Cormorant Asset Management, LP Acquires New Stake in VYNE Therapeutics Inc

On November 1, 2023, Cormorant Asset Management, LP (Trades, Portfolio) made a significant move in the biopharmaceutical sector by acquiring 1,394,336 shares of VYNE Therapeutics Inc (NASDAQ:VYNE). This transaction marked a new holding for the firm, with a trade impact of 0.23% on their portfolio and a trade price of $2.99 per share. The total shares held by Cormorant in VYNE now stand at 1,394,336, representing a 9.99% ownership in the company and a 0.23% position in Cormorant's portfolio.

Insight into Cormorant Asset Management, LP (Trades, Portfolio)

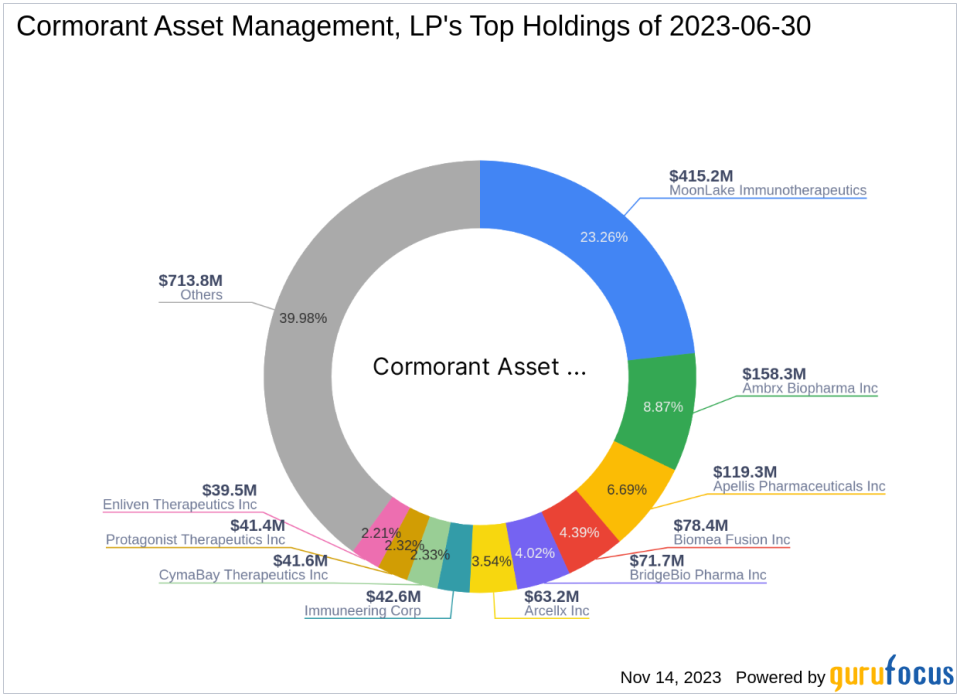

Cormorant Asset Management, LP (Trades, Portfolio), based in Boston, MA, is a well-recognized investment firm with a focus on the healthcare sector. The firm's investment philosophy is centered around identifying and investing in companies with the potential for significant value creation. With a portfolio comprising 64 stocks and top holdings that include Apellis Pharmaceuticals Inc (NASDAQ:APLS), BridgeBio Pharma Inc (NASDAQ:BBIO), and Biomea Fusion Inc (NASDAQ:BMEA), Cormorant manages an equity portfolio valued at approximately $1.79 billion.

About VYNE Therapeutics Inc

VYNE Therapeutics Inc is a USA-based biopharmaceutical company that specializes in developing treatments for immuno-inflammatory conditions. Its lead product candidate, FMX114, is aimed at treating mild-to-moderate atopic dermatitis. The company, which went public on January 25, 2018, operates within the royalty revenues segment of the biotechnology industry. With a market capitalization of $11.712 million and a current stock price of $3.57, VYNE's financial metrics indicate a PE Percentage of 0.00, signaling that the company is currently not profitable.

