Cormorant Asset Management, LP Acquires New Stake in Ambrx Biopharma Inc

Introduction to the Transaction

On October 23, 2023, Cormorant Asset Management, LP (Trades, Portfolio) made a significant move in the biotechnology sector by acquiring a new stake in Ambrx Biopharma Inc (NASDAQ:AMAM). The firm purchased 11,231,000 shares at a trade price of $6.99 per share. This transaction has a notable impact on the firm's portfolio, increasing its position by 4.21%. The firm now holds a total of 11,231,000 shares in Ambrx Biopharma Inc, representing 17.96% of the company's total shares.

Profile of the Investing Firm

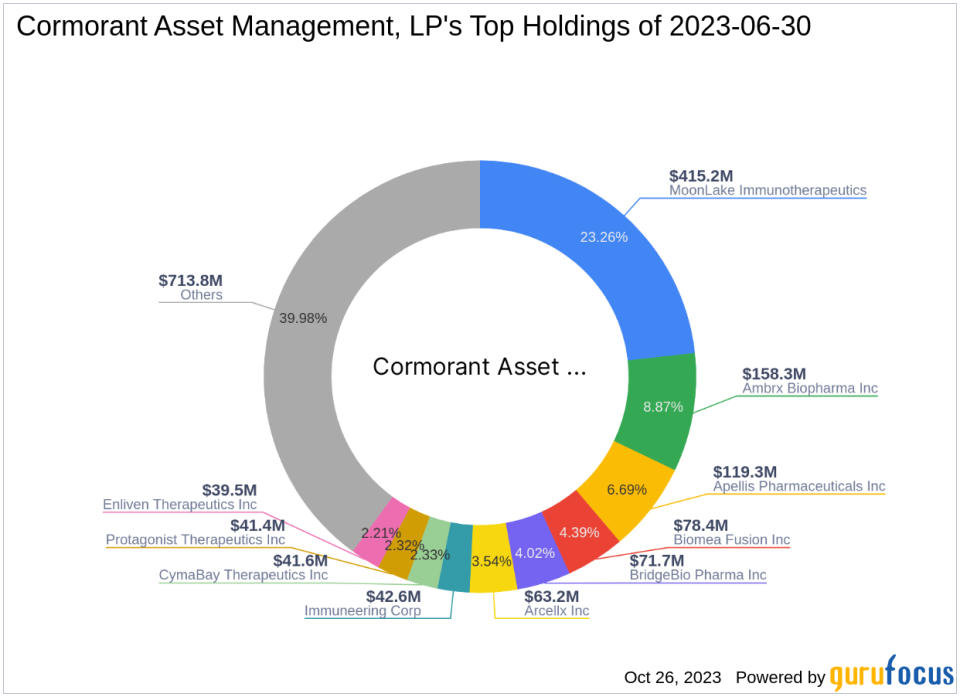

Cormorant Asset Management, LP (Trades, Portfolio), a Boston-based investment firm, is known for its strategic investments in the healthcare sector. The firm currently holds 64 stocks in its portfolio, with a total equity of $1.79 billion. Its top holdings include Apellis Pharmaceuticals Inc (NASDAQ:APLS), BridgeBio Pharma Inc (NASDAQ:BBIO), Biomea Fusion Inc (NASDAQ:BMEA), Ambrx Biopharma Inc (NASDAQ:AMAM), and MoonLake Immunotherapeutics (NASDAQ:MLTX).

Details of the Purchased Stock

Ambrx Biopharma Inc, a clinical-stage biologics company, is focused on discovering and developing a novel class of engineered precision biologics (EPBs) using its proprietary expanded genetic code technology platform. The company's product pipeline includes ARX788, ARX517, ARX305 among others. The company's market segments include license fees, milestones, reimbursements, and research and development (R&D) services. As of October 26, 2023, the company's market capitalization stands at $616.036 million, with a current stock price of $9.85.

Analysis of the Stock's Financial Health

Ambrx Biopharma Inc's financial health is a crucial factor for investors. The company's PE percentage is currently at 0.00, indicating that the company is at a loss. The GF Value, which represents the current intrinsic value of a stock, is not applicable for Ambrx Biopharma Inc. The stock's gain percent since the transaction is 40.92%, while the year-to-date percent change stands at -27.94%. The company's Altman Z score is 14.14, and its cash to debt ratio is 21.34, ranking 586th in the industry.

Evaluation of the Stock's Performance Potential

Ambrx Biopharma Inc's performance potential is evaluated using various metrics. The company's GF Score is 22/100, indicating poor future performance potential. The company's financial strength is ranked 8/10, while its profitability rank is 1/10. The company's growth rank is 0/10, indicating a lack of growth in recent years.

Examination of the Stock's Financial Ratios

Ambrx Biopharma Inc's financial ratios provide further insight into the company's performance. The company's ROE is -35.07, and its ROA is -29.44. The company's gross margin growth and operating margin growth are both at 0.00. The company's three-year revenue growth is -2.40, and its three-year EBITDA growth is -67.20.

Assessment of the Stock's Momentum and Predictability

The company's RSI 5 Day is 36.24, and its RSI 9 Day is 24.47. The company's momentum index 6 - 1 month and momentum index 12 - 1 month are both at 0.00, indicating a lack of momentum in the stock's price movement.

Conclusion

In conclusion, Cormorant Asset Management, LP (Trades, Portfolio)'s acquisition of a new stake in Ambrx Biopharma Inc is a significant move that increases the firm's exposure to the biotechnology sector. Despite the company's current financial challenges, the firm's investment could yield significant returns if Ambrx Biopharma Inc can successfully navigate its way to profitability. As always, investors are advised to conduct their own thorough research before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.