Corcept Puts Active After Negative Report

The shares of drugmaker Corcept Therapeutics Incorporated (NASDAQ:CORT) are lower today, as traders digest a scathing report from the Southern Investigative Reporting Foundation (SIRF). In a nutshell, the report says Corcept epitomizes what's wrong with the U.S. healthcare system, laying out a case that the "small company with just one drug" treating a rare disorder is "exploiting gaps in the nation's health care regulatory framework" to make money. SIRF questions the "peculiar geographic clustering" of high-volume prescribers, and suggests the firm is compensating doctors to stimulate Korlym sales. Against this backdrop, CORT is seeing unusual options volume today.

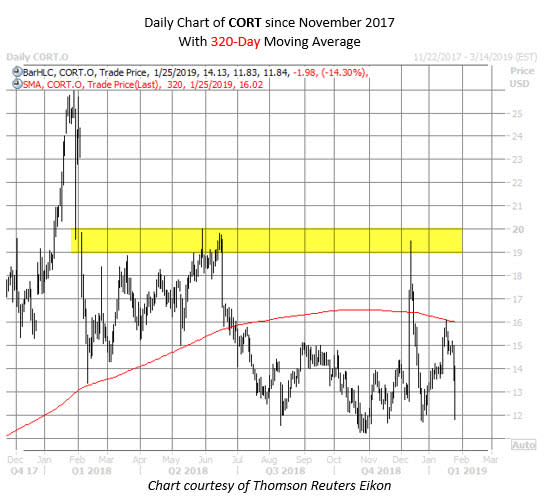

Corcept stock was last seen 14.3% lower to trade at $11.77 -- within striking distance of its Oct. 30 annual low of $11.21 -- on pace for its worst session since Feb. 5. From a longer-term perspective, shortly after touching a record high of $25.96 in late January, CORT shares took a nosedive on news that Teva Pharmaceutical (TEVA) filed an abbreviated new drug application (NDA) for a generic version of Corcept's Korlym. Since then, the equity has run into a wall in the $19-$20 region -- where CORT landed after that plunge -- with more recent rebound attempts capped by the 320-day moving average.

So far today, about 2,700 Corcept puts have changed hands -- four times the average afternoon put volume. For comparison, fewer than 400 CORT calls have traded. Most active is the February 12 put, where it seems bears are buying to open the options. By doing so, they expect CORT to extend its retreat south of $12 through the next few weeks, before February options expire.

Should the equity continue to struggle on the charts, a round of negative analyst attention could ensue. Currently, 60% of brokerage firms following the drug stock maintain "buy" or better opinions, and the consensus 12-month price target of $19.20 represents a premium of 61.3% to the security's current perch.