Couchbase Inc (BASE) Reports Strong ARR Growth and Improved Gross Margins in Fiscal 2024

Annual Recurring Revenue (ARR): Increased by 25% year-over-year to $204.2 million.

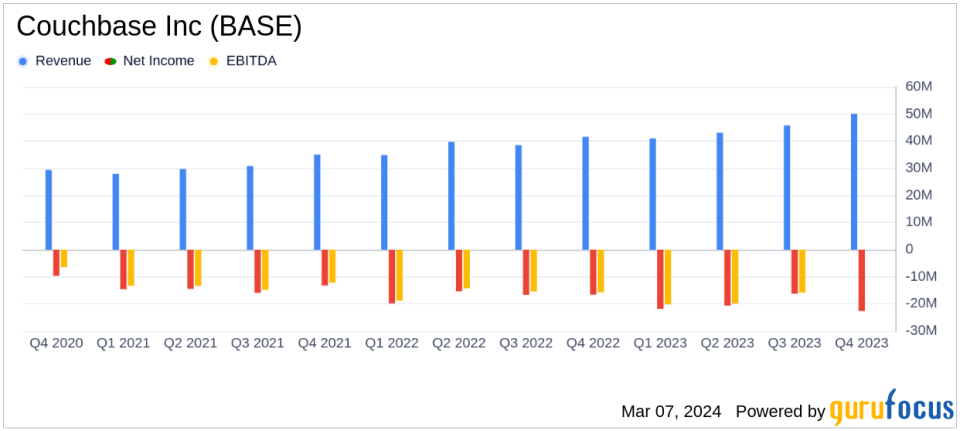

Total Revenue: Grew by 20% year-over-year in Q4 and 16% for the full year.

Gross Margin: Improved to 89.7% in Q4 and 87.7% for the full year.

Operating Loss: Reduced non-GAAP operating loss in Q4; however, GAAP loss from operations increased year-over-year.

Free Cash Flow: Negative free cash flow improved to -$7.7 million in Q4 from -$11.8 million in the same period last year.

Financial Outlook: Provides guidance for Q1 and full year fiscal 2025 with expected revenue and ARR growth.

On March 5, 2024, Couchbase Inc (NASDAQ:BASE) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended January 31, 2024. The company, known for its modern cloud database platform, reported a year of significant achievements, including a 25% increase in ARR and a substantial improvement in gross margins.

Company Overview

Couchbase Inc provides a cutting-edge cloud database platform that empowers developers and architects to build, deploy, and run mission-critical applications. Its platform, Couchbase Capella, is designed for high performance, flexibility, and scalability, and is trusted by over 30% of the Fortune 100 companies.

Financial Performance and Challenges

The company's 25% ARR growth signifies a robust demand for its services, with Capella now representing 11% of the ARR and over 25% of the customer base. This growth is critical as it indicates a recurring revenue stream and customer commitment. However, despite the revenue growth, Couchbase Inc (NASDAQ:BASE) reported an operating loss of $22.6 million for the quarter, which is higher than the $18.5 million loss in the same quarter of the previous fiscal year. This loss from operations could signal challenges in managing expenses or investing in growth initiatives.

Financial Achievements

The improvement in gross margin to 89.7% from 85.7% in the prior year's quarter is a significant achievement for Couchbase Inc (NASDAQ:BASE), as it reflects better cost management and potentially higher profitability per customer. For software companies like Couchbase, high gross margins are essential as they allow for more resources to be allocated towards research and development, sales, and marketing efforts.

Key Financial Details

The company's total revenue for the quarter was $50.1 million, a 20% increase year-over-year, driven by a 26% increase in subscription revenue. The non-GAAP operating loss improved to $4.1 million from $9.9 million in the fourth quarter of fiscal 2023. The cash flow used in operating activities was $6.5 million for the quarter, an improvement from $10.2 million in the same quarter last year. The remaining performance obligations (RPO) stood at $241.8 million, a 46% increase year-over-year, indicating future revenue that is under contract.

"We finished fiscal 2024 on a strong note, highlighted by 25% ARR growth, and marking a historical year for Couchbase," said Matt Cain, Chair, President and CEO of Couchbase. "In addition to delivering results that exceeded the high end of our guidance range on all metrics, we achieved an important milestone with Capella, which now represents 11% of our ARR and over 25% of our customer base."

Analysis of Performance

The company's performance reflects a strong market demand for its cloud database solutions, with significant growth in ARR and RPO. The improved non-GAAP gross margin and reduced non-GAAP operating loss suggest that Couchbase Inc (NASDAQ:BASE) is moving towards a more efficient cost structure. However, the increased GAAP loss from operations year-over-year indicates that the company is still in a phase where it is investing heavily in growth, which is common for technology companies in expansion mode.

For the upcoming fiscal year 2025, Couchbase Inc (NASDAQ:BASE) anticipates continued revenue growth and aims to further reduce its non-GAAP operating loss, projecting total revenue between $203.0 million and $207.0 million and total ARR between $235.5 million and $240.5 million.

Investors and potential members of GuruFocus.com should consider the company's strong ARR growth, improved gross margins, and the strategic initiatives outlined for the coming year when evaluating Couchbase Inc (NASDAQ:BASE) as an investment opportunity.

Explore the complete 8-K earnings release (here) from Couchbase Inc for further details.

This article first appeared on GuruFocus.