Corning (GLW) Q4 Earnings Miss Estimates on Lower Revenues

Corning Incorporated GLW reported mixed fourth-quarter 2023 results, wherein the top line surpassed the Zacks Consensus Estimate, but the bottom line missed the same. The company witnessed a top-line contraction year over year due to sluggish demand trends in several verticals, including Optical Communications and Specialty Materials. Strong momentum in the Environmental Technologies partially cushioned the top line. The strategy of price hikes to offset inflation and various productivity improvement actions somewhat strengthened profitability.

Net Income

On a GAAP basis, the company reported a net loss of $40 million or a loss of 5 cents per share compared to a loss of $36 million or 4 cents per share in the year-ago quarter. Lower net sales, constant currency adjustments, restructuring and asset write-off charges affected the GAAP earnings during the quarter.

Core earnings were $339 million or 39 cents per share, down from $402 million or 47 cents per share in the year-ago quarter. The bottom line missed the Zacks Consensus Estimate by a penny.

In 2023, quarterly GAAP net income was $581 million or 68 cents per share, down from $1.31 billion or $1.54 per share in 2022. Core net income stands at $1.46 billion or $1.70 per share, down 18% year over year.

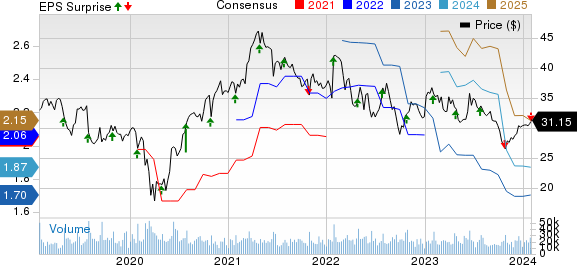

Corning Incorporated Price, Consensus and EPS Surprise

Corning Incorporated price-consensus-eps-surprise-chart | Corning Incorporated Quote

Revenues

Net sales on a GAAP basis declined to $2.99 billion from $3.4 billion reported in the year-ago quarter. Revenue decline in Optical Communications, Specialty Materials and Life Sciences impeded the top-line growth. Core sales were down 10% to $3.27 billion. However, the top line beat the consensus estimate of $3.26 billion.

In 2023, GAAP net sales were $12.58 billion, down 11% from the previous year’s figure of $14.18 billion. Core sales decreased to $13.58 billion from $14.8 billion in 2022.

Segment Results

Optical Communications generated $903 million in revenues, down 24% from $1.19 billion in the year-ago quarter. The top line beat our revenue estimate of $819.8 million. Net income from this segment declined to $88 million from $130 million reported in the year-ago quarter. Declining demand from carrier customers and inventory adjustments impacted the net sales.

Display Technologies registered $869 million in revenues, up 11% year over year. Net sales missed our revenue estimate of $923.7 million. The segment’s net income was $232 million compared with the prior-year quarter’s figure of $171 million. Despite a decrease in volume, the company’s strategy of price hikes supported the top line.

Net sales from Specialty Materials stood at $473 million, down 6% year over year, owing to declining sales volume. The top line missed our estimate of $519.8 million. Net income was $58 million, down from $78 million reported in the prior-year quarter.

Environmental Technologies contributed $429 million in net sales, up from $394 million in the year-ago quarter, backed by healthy demand trends. The top line surpassed our revenue estimate of $399.2 million. Net income was $98 million, up from $69 million in the year-earlier quarter.

Revenues from the Life Sciences segment were $242 million compared with the year-earlier quarter’s figure of $294 million. Segment net income was $17 million compared with $31 million in the year-ago quarter.

Hemlock and Emerging Growth Businesses reported a 23% decline in net sales year over year to $356 million. The company reported a net loss of $19 million from this segment against a net income of $4 million in the year-ago quarter. However, the higher sales volume of semiconductor polysilicon partially cushioned the revenues in this vertical.

Other Details

Core gross profit was $1.2 billion compared with $1.22 billion a year ago, with respective margins of 36.9% and 33.6%. The growth was driven by various productivity enhancement initiatives. Core operating margin improved to 16.3% from 14% in the year-earlier quarter.

Cash Flow & Liquidity

During the fourth quarter of 2023, Corning generated $713 million of net cash from operating activities compared with $617 million in the prior-year period. The company registered an adjusted free cash flow of $487 million compared with the prior year’s figure of $377 million.

In 2023, Corning generated $2 billion cash from operations compared with $2.61 billion in 2022.

As of Dec 31, 2023, Corning had $1.77 billion in cash and cash equivalents, with $7.2 billion of long-term debt compared to respective tallies of $1.67 billion or $6.68 billion in 2022.

Outlook

For the first quarter of 2024, core sales are estimated at $3.1 billion. Core EPS is projected to be in the range of 32-38 cents. The first quarter EPS is anticipated to be the lowest of fiscal 2024. Management expects to increase sales by more than $3 billion in the medium term by capitalizing on the market recovery.

Zacks Rank & Stocks to Consider

Corning currently carries a Zacks Rank #3 (Hold)

Here are some better-ranked stocks that investors may consider.

NVIDIA Corporation NVDA, currently carrying a Zacks Rank #2 (Buy), delivered a trailing four-quarter average earnings surprise of 18.99%. In the last reported quarter, it delivered an earnings surprise of 19.64%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

InterDigital, Inc. IDCC, carrying a Zacks Rank #2 at present, delivered a trailing four-quarter average earnings surprise of 170.71%. In the last reported quarter, it delivered an earnings surprise of 78.99%.

IDCC is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has delivered an earnings surprise of 12%, on average, in the trailing four quarters.

The company holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. It is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Corning Incorporated (GLW) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report