Costco's Drop Presents an Opportunity

The share price of Costco Wholesale Corp. (NASDAQ:COST) dropped nearly 8% earlier this month after releasing second-quarter earnings results. Although the company's overall business performance is growing, its sales fell short of analysts' expectations.

Many investors viewed the decline as a sign of potential risks, while others saw it as an opportunity. Let's take a closer look to determine whether the recent share price dip represents a good opportunity for long-term investors.

A volume company, not a margin company

Costco is one of the largest global retailers in the world, with a special and outstanding business model. It provides its members with products at low prices across various categories. The strategy of focusing on high sales volumes rather than maximizing profit margins on individual items sets it apart from other traditional retail strategies. Former CEO Craig Jelinek described this philosophy as: We are the volume company, not a margin company.

This operational ethos is evident in Costco's product markup, which is only 12% to 13%, much lower than the typical 25% to 100% markups of many other retailers. Walmart Inc. (NYSE:WMT), another retail giant known for its value pricing, maintains a markup of around 24%.

Costco has a unique approach to inventory management. Rather than allocating substantial working capital towards inventory, high sales volume growth and rapid inventory turnover allow the company to effectively have most of its inventory financed by suppliers. This method reduces the need for significant working capital investments on its part.

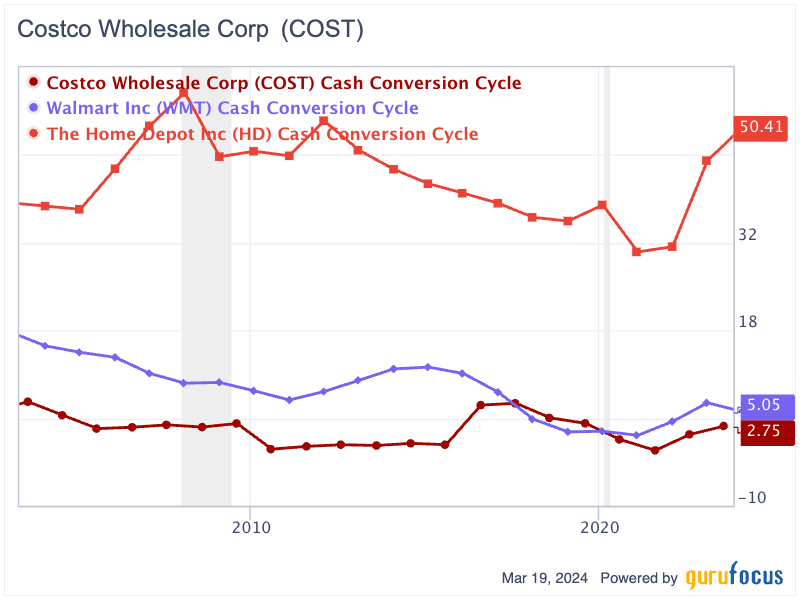

The cash conversion cycle, which measures the days a business needs to turn its working capital investments into cash flow, serves as a key indicator of business operational efficiency. A lower CCC indicates that a company's capital is less tied up in inventory or accounts receivable, signifying more efficient operations. Over the past two decades, the retailer has consistently had the lowest CCC among its peers, including Walmart and Home Depot (NYSE:HD). In 2023, Costco's CCC remained impressively low at just 2.75 days, significantly outperforming Walmart's five days and Home Depot's 50.40 days, underscoring its exceptional operational efficiency.

