Corning Inc (GLW) Demonstrates Resilience in Q4 and Full-Year 2023 Financial Results

GAAP and Core Sales: Q4 GAAP sales decreased by 12% year over year, while core sales declined by 10%.

Gross Margin: Both GAAP and core gross margins improved significantly, by 350 and 330 basis points respectively.

Net Income and EPS: Full-year GAAP EPS was $0.68, and core EPS was $1.70, reflecting various adjustments including currency translations and restructuring charges.

Cash Flow: GAAP operating cash flow for the year reached $2 billion, with adjusted free cash flow at $880 million.

Q1 2024 Outlook: Core sales expected to be around $3.1 billion with EPS ranging from $0.32 to $0.38.

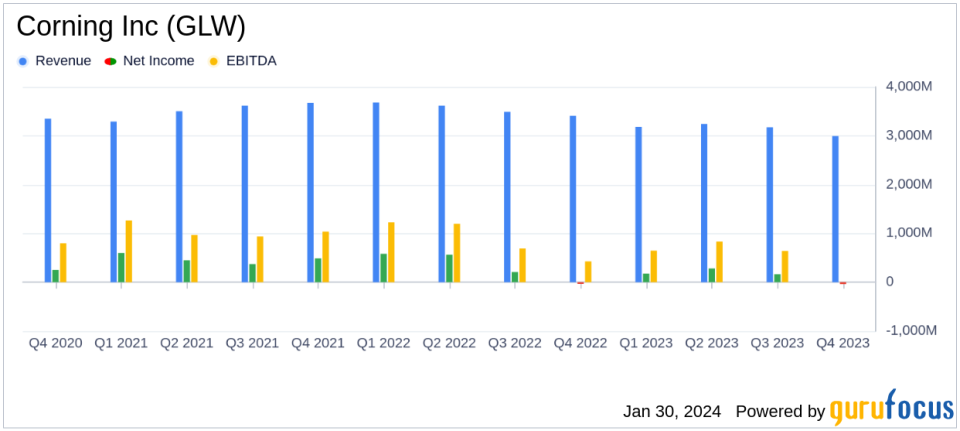

Corning Inc (NYSE:GLW) released its 8-K filing on January 30, 2024, revealing its financial performance for the fourth quarter and full year of 2023. The company, a leader in materials science specializing in glass, ceramics, and optical fiber, faced a challenging year with a decline in sales. However, it managed to improve its gross margins and cash flow significantly, demonstrating the company's ability to navigate a tough economic environment.

Financial Performance Overview

For the fourth quarter, Corning Inc (NYSE:GLW) reported a 12% decrease in GAAP net sales year over year, with a slight improvement in GAAP net loss. The core sales, which adjust for certain non-GAAP measures, also saw a 10% decline. Despite the sales downturn, the company achieved a substantial improvement in gross margins, with GAAP gross margin increasing by 350 basis points and core gross margin by 330 basis points compared to the same quarter the previous year.

The full-year results echoed the fourth quarter's pattern, with a decline in GAAP and core sales by 11% and 8%, respectively. The GAAP EPS stood at $0.68, while the core EPS was $1.70. The difference between GAAP and core EPS primarily reflected constant currency adjustments and restructuring charges. The company's cash flow showed resilience, with GAAP operating cash flow totaling $2 billion and adjusted free cash flow at $880 million for the year.

Segment Performance and Future Outlook

Corning Inc (NYSE:GLW) experienced mixed results across its business segments. Optical Communications saw a 20% decrease in full-year sales, while Display Technologies and Specialty Materials also faced declines. However, Display Technologies managed to execute a double-digit price increase in the second half of 2023, which helped mitigate some of the sales volume decline.

Looking ahead, Corning Inc (NYSE:GLW) anticipates the first quarter of 2024 to be the low point of the year, with core sales expected to be around $3.1 billion and EPS in the range of $0.32 to $0.38. The company remains optimistic about the medium-term opportunity to add more than $3 billion in annualized sales as markets normalize, aiming to deliver strong incremental profit and cash flow.

Investor Considerations

Corning Inc (NYSE:GLW)'s ability to improve productivity ratios and raise prices to offset inflation, even in the face of lower sales, is a testament to the company's operational strength. The improved cash generation and gross margins are particularly important for a hardware company, as they reflect efficient management of costs and the ability to maintain profitability in a challenging market.

For value investors, the company's focus on advancing market leadership and strengthening profitability, despite lower demand, may present a compelling investment narrative. The expected growth in sales and the potential for increased profitability as markets stabilize could be attractive for long-term investors seeking companies with a clear path to recovery and growth.

Corning Inc (NYSE:GLW) continues to innovate in its product offerings across diverse industries, including optical communications, mobile consumer electronics, display, automotive, and life sciences. This diversification and the company's sustained investment in research, development, and engineering underscore its commitment to being at the forefront of materials science innovation.

Investors and stakeholders can look forward to upcoming investor events, including the Susquehanna Financial Group Technology Conference and the Morgan Stanley Technology, Media & Telecom Conference, where Corning Inc (NYSE:GLW) will further discuss its performance and outlook.

For a detailed analysis of Corning Inc (NYSE:GLW)'s financial results, including reconciliations of non-GAAP measures, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Corning Inc for further details.

This article first appeared on GuruFocus.