Coty (COTY) Focuses on Boosting Global Presence, Ups FY23 View

Coty Inc. COTY has been focused on enhancing its international recognition. The cosmetics behemoth unveiled that it is hosting its first investor event in Paris, wherein it will increase its financial guidance.

Europe has been a significant region for Coty since it invented modern perfumery in Paris more than 120 years back. The company’s regular innovation has solidified its position in the nation as a Global Beauty Powerhouse.

At the investor event, Coty plans to highlight its success across whitespace categories and geographies, alongside outlining how the company is implementing its strategic priorities. COTY will offer an update on the company’s solid momentum in categories like Prestige fragrances, makeup and skincare. Management also plans to provide details related to the company’s near-term innovation agenda and digital strategy.

Management will provide details regarding the company’s financial performance, operating landscape, growth agenda and product launches. Further, Coty will discuss its short-and-medium-term financial outlook at the event, wherein it will raise its financial guidance for fiscal 2023 again.

Raised Guidance

Management now expects fourth-quarter fiscal 2023 revenues to increase 12-15% on a like-for-like (LFL) basis compared with more than 10% growth expected earlier. The raised view is backed by the company’s robust momentum in Prestige, along with the recovery in China’s market.

Consequently, COTY now envisions core revenue growth of 10-11% on an LFL basis in fiscal 2023, excluding the impact of Russia’s exit. Earlier, this metric was expected in the range of 9-10%. Further, Coty anticipates fiscal 2023 adjusted EBITDA in the band of $965-970 million now, up from the $955-965 million projected earlier.

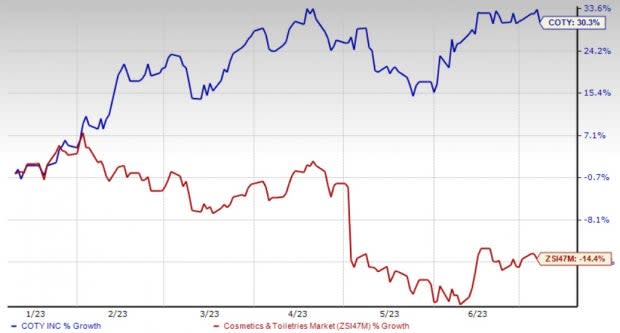

Image Source: Zacks Investment Research

What’s More?

Coty has been benefiting from its focus on six strategic pillars aimed at sustainable growth. These include stabilizing Consumer Beauty makeup brands and mass fragrances, accelerating luxury fragrances and setting up Coty as a core player in prestige makeup, establishing a skincare portfolio in prestige and mass channels, strengthening e-commerce and Direct-to-Consumer (DTC) capabilities, growing presence in China via Prestige and certain Consumer Beauty brands and setting Coty as an industry leader in sustainability.

Management is committed to optimizing the overall cost structure. It is progressing well with the All In to Win transformation program across five key work areas, driving a notable improvement in costs, gross margins, sales growth and cash. In the third quarter of fiscal 2023, the company delivered savings of nearly $60 million, which brings year-to-date savings to nearly $1300 million. On its last earnings call, Coty projected savings of almost $170 million for fiscal 2023.

Coty looks well-placed for growth. Shares of this Zacks Rank #1 (Strong Buy) company have rallied 30.3% in the past six months against the industry’s decline of 14.4%.

Other Solid Staple Stocks

Some other top-ranked consumer staple stocks are Nomad Foods NOMD, Celsius Holdings CELH and Lamb Weston LW.

Nomad Foods, a frozen food product company, currently sports a Zacks Rank #1. NOMD has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods’ current fiscal-year sales suggests growth of around 8% from the year-ago reported figures.

Celsius Holdings, which offers functional drinks and liquid supplements, currently sports a Zacks Rank #1. CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 69.6% and 154.4%, respectively, from the year-ago reported numbers.

Lamb Weston, which is a frozen potato product company, currently carries a Zacks Rank #2 (Buy). LW has a trailing four-quarter earnings surprise of 47.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and earnings suggests growth of 30% and 117.3%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Coty (COTY) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report