study continues to enroll patients, with results from the same expected in mid-2024.

Corcept is also developing relacorilant in combination studies targeting oncology indications.

A phase Ib study is evaluating relacorilant in combination with Merck’s MRK blockbuster PD-1 checkpoint inhibitor, Keytruda (pembrolizumab), for treating patients with adrenal cancer along with cortisol excess.

Merck’s biggest revenue generator, Keytruda, is approved for treating several cancer indications. MRK continues to study Keytruda to address additional cancer indications.

The pivotal phase III ROSELLA study is investigating relacorilant in combination with nab-paclitaxel for treating patients with recurrent platinum-resistant ovarian cancer. Enrollment in this study is ongoing and CORT plans to complete the same by the end of 2024.

The successful development and potential approval of relacorilant will be an added boost for the company.

Zacks Rank & Stocks to Consider

Corcept currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are AnaptysBio, Inc. ANAB and Puma Biotechnology, Inc. PBYI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for AnaptysBio’s 2024 loss per share have narrowed from $6.44 to $6.38. In the past year, shares of ANAB have inched up 2.5%.

Earnings of AnaptysBio beat estimates in two of the last four quarters while missing the same on the remaining two occasions. ANAB delivered a negative four-quarter average earnings surprise of 6.48%.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 62 cents to 69 cents. In the past year, shares of PBYI have risen 4.6%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

AnaptysBio, Inc. (ANAB) : Free Stock Analysis Report