Costamare: A Strong Maritime Player With Financial Resiliency

Costamare Inc. (NYSE:CMRE) is a leading marine shipping company based in Monaco that specializes in the international ownership, operation and chartering of containerships and dry bulk vessels. Its fleet currently consists of 68 containerships and 45 dry bulk vessels, which is a major improvement over the 42 containerships it owned during its public listing in 2010.

The macroeconomic effects of Covid-19

According to the United States International Trade Commission, in the early months of 2020, the Covid-19 pandemic significantly disrupted maritime and air freight services, which lead to the cancellation of sailings and flights, as well as port delays and container shortages. This had a profound impact on U.S. imports, particularly from Northeast Asia, leading to increased volatility in freight rates and significant delays in delivery.

In the first half of 2020, U.S. maritime container imports dropped by 7%, compared to the same period in 2019, but in the second half, they surged by 9.5% compared to the same period in 2019. The increased volume of imports led to a sharp rise in associated maritime shipping and port services, particularly with Asia and notably with China.

The initial decline prompted shipping companies to cancel scheduled sailings (called blank sailings) and consolidate shipping routes to focus service on major ports in the first half of 2020. This, in turn, permitted shipping lines to lower costs and mitigate a downward pressure on freight rates due to overcapacity, which stabilized freight rates toward the end of the first half of 2020. However, in the second half, as trade rebounded beyond shipping capacity, freight rates substantially increased.

Source: heavyliftpfi.com

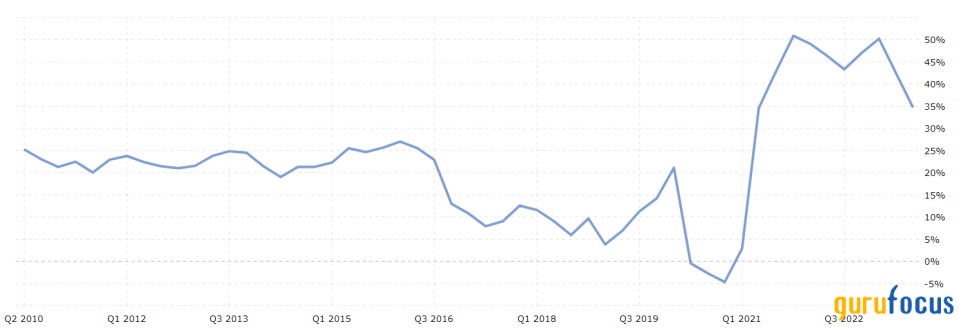

The increase in freight rates is reflected in various time charter indexes. The one shown above is Drewry's Multipurpose Time Charter Index: It monitors one-year period charter rates across a basket of various vessel types and sizes, specifically focusing on breakbulk and project cargo ships (containerships). Another Index that can be used is the Baltic Dry Index (BDI), which like the Index above, tracks time charter rates for a basket of vessel types except this basket is more focused on dry bulk vessels and is composed of the dry bulk timecharter averages of the Capesize (40%), Panamax (30%) and Supramax (30%) indices.

The BDI is my preferred measure of charter rates and I will be referencing that index later on as Costamare expands into the dry bulk market.

The increase in charter rates came as a great benefit to Costamare, as stated by Chief Financial Officer Gregory Zikos during its third-quarter 2020 earnings call:

During the third quarter the Company continued its profitability.

As part of our fleet renewal program, we sold for demolition two vessels with an average age of 23 years and we agreed to acquire three larger secondhand ships on average 11 years younger. The new acquisitions will be initially funded with equity.

Meanwhile, our newbuilding program is progressing on schedule, and we have now accepted delivery of three out of the five 13,000 TEU vessels, which have commenced their 10-year charters.

On the market, the inactive containership fleet continues to shrink to levels below 2%, on the back of healthy demand for container shipping. Charter rates have been rising and we have chartered in total 13 ships during the quarter. We have 14 ships coming off charter over the next six months which positions us favorably, should market momentum continue.

