The Core Laboratories (NYSE:CLB) Share Price Is Up 112% And Shareholders Are Boasting About It

It's been a soft week for Core Laboratories N.V. (NYSE:CLB) shares, which are down 14%. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Indeed, the share price is up an impressive 112% in that time. So it may be that the share price is simply cooling off after a strong rise. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Check out our latest analysis for Core Laboratories

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Core Laboratories went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We are skeptical of the suggestion that the 0.1% dividend yield would entice buyers to the stock. Core Laboratories' revenue actually dropped 32% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

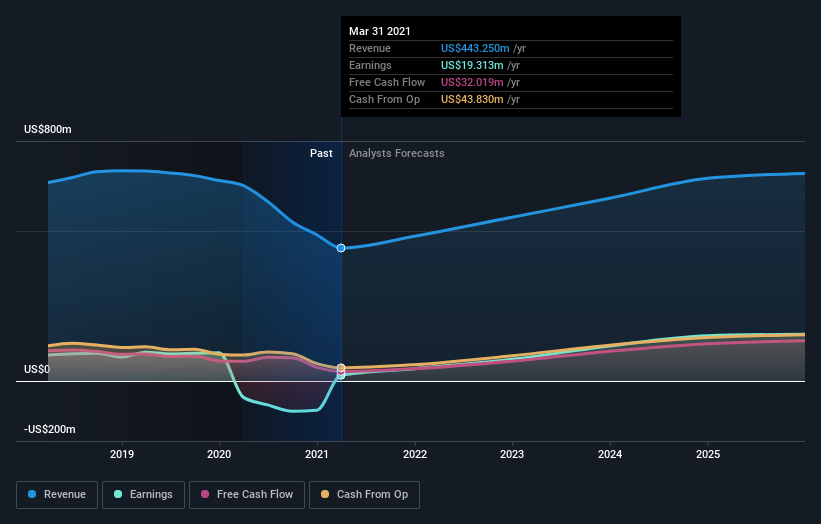

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Core Laboratories has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Core Laboratories

A Different Perspective

It's good to see that Core Laboratories has rewarded shareholders with a total shareholder return of 112% in the last twelve months. That's including the dividend. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Core Laboratories that you should be aware of.

Of course Core Laboratories may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.