CorVel Corp (CRVL): A Stock with Good Outperformance Potential

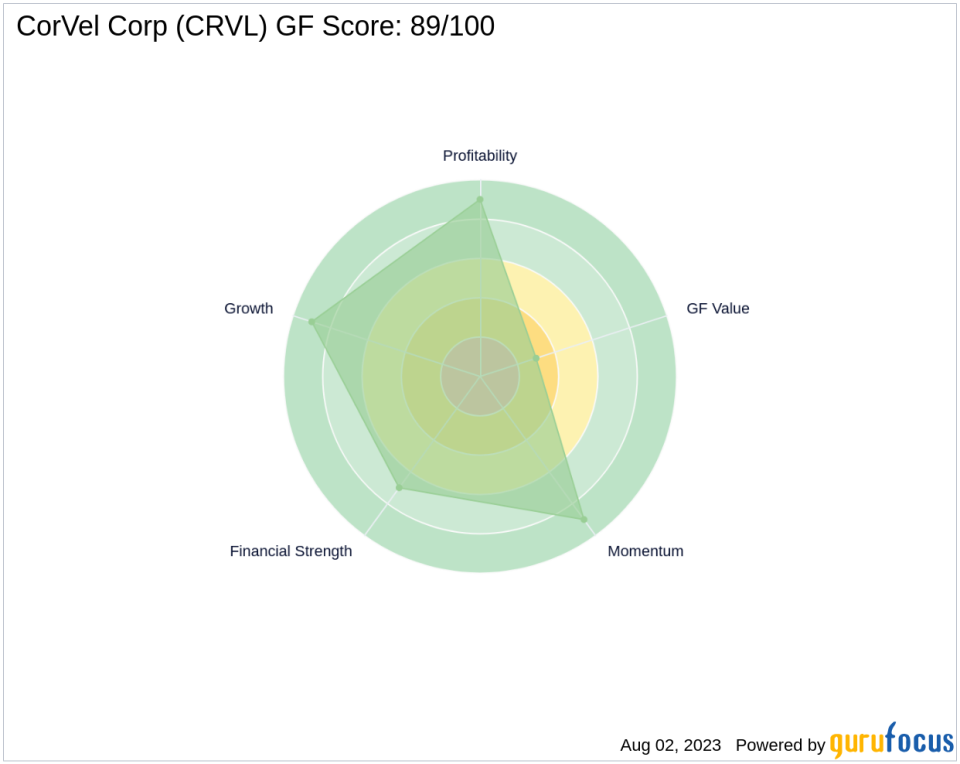

CorVel Corp (NASDAQ:CRVL), a prominent player in the insurance industry, is currently trading at $214.57 with a market capitalization of $3.69 billion. The company's stock price has seen a gain of 4.48% today and a 10% increase over the past four weeks. According to GuruFocus, CorVel Corp has a GF Score of 89 out of 100, indicating good outperformance potential. The GF Score is a comprehensive stock performance ranking system that evaluates a company's valuation across five key aspects, including Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

CorVel Corp's Financial Strength

CorVel Corp's Financial Strength rank is 7 out of 10. This rank measures the robustness of a company's financial situation, considering factors such as interest coverage (not applicable due to no interest expenses), debt to revenue ratio (0.05), and Altman Z score (16.42). The company's low debt to revenue ratio and high Altman Z score indicate a strong financial position.

Profitability Rank Analysis

The company's Profitability Rank is 9 out of 10, suggesting high profitability and consistency. This rank is based on factors such as Operating Margin (11.77%), Piotroski F-Score (7 out of 9), and a consistent profitability trend over the past 10 years based on a predictability rank of 4 stars out of 5. The high Profitability Rank indicates that CorVel Corp's business is likely to remain profitable.

Growth Rank Analysis

CorVel Corp's Growth Rank is 9 out of 10, reflecting strong revenue and profitability growth. The Growth Rank considers the 5-year revenue growth rate (5.90%), 3-year revenue growth rate (8.70%), and 5-year EBITDA growth rate (10.70%). The high Growth Rank suggests that CorVel Corp has been successful in expanding its business operations.

GF Value Rank Analysis

The company's GF Value Rank is 3 out of 10, indicating that the stock is currently overvalued. The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

CorVel Corp's Momentum Rank is 9 out of 10, suggesting strong stock price performance. The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators, reflecting the stock's price performance from 12 months ago to 1 month ago and 6 months ago to 1 month ago.

Competitive Analysis

When compared to its competitors in the insurance industry, CorVel Corp stands out with its high GF Score. BRP Group Inc (NASDAQ:BRP) has a GF Score of 77, Fanhua Inc (NASDAQ:FANH) has a GF Score of 67, and Crawford & Co (NYSE:CRD.A) has a GF Score of 73. This comparative analysis suggests that CorVel Corp has good performance potential in the industry. For more details, please visit the competitors page.

In conclusion, CorVel Corp's high GF Score, strong financial strength, high profitability, and growth ranks, along with its strong momentum, make it a promising investment. However, investors should be cautious due to its current overvaluation as indicated by its low GF Value Rank.

This article first appeared on GuruFocus.