CorVel Corp (CRVL) Reports Revenue Growth and EPS Increase in Latest Quarter

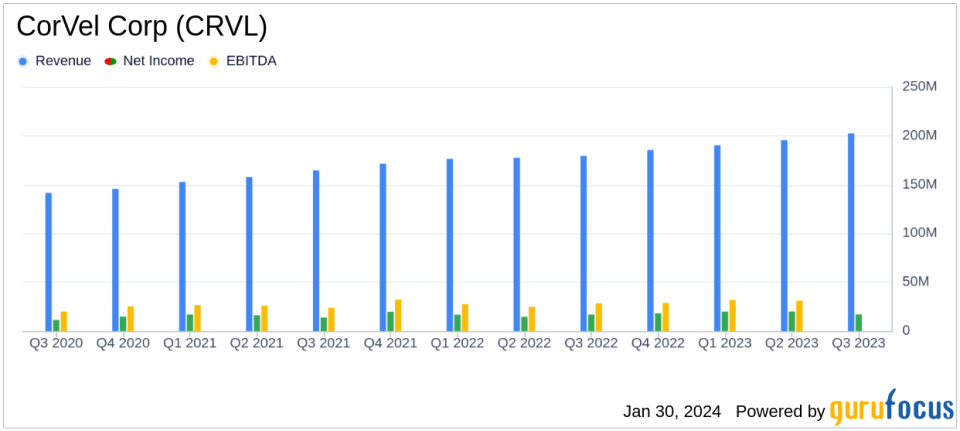

Revenue Growth: Quarterly revenue increased to $202 million, up from $179 million year-over-year.

Earnings Per Share (EPS): EPS for the quarter rose to $0.99 from $0.96 in the same quarter last year.

Nine-Month Financials: Revenue for the nine months ended December 31, 2023, reached $588 million, with EPS of $3.27.

New Business and Retention: A 34% increase in new business sold and high customer retention rates underscore CorVel's market position.

Technological Advancements: Implementation of generative AI initiatives boosts efficiency across the company.

On January 30, 2024, CorVel Corp (NASDAQ:CRVL) released its 8-K filing, announcing financial results for the quarter ended December 31, 2023. The company reported a significant increase in revenues and earnings per share, indicating a strong performance amidst a challenging market.

Company Overview

CorVel Corp is a leader in applying advanced technologies such as artificial intelligence, machine learning, and natural language processing to improve healthcare management and cost control. The company's innovative approach has made it a valuable partner for employers, third-party administrators, insurance companies, and government agencies, particularly in the workers' compensation and health, auto, and liability sectors. CorVel's commitment to integrating technology with personalized service ensures that its solutions are both effective and user-friendly.

Financial Performance and Challenges

The company's revenues for the quarter were $202 million, marking an increase from $179 million in the December quarter of the previous year. This growth is a testament to CorVel's robust business model and its ability to attract and retain customers. The earnings per share (EPS) also saw an uptick, rising from $0.96 to $0.99 year-over-year. For the nine months ended December 31, 2023, revenues stood at $588 million, up from $533 million in the prior year, with EPS increasing from $2.73 to $3.27.

The performance is particularly noteworthy given the competitive nature of the insurance industry, where customer retention is as crucial as acquiring new business. CorVel's impressive customer retention rate of 95% and a net revenue retention of 108% reflect the company's ability to maintain and grow its customer base. However, the industry faces challenges such as increased churn and the need for continuous innovation to keep pace with evolving customer demands and regulatory changes.

Financial Achievements and Industry Significance

The 34% increase in new business sold and balanced bookings across Network Solutions and Patient Management segments highlight CorVel's competitive edge in the insurance industry. The company's payment integrity services have attracted significant attention, indicating a strong demand for CorVel's offerings. These achievements are crucial as they demonstrate the company's ability to expand its market share and solidify its position as a trusted provider in a sector where trust and reliability are paramount.

Income Statement and Balance Sheet Highlights

CorVel's income statement reveals a gross profit of $42.16 million for the quarter, up from $40.34 million in the previous year. The income from operations also saw a slight increase to $22.36 million. The balance sheet shows a healthy cash position of $106.99 million, an increase from $71.33 million at the end of the previous fiscal year. These figures underscore CorVel's financial stability and its ability to invest in growth opportunities.

Technological Innovations and Market Impact

The implementation of generative AI initiatives has enhanced the efficiency of CorVel's Property & Casualty (P&C) and Commercial Claims teams. By reducing time spent on routine tasks, the company has been able to allocate more resources to critical thinking and customer service activities, thereby improving the overall user experience and outcomes.

Conclusion

CorVel Corp's latest earnings report reflects a company that is not only growing its top and bottom lines but also innovating and adapting to the needs of a dynamic industry. The strategic use of technology and a focus on customer retention are driving CorVel's success, positioning it well for future growth. Investors and stakeholders can view the detailed financials in the company's 8-K filing.

Explore the complete 8-K earnings release (here) from CorVel Corp for further details.

This article first appeared on GuruFocus.