Membership fees are an important revenue source

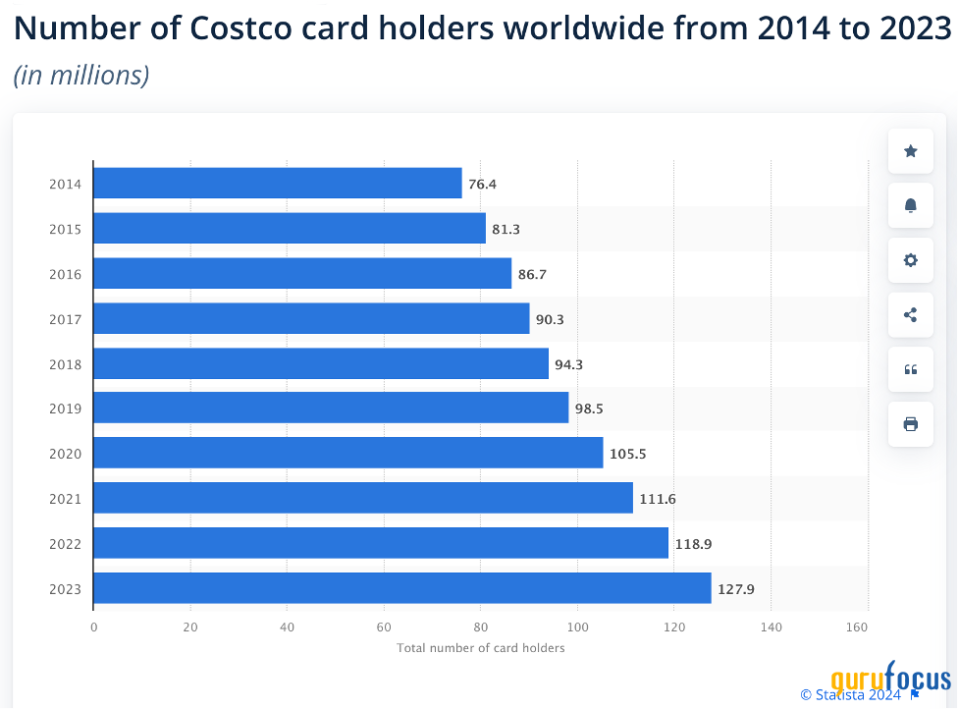

A membership is required to shop at Costco, and the fees from these memberships are a key source of revenue for the company. From 2014 to 2023, the number of members has seen a steady increase, climbing from 76.40 million to 127.90 million. The retention rate is particularly noteworthy; in 2023, over 90% of members chose to renew their memberships, demonstrating Costco's strong ability to maintain its customer base.

Source: Statista

As the membership base expanded, so did Costco's revenue from membership fees. The revenue from these membership fees increased steadily from $2.43 billion in 2014 to $4.58 billion in 2023. Notably, in 2023, the membership fees made up over 56% of Costco's operating income.

Robust cash flow generation

Costco's efficient business model and growing number of loyal customers have enabled the company to generate increasing operating cash flow and free cash flow over time. The company's operating cash flow has grown from $1.50 billion in 2003 to $11.07 billion in 2023, while its free cash flow surged from $696.50 million to $6.75 billion over the same period. The free cash flow has effectively increased at a compounded annual growth rate of 12%.

Growing operating performance

Costco's business performance kept growing in the second quarter. Its net sales rose 5.70% to $57.33 billion, driven by a 5.60% increase in comparable sales and impressive 18.40% growth in the e-commerce sector. Revenue from membership fees jumped by 8.20% to $1.11 billion, with high renewal rates of 90.50% globally. Diluted earnings per share recorded 18.80% growth, from $3.30 last year to $3.92 this year.

The company has a solid balance sheet with a conservative capital structure. As of February, the company's shareholders' equity stood at $20.76 billion, including nearly $9.10 billion in cash and cash equivalents. The total interest-bearing debt amounted to more than $6.95 billion, leading to a debt-to-equity ratio of a modest 0.34. This ratio underscores the company's prudent financial management and its strong financial health.

Potential upside

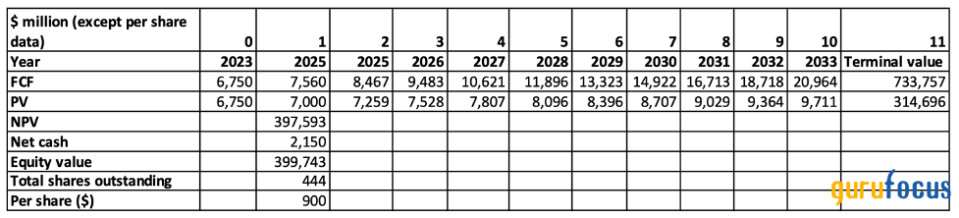

Let's use the discounted free cash flow method to calculate Costco's intrinsic value. Assuming the free cash flow maintains a growth rate of 12% over the next 10 years, and a terminal growth rate of 5% afterwards, with a discount rate of 8%, the company's value is estimated to be nearly $397.60 billion. After adding the net cash of $2.15 billion and dividing by the total outstanding shares of approximately 444 million, Costco's intrinsic value is calculated to be around $900 per share, representing a 25% premium over the current share price.

Source: Author's calculations

Key takeaway

Despite a recent drop in its share price, Costco shows strong potential for long-term investment. The company's steady increase in membership fees highlights a growing and loyal customer base, contributing significantly to its revenue. Its focus on selling large volumes at low margins, efficient inventory management and a low cash conversion cycle has led to strong cash flow generation. Moreover, the company has a strong balance sheet with a conservative capital structure. With the recent trading price, Costco appears to be undervalued, presenting an attractive opportunity for long-term investors.

This article first appeared on GuruFocus.