With liquidity of above $200 million, no meaningful debt maturities over the next three years and minimal capex commitments we are well positioned for acquisition opportunities increasing shareholder value and returns.

In the transcript above, the CFO highlights the continued profitability of the company and its commitment toward the continued growth and operation of its fleet, but most importantly, the increased profitability during the higher charter rate environment. Additionally, it affirmed the company's high amount of liquid cash reserves, thus giving it the ability to acquire more while not using too much leverage.

All of these macroeconomic factors led to shares of Costamare appreciating over 450% during the second half of 2020, which was predominantly led by the rising charter rates.

Costamare's ongoing expansion into dry bulk is illustrated through the increase in its quarter-over-quarter net profit margin.

Source: macrotrends.net

The period between the fourth quarter of 2020 and the fourth quarter of 2021 marked a time of record income growth for Costamare. %his was in alignment with the then-accelerated rise in charter rates. Realizing this growth, Costamare, as of a June 14, 2021 announcement, began an ongoing and rapid expansion into the dry bulk market, a market in which it was not previously a participant, which was kicked off with its acquisition of 16 dry bulk vessels ranging between 33,000 and 85,000 deadweight tons.

Along with the announcement, Zikos expressed confidence and satisfaction with the acquisition of the dry bulk vessels, stating that it was an investment in a robust sector and that the company anticipated improved returns for shareholders.

A week later, during the second-quarter 2021 earnings call, he announced the acquisition of 21 additional dry bulk vessels. He said:

On the dry bulk side, we are pleased to report the acquisition of 21 additional vessels since we first announced our entry into the sector.

Our dry bulk fleet comprised of 37 vessels in total between 32,000 and 85,000 deadweight with an average age of 10 years. Up to now, 14 ships have been delivered with the rest of the fleet expected to be delivered by year end. The dry bulk acquisitions result from our decision to invest in this liquid sector, where supply is limited by a low order book and demand is being driven by increased infrastructure spending and commodity consumption. Supported by contracted revenues of $3.3 billion at an average time charter duration of more than 4 years from our contribution fleet, we have 15 containerships coming off charter over the next 18 months and 37 dry bulk vessels operating in the spot market, favorably positioning our company should the currently strong market conditions continue.

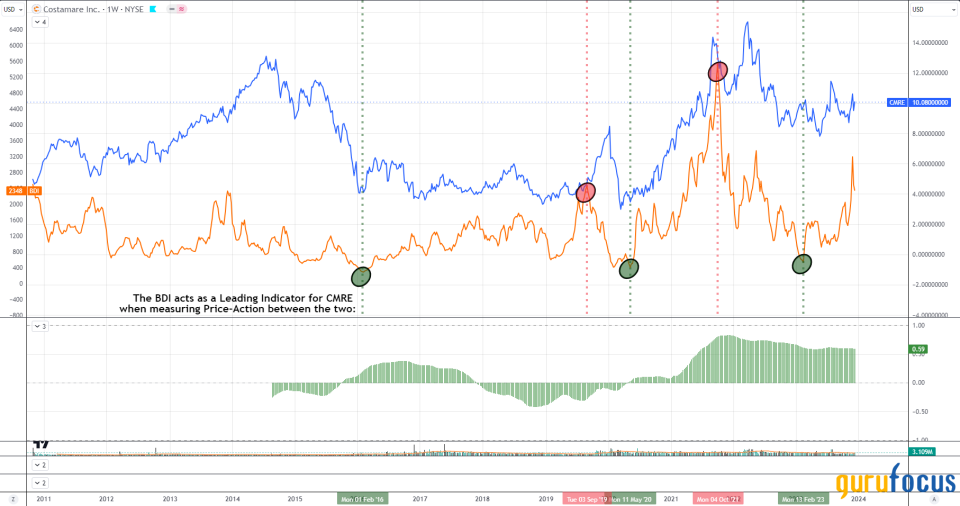

This expansion effort would come at a time when the stock (in blue) and the Baltic Dry Index (in orange) were making record highs and would prove to be somewhat poor timing given that it was just one quarter before the peak and subsequent sharp decline the Baltic Dry Index would experience during the end of 2021, taking the stock valuation down with it, a trend that would continue deep into 2023.

