Coty (NYSE:COTY) Q2: Beats On Revenue

Beauty products company Coty (NYSE:COTY) reported Q2 FY2024 results exceeding Wall Street analysts' expectations , with revenue up 13.4% year on year to $1.73 billion. It made a non-GAAP profit of $0.25 per share, improving from its profit of $0.22 per share in the same quarter last year.

Is now the time to buy Coty? Find out by accessing our full research report, it's free.

Coty (COTY) Q2 FY2024 Highlights:

Revenue: $1.73 billion vs analyst estimates of $1.68 billion (2.9% beat)

EPS (non-GAAP): $0.25 vs analyst estimates of $0.19 (28.7% beat)

Reiterated outlook for full year given in the previous quarter (adjusted EBITDA guidance slightly below, EPS guidance slightly above)

Free Cash Flow of $363 million, up 193% from the previous quarter

Gross Margin (GAAP): 65.1%, in line with the same quarter last year

Market Capitalization: $10.94 billion

With a portfolio boasting many household brands, Coty (NYSE:COTY) is a beauty products powerhouse with offerings in cosmetics, fragrances, and skincare.

Personal Care

Personal care products include lotions, fragrances, shampoos, cosmetics, and nutritional supplements, among others. While these products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. As with other consumer staples categories, personal care brands must exude quality and be priced optimally given the crowded competitive landscape. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Coty is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

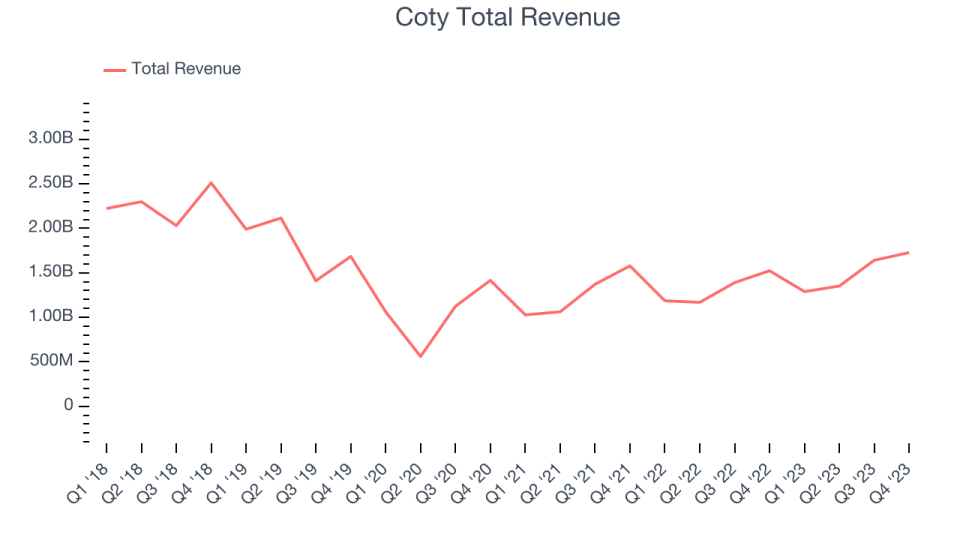

As you can see below, the company's annualized revenue growth rate of 13% over the last three years was solid for a consumer staples business.

This quarter, Coty reported robust year-on-year revenue growth of 13.4%, and its $1.73 billion in revenue exceeded Wall Street's estimates by 2.9%. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, a deceleration from this quarter.

It’s not often you find a high-quality company at a significant discount to its historical P/E multiple, but that’s exactly what we found. Click here for your FREE report on this attractive Network Effect stock at a very silly price.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

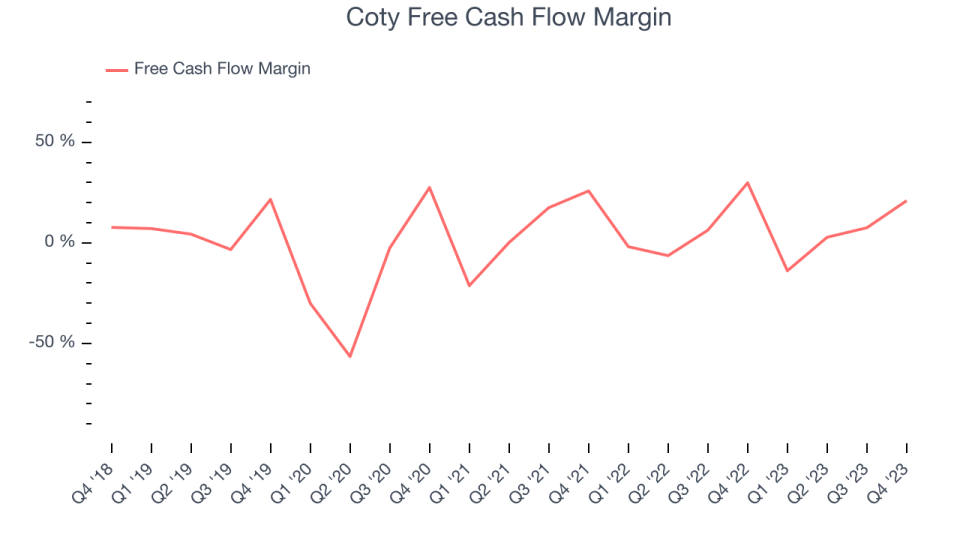

Coty's free cash flow came in at $363 million in Q2, down 20.2% year on year. This result represents a 21% margin.

Over the last two years, Coty has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 5.7%, slightly better than the broader consumer staples sector. However, its margin has averaged year-on-year declines of 2.7 percentage points over the last 12 months. If this trend continues, it could signal that the business is becoming slightly more capital-intensive.

Key Takeaways from Coty's Q2 Results

We were impressed by Coty's optimistic full-year earnings forecast, which exceeded analysts' expectations. However, full year adjusted EBITDA guidance was slightly below. As for the quarter, we were excited that EPS outperformed Wall Street's estimates. On the other hand, its operating margin missed analysts' expectations and its gross margin missed Wall Street's estimates. Overall, this quarter's results were mixed, although there were no big surprises. The stock is down 1.6% after reporting, trading at $12 per share.

So should you invest in Coty right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.