Service Corporation (SCI) Q2 Earnings Beat, Sales Rise Y/Y

Service Corporation International SCI posted second-quarter 2023 results, with the top and the bottom line beating the Zacks Consensus Estimate. Total revenues increased year over year, but earnings declined in the quarter.

Management revised its 2023 guidance range to reflect the inflationary environment and its impact on consumer discretionary spending. The revised outlook also takes into account the effect of greater-than-expected interest rates. SCI highlighted that it is seeing increased demand for preneed cemetery sales from its mid and high-price tiered consumers. However, it is seeing some softness from the more price-sensitive consumers amid an inflationary environment and economic uncertainty.

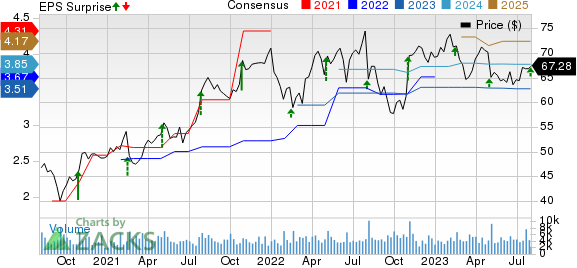

Service Corporation International Price, Consensus and EPS Surprise

Service Corporation International price-consensus-eps-surprise-chart | Service Corporation International Quote

Q2 in Detail

Service Corporation posted adjusted earnings of 83 cents per share, surpassing the Zacks Consensus Estimate of 80 cents. However, the metric fell from 84 cents reported in the year-ago quarter. The downside was caused by higher interest expenses. That said, fewer shares outstanding and increased operating income offered respite.

Total revenues of $1,013.4 million increased from $990.9 million reported in the year-ago quarter. The top line came ahead of the Zacks Consensus Estimate of $972.8 million.

The gross profit decreased to $261.5 million from $266.6 million reported in the year-ago quarter. We expected gross profit to come in at $242.7 million.

Corporate general and administrative costs were $34.9 million compared with $45.7 million in the year-ago period. The reduced cost was a result of the decline in incentive compensation.

The operating income of $233.5 million increased from $221.2 million reported in the year-ago quarter. We expected operating income to come in at $206.4 million.

Segment Discussion

Consolidated funeral revenues came in at $565.4 million, up from $548.8 million reported in the year-ago quarter. We expected funeral revenues to come in at $534.3 million.

Total comparable funeral revenues grew 1.9%, mainly due to higher core funeral revenues and other revenues. Core funeral revenues grew 1.7%, mainly on growth in the core average revenue per service to the tune of 4.2%. This was countered by a decline in core funeral services performed of 2.4%.

Comparable preneed funeral sales production increased 3.8%. Further, core preneed sales production went up 2.3% on increased velocity. The non-funeral home preneed sales production jumped 8.9% on the back of increased velocity and sales average.

Comparable funeral gross profit fell by $1.8 million to $115.2 million. Inflationary fixed cost increases slightly outpaced funeral revenue growth. We expected the funeral gross profit to come in at $111.3 million.

Consolidated cemetery revenues came in at $448 million, up from $442 million reported in the year-ago quarter. We expected cemetery revenues to come in at $429.4 million. Comparable cemetery revenue rose 1.2%, on higher core revenue. Core revenue rose by $4.5 million, owing to higher total recognized preneed revenue. This was countered by a decline in atneed revenues.

Comparable preneed cemetery sales production inched up 0.3% on greater sales activity and improved quality sales average. These factors were somewhat offset by a decline in the velocity of contracts sold.

Comparable cemetery gross profit fell $4.1 million to $146.1 million mainly due to escalated cost structure mainly stemming from inflationary employee-related expenses. We expected cemetery gross profit to come in at $131.3 million.

Image Source: Zacks Investment Research

Other Financial Details

Service Corporation ended the quarter with cash and cash equivalents of $172.5 million, long-term debt of $4,452.4 million and total equity of $1,645.4 million.

Net cash from operating activities amounted to $363.6 million during the six months ended Jun 30, 2023. During the same period, the company incurred capital expenditures of $177 million.

2023 Guidance

Service Corporation expects 2023 adjusted earnings per share (EPS) in the range of $3.40- $3.60 compared with $3.45-$3.75 expected earlier. We note that the company’s earnings came in at $3.80 per share in 2022.

Net cash provided by operating activities (excluding special items and cash taxes) is now anticipated in the range of $920-$960 million compared with $910-$960 million expected earlier. Net cash provided by operating activities (excluding special items) is now anticipated in the range of $830-$880 million compared with $740-$800 million projected earlier.

Management continues to expect maintenance capital expenditures in the band of $290-$310 million in 2023.

Shares of this Zacks Rank #4 (Sell) company have declined 8.8% in the past six months compared with the industry’s 6.8% decline.

Some Better-Ranked Staple Bets

Here, we have highlighted three better-ranked stocks, namely TreeHouse Foods, Inc. THS, Post Holdings POST and McCormick & Company, Incorporated MKC.

TreeHouse Foods, a manufacturer of packaged foods and beverages, currently sports a Zacks Rank #1 (Strong Buy). THS has a trailing four-quarter earnings surprise of 49.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TreeHouse Foods’ current financial year’s sales suggests a decline of 12.4% from the year-ago reported numbers.

Post Holdings, a consumer-packaged goods holding company, currently has a Zacks Rank #2 (Buy). POST has a trailing four-quarter earnings surprise of 46.7%, on average.

The Zacks Consensus Estimate for Post Holdings’ current fiscal year sales and earnings suggests growth of 13% and 141.1%, respectively, from the corresponding year-ago reported figures.

McCormick, a manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors, currently carries a Zacks Rank #2. MKC has a trailing four-quarter earnings surprise of 4.2%, on average.

The Zacks Consensus Estimate for McCormick’s current fiscal year sales and earnings suggests growth of 6.4% and 5.1%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Service Corporation International (SCI) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report