Source: tradingview.com

It is worth noting that since the company began acquiring dry bulk vessels, the price action of the stock has developed and maintained a correlation coefficient well above 50% on a rolling 200-week period, as highlighted by the green histogram using Tradingview's Built-in Correlation Coefficient indicator.

With correlation being this high from its historical peak (represented by the red circles) to trough (represented by the green circles), one may consider the BDI to be a leading indicator for the stock as it has generally moved well in advance to and, in many cases, was an accurate predictor of major bull/bear market cycles in the stock.

Since the initial announcement, Costamare has increased its dry bulk fleet from 16 vessels to the current total of 45 with capacities ranging from 31,776 to 179,842 deadweight tons, while maintaining its already robust containership fleet of 68 ships with capacities ranging from as low as 1,070 twenty-foot equivalent units to as high as 14,424 teu. This rapid expansion serves to further secure its newly acquired competitive stance in the dry bulk market and its leading positioning in the maritime shipping industry as a whole because, despite the year-long, industry-wide lull in charter rates, Costamare's earnings metrics remained relatively strong, maintaining positive net income and consistent quarterly revenue growth.

Source: tradingview.com

According to its third-quarter 2023 earnings release, Costamare bolsters a strong cash position of $806.7 million in cash and cash equivalents:

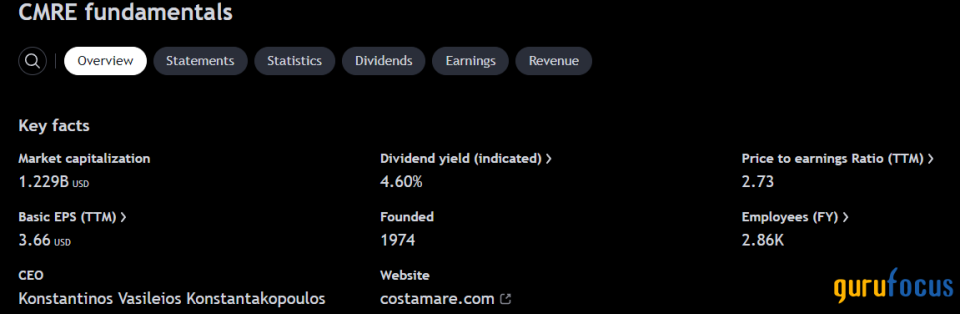

The stock currently has a market cap of $1.22 billion and trades at a pirce-earnings ratio of 2.73, putting its stock valuation significantly below peers of similar size, thereby offering a compelling argument for providing deep value to its investors.

Technical outlook

Source: tradingview.com

Presently, Costamare is consolidating between the low-to-high 50% and 61.8% Fibonacci Retraces, which aligns with a previous support/resistance zone highlighted in the green shaded area.

During the previous month, the stock successfully confirmed a bullish engulfing while also closing above the 55-month exponential moving average. Additionally, Hidden MACD Bullish Divergence can now be observed with the MACD histogram now sitting in positive territory for the first time since May of 2022.

It can also be seen that the Baltic Dry Index (highlighted above the MACD) has bottomed out this year at after reaching a 0.88 retrace and now appears to be consolidating at a higher level between its own set of 50% and 61.8% Fibonacci Retraces.

If the BDI continues its upwards trajectory and CMRE holds the current levels it should have full technical clearance to rise up to the next major high-to-low Fibonacci Retracement levels, which will be in alignment with the resistance zones of $16.83 to $18.01 and the next zone of $23.70 to $24.94.

This article first appeared on GuruFocus.