Corteva Inc (CTVA) Reports Mixed Fourth Quarter and Full-Year 2023 Results

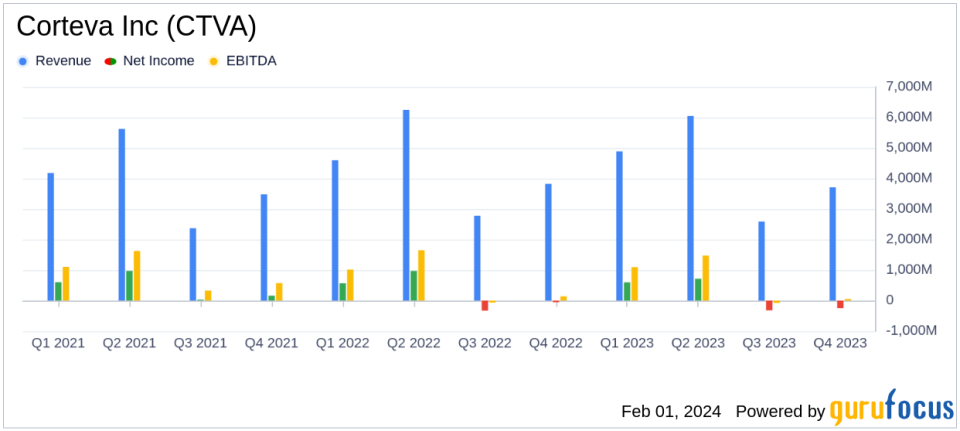

Net Sales: Full-year net sales slightly down by 1% to $17.23 billion, with a 3% decrease in organic sales.

Earnings Per Share (EPS): GAAP EPS for the full year decreased by 22% to $1.30, while non-GAAP operating EPS slightly up by 1% to $2.69.

Operating EBITDA: Full-year operating EBITDA increased by 5% to $3.38 billion.

Free Cash Flow: Free cash flow saw a significant increase of 98% to $1.2 billion for the year.

Seed Segment: Seed net sales grew by 5% with a 7% increase in organic sales, driven by a 13% global price rise.

Crop Protection Segment: Net sales declined by 9% with a 12% decrease in organic sales, affected by volume declines and strategic product exits.

2024 Guidance: Corteva anticipates net sales between $17.4 billion and $17.7 billion, with operating EBITDA between $3.5 billion and $3.7 billion.

On January 31, 2024, Corteva Inc (NYSE:CTVA) released its 8-K filing, detailing its financial performance for the fourth quarter and the full year ended December 31, 2023. The company, a global leader in seed and crop protection products, reported a slight decline in full-year net sales by 1% to $17.23 billion, with organic sales decreasing by 3%. Despite the dip in sales, Corteva's full-year operating EBITDA improved by 5% to $3.38 billion, and free cash flow surged by 98% to $1.2 billion.

Performance and Challenges

Corteva's performance in 2023 was a mixed bag, with the Seed segment showing resilience through a 5% growth in net sales, while the Crop Protection segment faced a 9% decline. The Seed segment's success was attributed to a 13% increase in global prices, reflecting the company's effective price for value strategy and demand for new technology. However, volume declines in the Crop Protection segment, driven by strategic product exits and inventory destocking, underscored the challenges faced by the company.

Financial Achievements and Industry Significance

The company's financial achievements, particularly the increase in operating EBITDA and a substantial rise in free cash flow, are significant as they demonstrate Corteva's ability to manage costs and improve operational efficiency in a challenging market. These metrics are crucial for the agriculture industry, which is highly sensitive to external factors such as weather conditions, commodity prices, and global trade dynamics.

Income Statement and Balance Sheet Highlights

For the fourth quarter, Corteva reported a GAAP net loss from continuing operations after tax of $231 million, a stark contrast to the previous year's $41 million loss. The non-GAAP operating EBITDA for the quarter was $386 million, a 4% increase from the prior year. The Seed segment's operating EBITDA for the quarter improved by 104%, while the Crop Protection segment saw a 20% decline.

2024 Outlook and Analysis

Looking ahead to 2024, Corteva provided an optimistic guidance, expecting net sales to range between $17.4 billion and $17.7 billion, with operating EBITDA projected to be between $3.5 billion and $3.7 billion. The company plans to repurchase approximately $1.0 billion of its shares, signaling confidence in its financial health and future prospects.

The global agriculture outlook remains positive, with steady on-farm demand and growing needs for grain, oilseeds, and biofuels. Corteva's focus on innovation, customer engagement, and operational execution positions it well to capitalize on these trends and navigate the complexities of the agriculture sector.

For detailed financial information and non-GAAP measure reconciliations, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Corteva Inc for further details.

This article first appeared on GuruFocus.