Corsair Gaming Inc (CRSR) Reports Strong Earnings Growth and Margin Improvement for Q4 and Full ...

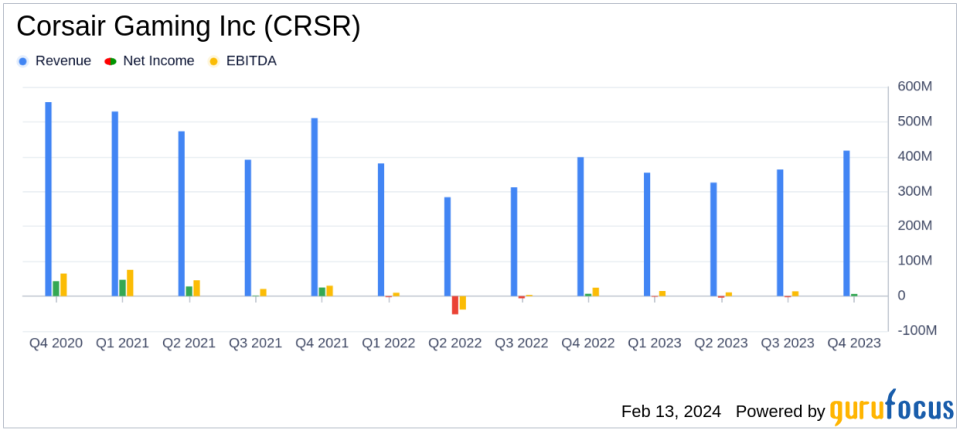

Net Revenue: Q4 net revenue increased to $417.3 million, with full-year revenue reaching $1,459.9 million.

Net Income: Q4 net income attributable to common shareholders was $6.2 million, with full-year net income turning positive to $3.2 million.

Adjusted EBITDA: Significant growth with Q4 adjusted EBITDA at $33.7 million and $95.1 million for the full year.

Gross Margin: Gross margin improved by 310 basis points to 24.7% for 2023.

Product Launches: Successful new product launches contributed to the company's strong performance.

Financial Outlook: For 2024, net revenue is expected to be in the range of $1.45 billion to $1.60 billion, with adjusted EBITDA between $105 million to $125 million.

On February 13, 2024, Corsair Gaming Inc (NASDAQ:CRSR) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading global provider of high-performance gear for gamers and content creators, reported a 16% year-over-year revenue growth in its Gamer and Creator Peripherals segment for Q4, with a 6% growth in total FY23 revenue. Adjusted EBITDA saw an impressive surge, growing over 100% in FY23.

Corsair Gaming Inc operates in two segments: Gamer and Creator Peripherals, and Gaming Components and Systems. The former is the key revenue-generating segment, while the latter also contributes significantly to the company's financials. Geographically, Corsair derives revenue from the Americas, Europe and the Middle East, and the Asia Pacific.

The company's performance is particularly noteworthy given the challenges faced by the industry, including high inflation and potential recession risks. Corsair's ability to navigate these headwinds and report increased revenue and net income is crucial, as it demonstrates resilience and the effectiveness of its strategic initiatives. The growth in adjusted EBITDA is also significant, as it reflects the company's ability to improve its operational efficiency and profitability.

Financial achievements such as the improved gross margin, which increased by 310 basis points to 24.7% for 2023, are important for Corsair and the hardware industry. This improvement indicates better cost management and a favorable product mix, which can lead to enhanced profitability.

Key financial metrics from the income statement, balance sheet, and cash flow statement include:

"I am really excited to see that the gaming market is now showing signs of growth again after relaxing back from the surge that occurred during the pandemic," said Andy Paul, CEO of Corsair. He also highlighted the success of new product launches and the company's market share gains.

CFO Michael G. Potter noted, "We more than doubled our adjusted EBITDA to $95.1 million from $46.5 million in 2022, and turned profitable on a GAAP basis with earnings per share to $0.03 per diluted share from a loss of $0.63 per diluted share in 2022, with adjusted earnings per share tripling to $0.55 per diluted share from $0.18 per diluted share in 2022."

The company's balance sheet remains strong with cash and restricted cash totaling $178.6 million as of December 31, 2023. The reduction of face value of debt to below $200 million positions Corsair well for future investments and growth.

Looking ahead, Corsair expects the overall gaming market to enter a new growth phase and anticipates significant growth in the Gamer and Creator Peripherals segment. The company plans to enter two new product categories in 2024, sim racing and mobile controllers, which could further enhance its market position.

Corsair's performance analysis indicates a company that is successfully capitalizing on market opportunities and executing its growth strategies effectively. The company's focus on innovation, market expansion, and operational efficiency is likely to continue driving positive financial results in the future.

For more detailed information on Corsair Gaming Inc's financial performance, readers are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Corsair Gaming Inc for further details.

This article first appeared on GuruFocus.