Corcept Therapeutics Inc's Meteoric Rise: Unpacking the 36% Surge in Just 3 Months

Corcept Therapeutics Inc (NASDAQ:CORT), a commercial-stage pharmaceutical company in the biotechnology industry, has seen a significant surge in its stock price over the past three months. With a current market cap of $3.33 billion and a price of $32.52, the company's stock has experienced a 35.69% increase over the past quarter, despite a slight dip of 1.04% in the past week. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of Corcept Therapeutics Inc is $29.91, indicating that the stock is fairly valued. However, three months ago, the GF Value was $27.33, suggesting that the stock was modestly undervalued at that time.

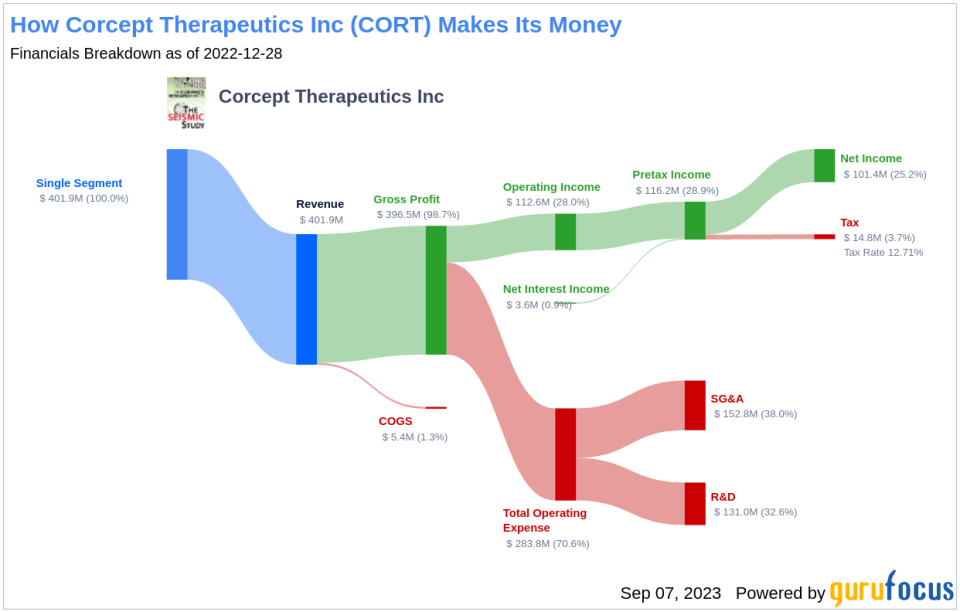

Profitability Analysis

Corcept Therapeutics Inc has a Profitability Rank of 8/10, indicating a high level of profitability. The company's operating margin is 23.09%, which is better than 91.35% of companies in the industry. Additionally, the company's ROE and ROA are 19.97% and 17.17% respectively, both of which are better than the majority of companies in the industry. The company's ROIC is 88.12%, which is better than 98.97% of companies in the industry. Over the past 10 years, the company has been profitable for 7 years, which is better than 79.55% of companies.

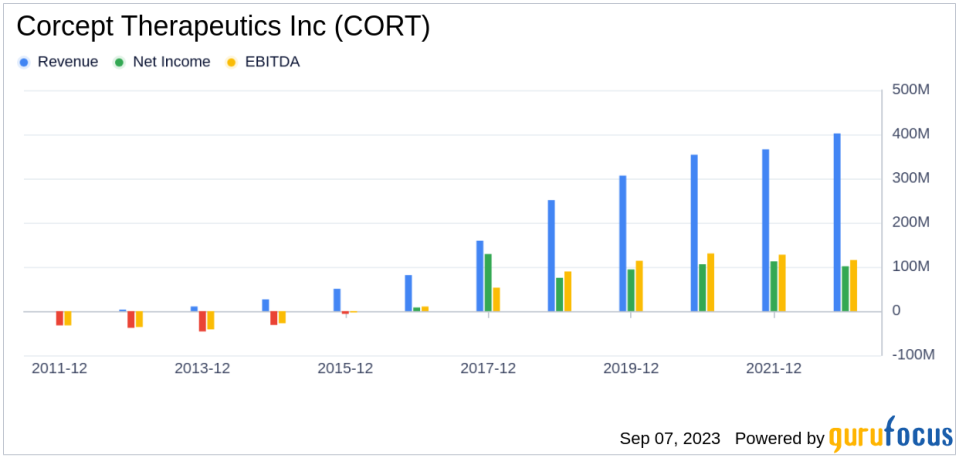

Growth Prospects

Corcept Therapeutics Inc has a Growth Rank of 9/10, indicating a high level of growth. The company's 3-year and 5-year revenue growth rates per share are 11.50% and 19.60% respectively, both of which are better than the majority of companies in the industry. The company's future 3 to 5-year total revenue growth rate estimate is 11.68%. Additionally, the company's 3-year and 5-year EPS without NRI growth rates are 4.20% and 1.10% respectively.

Major Stock Holders

The top three holders of Corcept Therapeutics Inc's stock are Jim Simons (Trades, Portfolio), who holds 6.53% of the company's shares, Chuck Royce (Trades, Portfolio), who holds 0.29% of the company's shares, and John Hussman (Trades, Portfolio), who holds 0.09% of the company's shares.

Competitive Landscape

Corcept Therapeutics Inc operates in a competitive industry with several key players. The company's main competitors in the biotechnology industry include Madrigal Pharmaceuticals Inc, with a market cap of $3.44 billion, Denali Therapeutics Inc, with a market cap of $3.37 billion, and Cytokinetics Inc, with a market cap of $3.46 billion.

Conclusion

In conclusion, Corcept Therapeutics Inc has demonstrated strong performance in terms of stock price, profitability, and growth. The company's stock has seen a significant increase over the past three months, and its profitability and growth ranks are high. The company's major stock holders and competitors also play a crucial role in its performance. Given these factors, Corcept Therapeutics Inc appears to be well-positioned for future success in the biotechnology industry.

This article first appeared on GuruFocus.