Trade's Significance for Cormorant Asset Management, LP (Trades, Portfolio)

The acquisition of VYNE shares by Cormorant Asset Management, LP (Trades, Portfolio) is a strategic addition to their portfolio, given the firm's expertise in the healthcare sector. The trade's position size and impact suggest a confident investment in VYNE's potential, despite the company's current financial metrics, which include a GF Value of $2.56 and a stock price to GF Value ratio of 1.39, indicating that the stock is significantly overvalued.

VYNE's Financial Health and Stock Performance

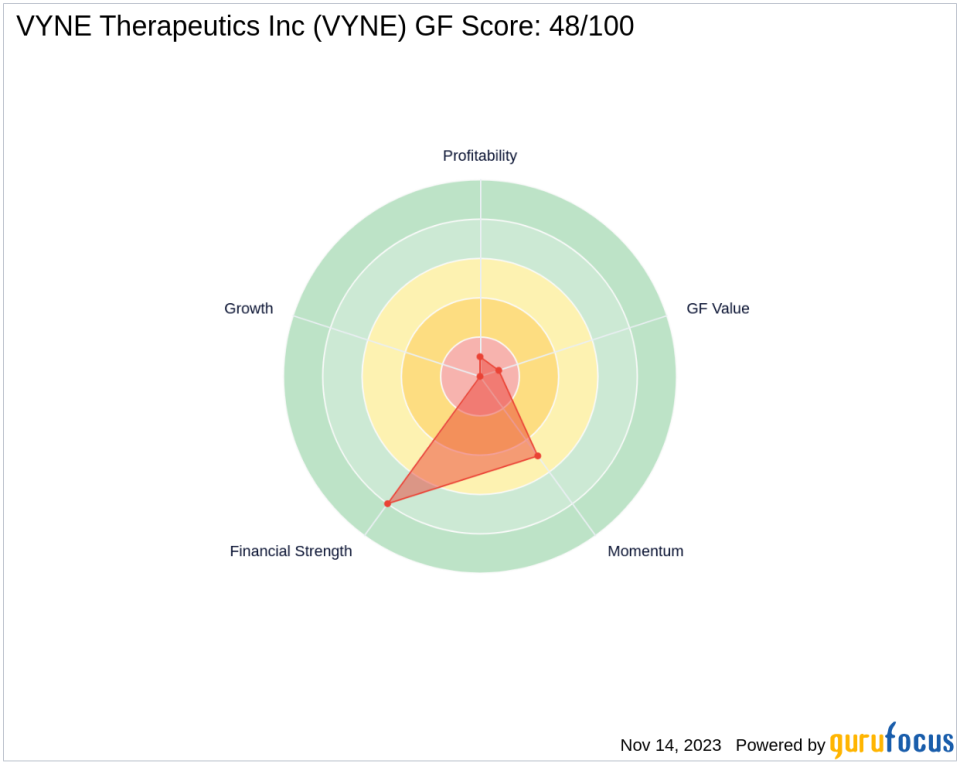

VYNE's financial health is a mix of strengths and weaknesses. The company has a strong Financial Strength rank of 8/10, but its Profitability Rank is low at 1/10. The Growth Rank and GF Value Rank are also at the bottom with scores of 0/10 and 1/10, respectively. However, the company's stock has gained 19.4% since the trade and has seen a year-to-date increase of 44.29%.

Market Reaction and Future Outlook

Since Cormorant's investment, VYNE's stock has shown positive momentum, with a GF Score of 48/100, indicating a potential for future performance that is below average. The stock's RSI indicators suggest a neutral to slightly bullish sentiment in the short term.

Comparative and Historical Performance Analysis

When compared to industry standards and historical data, VYNE's stock performance has been volatile. The stock has plummeted by -99.76% since its IPO, but recent growth in EBITDA and earnings over the past three years, at 64.00% and 63.70% respectively, provide a glimmer of hope for future performance.

Conclusion

Cormorant Asset Management, LP (Trades, Portfolio)'s recent acquisition of VYNE Therapeutics Inc shares is a calculated move that aligns with the firm's healthcare-focused investment strategy. Despite VYNE's current overvaluation and mixed financial health, Cormorant's stake in the company could be indicative of a belief in VYNE's long-term potential. Investors and market watchers will be keen to see how this investment plays out in the dynamic biopharmaceutical landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.