Core Laboratories (CLB) Q2 Earnings Top, Revenues Miss

Core Laboratories CLB reported second-quarter 2023 adjusted earnings of 21 cents per share, which marginally beat the Zacks Consensus Estimate of 20 cents. The bottom line also improved from the year-ago quarter’s reported figure of 12 cents.

Adjusted revenues of $127.9 million missed the Zacks Consensus Estimate of $132 million by 3.2% due to underperformance from Production Enhancement. The top line, however, rose from the year-ago quarter’s recorded figure of $120.9 million. This can be attributed to the Reservoir Description segment’s impressive performance.

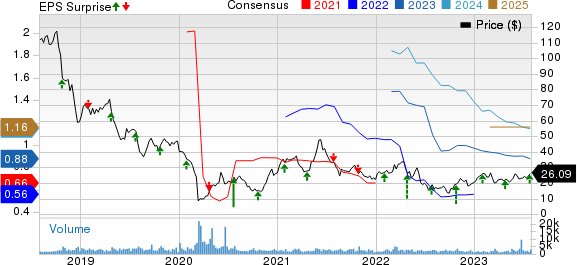

Core Laboratories Inc. Price, Consensus and EPS Surprise

Core Laboratories Inc. price-consensus-eps-surprise-chart | Core Laboratories Inc. Quote

Segmental Performance

Reservoir Description: Revenues in this segment increased about 10% to $83.4 million from $75.8 million in the second quarter of 2022. The top line beat our projection of $81.1 million. Operating income increased from $5.9 million in the year-ago period to $13.3 million but missed our estimate of $7.6 million. This was due to the heavy impact of the Russia-Ukraine conflict.

Production Enhancement: This segment’s revenues decreased 1.3% to $44.5 million from $45.1 million in the prior-year quarter. The same lagged our estimate of $51 million. Operating income of $5.5 million missed our projection of $7.2 million due to lower international bulk product sales and a decrease in U.S. land completion activity. The figure improved from the year-ago quarter’s reported profit of $4.9 million.

Financials and Dividends

As of Jun 30, 2023, Core Laboratories had cash and cash equivalents of $26.2 million and long-term debt of $182.6 million. The company’s debt-to-capitalization was 45.4%.

Operating cash totaled $5.6 million while capital expenditure amounted to $2.2 million. This led to a positive free cash flow of $6.6 million.

CLB’s board of directors approved a regular quarterly dividend of a cent per share on the company's

common stock, payable on Aug 30, 2023, to all shareholders of record as of Jul 26, 2023.

Outlook

For the third quarter of 2023, revenues are anticipated in the range of $128-$132 million. Operating income is estimated in the $15.2-$17.5 million band. Earnings per share are expected between 21 cents and 25 cents. The company expects a 20% tax rate for the same time frame.

Core Laboratories is optimistic about international upstream activity for the second half of 2023.

It anticipates increased investment for hydrocarbon production maintenance and growth, and plans to expand spending on long-cycle upstream projects in onshore and offshore environments.

CLB predicts Reservoir Description's third-quarter revenue growth to be low-single digits. Although it anticipates international growth, a slight decrease in U.S. activity may moderate the same.

Third-quarter revenues for the Production Enhancement segment is projected to be flat to down by low-single digits. The anticipated decline in U.S. revenues may be partially offset by growth in Production Enhancement international sales.

Core Laboratories thinks that the operations of the Reservoir Description segment in Russia, Ukraine and Europe may be impacted by changes in crude oil trading patterns due to the ongoing wars in Russia and Ukraine.

Zacks Rank and Key Picks

Currently, CLB carries a Zack Rank #4 (Sell).

Some better-ranked stocks for investors interested in the energy sector are Evolution Petroleum EPM, sporting a Zacks Rank #1 (Strong Buy), and Murphy USA MUSA and NGL Energy Partners NGL, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Evolution Petroleum is worth approximately $307.07 million. EPM currently pays a dividend of 48 cents per share, or 5.20% on an annual basis.

The company currently has a forward P/E ratio of 8.55. In comparison, its industry has an average forward P/E of 13.40, which means EPM is trading at a discount to the group.

Murphy USA is valued at around $6.58 billion. In the past year, its shares have risen 5.8%

MUSA currently pays a dividend of $1.52 per share, or 0.50% on an annual basis. Its payout ratio currently sits at 6% of earnings.

NGL Energy Partners is valued at around $535.63 million. In the past year, its units have risen 149.1%.

The partnership currently has a forward P/E ratio of 4.67. In comparison, its industry has an average forward P/E of 16.20, which means NGL is trading at a discount to the group.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Core Laboratories Inc. (CLB) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

NGL Energy Partners LP (NGL) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report