COTY Ups View on Solid Beauty Demand & Product Launch Gains

Coty Inc. COTY is in solid shape, benefiting from the robust beauty demand across its core markets and categories, especially prestige fragrances. These solid trends, along with the notable success of the recent launch of the Burberry Goddess fragrance, encouraged management to raise the company’s guidance for the first half as well as fiscal 2024.

FY24 & 1H24 Guidance

Coty revised its projections, now anticipating a robust 10-12% increase in core like-for-like (LFL) sales for the first half of the fiscal year 2024. This marks an increase from its estimate of 8-10% projected in fourth-quarter fiscal 2022 earnings released last month. Consequently, Coty's now envisions overall fiscal 2024 core LFL sales growth of 8-10%, surpassing its earlier guidance to achieve the upper limit of its medium-term target range of 6-8%.

Management continues to expect a modest gross margin increase in fiscal 2024. The adjusted EBITDA margin is expected to expand 10-30 bps, indicating adjusted EBITDA to be nearly $1,075-1,085 million. Earlier, management projected the metric to come in the range of $1,065-1,075 million.

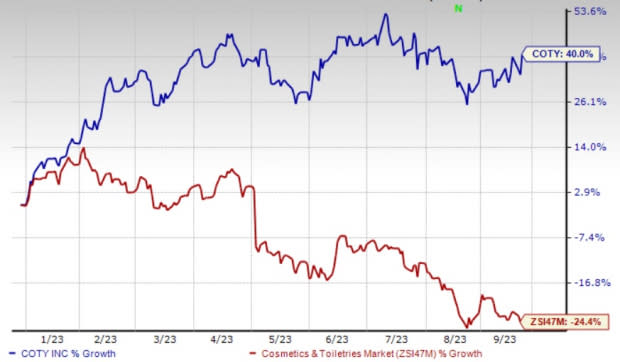

Image Source: Zacks Investment Research

COTY is on track to keep leverage toward 3X as it exits CY23 and 2.5X as it exits CY24. This is likely to be backed by seasonally solid free cash flow.

Moreover, the company is dedicated to achieving its medium-term growth plan, which encompasses achieving a CAGR in the mid-20s percent for earnings per share (EPS) through profit growth, reduced interest expenses and a medium-term goal of managing the share count around 800 million. Additionally, Coty is actively working on reducing its debt levels and undertaking strategic capital returns.

Robust Business Trends Boost Guidance

Since its fourth-quarter fiscal 2023 earnings release (issued last month), Coty has experienced impressive growth in beauty demand. Additionally, the company's recent introduction of the Burberry Goddess fragrance, known for its distinctive scent and innovative packaging, has seen remarkable success in the market.

This has positioned Burberry Goddess as the leading product launch in the United States in August, with sales easily surpassing recent competitive blockbuster launches. Markedly, Coty now boasts three fragrance lines in the top ten best-selling products in the United States. Together, these aspects are boosting the company’s volumes and sales, leading management to pull up its view. Coty’s marketing prowess and innovation keep it well-placed for the next phase of growth.

Wrapping Up

Coty has long been benefiting from its focus on six strategic pillars aimed at sustainable growth. These include stabilizing Consumer Beauty make-up brands and mass fragrances, accelerating luxury fragrances and setting up Coty as a core player in prestige make-up, establishing a skincare portfolio in prestige and mass channels, strengthening e-commerce and Direct-to-Consumer capabilities, growing presence in China via Prestige and certain Consumer Beauty brands and setting Coty as an industry leader in sustainability.

Shares of this Zacks Rank #3 (Hold) company have rallied 40% year to date against the industry’s decline of 24.4%.

Solid Cosmetic Picks

Inter Parfums IPAR, which manufactures, markets and distributes a range of fragrances and fragrance-related products, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales indicates 19.7% growth from the year-ago reported figure. IPAR has a trailing four-quarter earnings surprise of 45.9%, on average.

Helen of Troy HELE, a provider of several consumer products, currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Helen of Troy’s current fiscal-year sales suggests a decline of 2.9% from the year-ago reported numbers. HELE has a trailing four-quarter earnings surprise of 8.1%, on average.

e.l.f. Beauty ELF, a cosmetic and skin care product company, currently carries a Zacks Rank #2. ELF has a trailing four-quarter earnings surprise of 108.3%, on average.

The Zacks Consensus Estimate for e.l.f. Beauty’s current fiscal-year sales suggests growth of 64.6% from the corresponding year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report