Can Coterra Energy (CTRA) Maintain Its Earnings Beat in Q3?

Coterra Energy Inc. CTRA is set to release third-quarter results on Nov 6. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 44 cents per share on revenues of $1.4 billion.

Let’s delve into the factors that might have influenced the oil and gas exploration and production firm’s performance in the September quarter. But it’s worth taking a look at CTRA’s previous-quarter performance first.

Highlights of Q2 Earnings & Surprise History

In the last reported quarter, the Houston, TX-based upstream energy company beat the consensus mark on strong production. CTRA had reported adjusted earnings per share of 39 cents, beating the Zacks Consensus Estimate of 36 cents. However, revenues of $1.2 billion generated by the firm came in 7.4% below the Zacks Consensus Estimate due to weaker natural gas realizations.

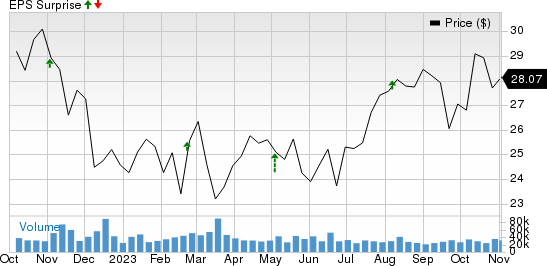

Coterra Energy beat the Zacks Consensus Estimate for earnings in each of the last four quarters, resulting in an earnings surprise of 9.5% on average. This is depicted in the graph below:

Coterra Energy Inc. Price and EPS Surprise

Coterra Energy Inc. price-eps-surprise | Coterra Energy Inc. Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the third-quarter bottom line has remained unchanged in the past seven days. The estimated figure indicates a 69% fall year over year. Meanwhile, the Zacks Consensus Estimate for revenues suggests a 45.1% decrease from the year-ago period.

Factors to Consider

Coterra Energy is expected to have reaped the reward of higher production during the quarter. CTRA continues to churn out an impressive output from its assets in the Permian Basin, Marcellus Shale and Anadarko Basin. In the previous quarter, the company’s production rose 5.3% year over year. The uptick is expected to have continued in the to-be-reported quarter on the back of better well performance and improved cycle times. Consequently, the Zacks Consensus Estimate for the company’s third-quarter volume is pegged at some 644 thousand barrels of oil equivalent per day (MBOE/d), up from the year-ago quarter’s level of 641 MBOE/d.

But on a somewhat bearish note, a dip in commodity realizations might have dampened the positives associated with production gains. In the second quarter of 2023, the company’s average realized oil price decreased by 34.2% from the year-ago period, while natural gas fetched 71.5% less. The decline is most likely to have continued in the third quarter, with investors opting for safer assets due to concerns about a slowing global economy.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Coterra Energy is likely to beat estimates in the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company is -1.67%.

Zacks Rank: CTRA currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for Coterra Energy, here are some energy firms that you may want to consider on the basis of our model:

Diamondback Energy FANG has an Earnings ESP of +2.23% and a Zacks Rank #3. The firm is scheduled to release earnings on Nov 6.

Over the past 90 days, Diamondback Energy saw the Zacks Consensus Estimate for 2023 move up 7.4%. Valued at around $28.5 billion, FANG has gained 3% in a year.

Delek US Holdings DK has an Earnings ESP of +5.26% and a Zacks Rank #2. The firm is scheduled to release earnings on Nov 7.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 90 days, Delek US Holdings saw the Zacks Consensus Estimate for 2023 move up 26.5%. Valued at around $1.7 billion, DK has lost 12.2% in a year.

Devon Energy DVN has an Earnings ESP of +0.72% and a Zacks Rank #2. The firm is scheduled to release earnings on Nov 7.

Over the past 90 days, Devon Energy saw the Zacks Consensus Estimate for 2023 move up 7.4%. Valued at around $29.8 billion, DVN has lost 34.7% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Delek US Holdings, Inc. (DK) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Coterra Energy Inc. (CTRA) : Free Stock Analysis Report