Costco's (COST) Q1 Earnings Top, Comparable Sales Up 3.8%

Costco Wholesale Corporation COST reported first-quarter fiscal 2024 results, with the top and the bottom line beating the Zacks Consensus Estimate and increasing year over year. Comparable sales also showcased a year-over-year improvement. Management announced a special dividend, marking its fifth special dividend in the last 11 years.

Q1 in Details

Costco’s reported earnings of $3.58 per share compared with $3.07 million reported in the year-ago quarter. Excluding tax benefits, earnings came in at $3.48 million. The Zacks Consensus Estimate for the bottom line was pegged at $3.45 per share.

Total revenues — comprising net sales and membership fees — reached $57,799 million, up from $54,437 million reported in the year-ago quarter. This figure also surpassed the Zacks Consensus Estimate of $57,674.1 million.

Costco's net sales exhibited growth of 6.1% year over year to reach $56,717 million. Membership fees stood at $1,082 million, up from $1,000 million reported in the year-ago quarter.

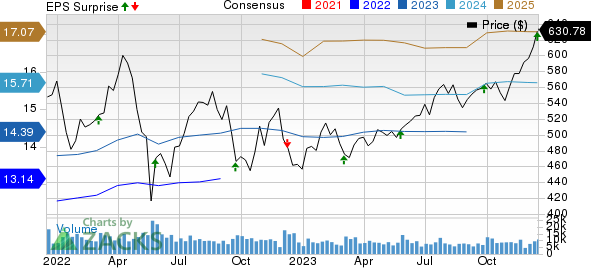

Costco Wholesale Corporation Price, Consensus and EPS Surprise

Costco Wholesale Corporation price-consensus-eps-surprise-chart | Costco Wholesale Corporation Quote

Total company comparable sales increased 3.8% year over year. Excluding the impact of gasoline prices and foreign exchange, the adjusted figure increased 3.9% year over year.

The United States, Canada and Other International locations registered comparable sales growth of 2%, 6.4% and 11.2%, respectively. On an adjusted basis, comparable sales in the United States, Canada and Other International locations moved up 2.6%, 8.2% and 7.1%, respectively.

In the fiscal first quarter, Costco's comparable e-commerce sales grew 6.3%, while the adjusted figure increased 6.1%.

Selling, general and administrative came in at $5,358 million, up from $4,917 million reported in the year-ago quarter. As a percentage of net sales, the metric came in at 9.45%, up 25 basis points (bps) year over year.

Costco's reported gross margin of 11.04% expanded 43 bps year from 10.61% reported in the year-ago quarter. Operating income was $1,984 million, reflecting an increase from $1,751 million posted in the prior-year quarter.

Traffic or shopping frequency rose 4.7% globally and 3.6% in the United States. However, the company’s average transaction inched down 0.9% worldwide while dropping 1.6% in the United States.

Other Update

Costco currently operates 871 warehouses. These include 600 in the United States and Puerto Rico, 108 in Canada, 40 in Mexico, 33 in Japan, 29 in the U.K., 18 in Korea, 15 in Australia, 14 in Taiwan, five in China, four in Spain, two in France and one each in Iceland, New Zealand and Sweden. For the fiscal 2024, management expects to open 33 locations, which includes two relocations. In the fiscal second quarter, the company is planning to open four new locations.

The company unveiled a special cash dividend on the common stock of $15 per share, payable on Jan 12, 2024, to shareholders of record as of Dec 28.

Image Source: Zacks Investment Research

Financial Aspects

Costco ended the reported quarter with cash and cash equivalents of $17,011 million and long-term debt (excluding the current portion) of $5,866 million. The total equity was $26,147 million. For the 12 weeks ended Nov 26, 2023, net cash provided by operating activities stood at $4,651 million.

Management incurred capital expenditures of nearly $1.04 billion in the reported quarter. For fiscal 2024, the company expects capital expenditures in the range of $4.4-$4.6 billion.

Shares of this Zacks Rank #3 (Hold) company have increased 13.1% in the past three months compared with the industry’s growth of 12.2%.

Top 3 Picks

Regis Corporation RGS owns, franchises and operates beauty salons. RGS currently flaunts a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Regis Corp’s current fiscal year earnings suggests growth of 43.5% from the year-ago period’s reported figure. RGS has a trailing four-quarter earnings surprise of 22%, on average.

Target TGT, a general merchandise retailer, currently has a Zacks Rank #2 (Buy). TGT has a trailing four-quarter earnings surprise of 30.8%, on average.

The Zacks Consensus Estimate for Target’s current financial-year earnings suggests growth of 38.5% from the year-ago reported numbers.

MarineMax HZO, a recreational boat and yacht retailer and a superyacht services company, carries a Zacks Rank #2. MarineMax has a trailing four-quarter negative earnings surprise of 10.1% on average.

The Zacks Consensus Estimate for HZO’s current financial year sales suggests growth of 3.1% from the year-ago period’s figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Regis Corporation (RGS) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

MarineMax, Inc. (HZO) : Free Stock Analysis Report