How Softbank’s bet on DoorDash differs from WeWork, Uber fails

It’s shaping up to be a year that SoftBank’s record $100 billion dollar Vision Fund would like to forget.

First, there was Uber’s less-than-stellar initial public offering. Then, there was the utter unraveling of workplace leasing startup WeWork, plummeting from a SoftBank-fueled valuation of $47 billion earlier this year to a Softbank-rescued valuation of just under $10 billion last month.

The shockingly bad call was even enough to give investor and SoftBank founder Masayoshi Son rare pause. “My investment judgment was poor in many ways and I am reflecting deeply on that,” he said in SoftBank’s news conference after both debacles led to SoftBank’s largest-ever quarterly loss.

But with two of the Vision Fund’s biggest bets taking serious hits, it raises questions about other startups it’s invested in that could follow a similar path. One of those Vision Fund-backed startups showing signs that are eerily similar to both Uber’s money losing ways and WeWork’s staggering pace of fundraising is food delivery unicorn DoorDash.

DoorDash first attracted SoftBank money in its SoftBank-led Series D fundraising round in March 2018. The round marked the first time the startup raised money at a valuation above $1 billion. Just a year later, DoorDash raised another $600 million from investors, including Darsana Capital Partners and Sands Capital alongside the Vision Fund, in its May Series G round to reach a valuation of $12.6 billion. The company even locked up another $100 million from accounts tied to T. Rowe Price Group just this week, according to a person familiar with the matter.

Importantly, though, despite raising money at a clip that rivals that of WeWork, DoorDash has been able to attract new lead investors in each round that followed SoftBank’s first bet, including Dragoneer Investment Group and Coatue Management, proving other investors outside of SoftBank’s Vision Fund see DoorDash’s potential.

But what really is that potential?

As evidenced by delivery competitor Grubhub’s latest quarterly update, which sent the stock plummeting more than 40%, there’s more and more reason to believe the potential in the delivery space is severely limited. As Grubhub CEO Matt Maloney put it, “the easy wins in the market are disappearing a little more quickly than we thought.” He also conceded that competition in the delivery space over the logistics piece of getting a meal from a restaurant to a customer’s home was becoming a commodity and not a piece that would “generate significant profits.”

Uber, coincidentally, through its Uber Eats food delivery business, offers little reason to be any more upbeat on the sector. In the latest quarter, Uber Eats’ losses grew 67% to $316 million from $189 million in the year-ago period. Uber CEO Dara Khosrowshahi emphasized the fact that the company was able to slightly increase the amount of money it keeps per order in the quarter due to receding pricing pressures, but that was hardly an endorsement of a burgeoning growth opportunity.

A DoorDash spokesperson declined to comment on competitors, but hinted that the company was building on a path to profitability.

“We believe we have the right unit economics to enable us to build a sustainable and profitable business,” she told Yahoo Finance.

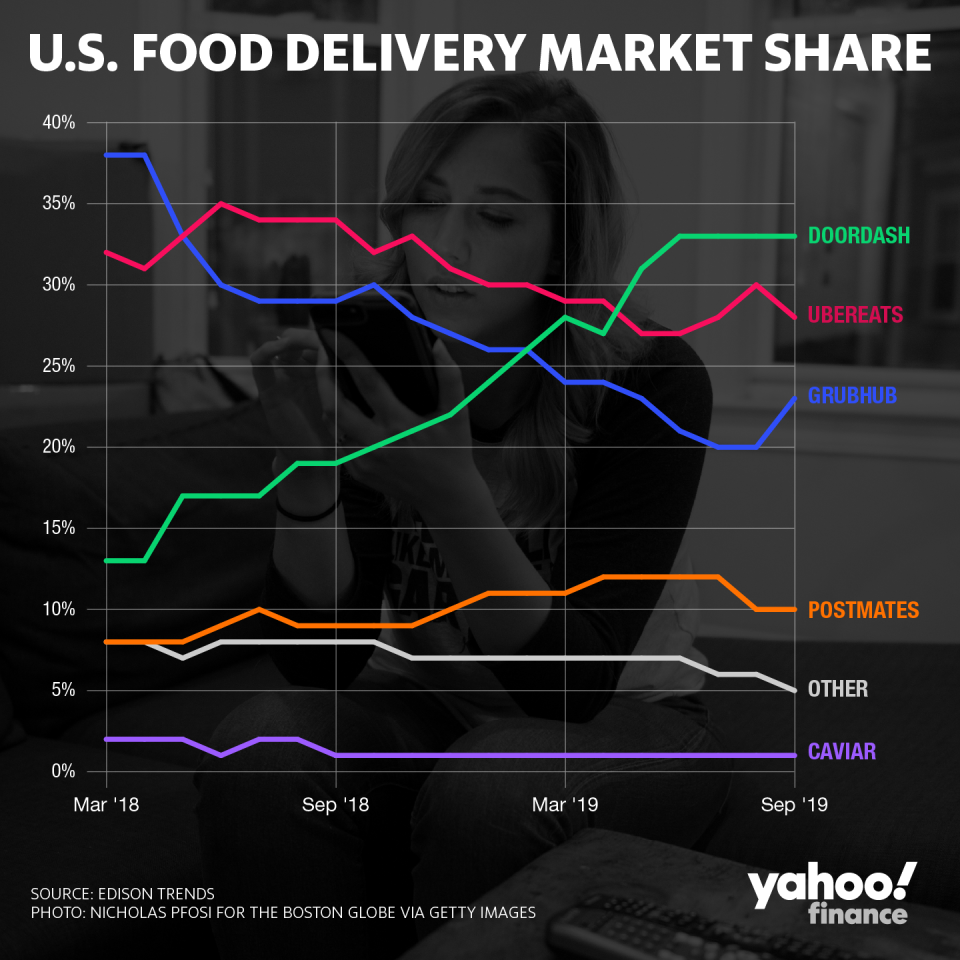

To DoorDash’s credit, while it hasn’t reached profitability - it has proved successful at quickly growing its market share to become the delivery leader, according to third-party analytics platform Edison Trends. The firm’s data shows DoorDash, which was founded in 2013, growing its share of the delivery market from 28% in February to about 35% last month, while Grubhub, founded in 2004, has retreated from 27% to 23% over the same time period. Uber Eats retreated slightly over the same period, as well.

For investors watching this all play out, one could make the case DoorDash is following the SoftBank grow-at-all-costs model perfectly: Steal share, even if that means losing money in the short term, and outlast the competition with the billions at your disposal. There’s just one catch to that thesis — and perhaps the only thing scarier to an investor comfortable with losses today: the idea of continued losses in the future. It was also one of the final thoughts Maloney added in his letter to Grubhub shareholders, seemingly in a nod to his profitless competitors.

“A common fallacy in this business is that an avalanche of volume, food or otherwise, will drive logistics costs down materially,” he wrote. “At some point, delivery drones and robots may reduce the cost of fulfillment, but it will be a long time before the capital costs and ongoing operating expenses are less than the cost of paying someone for 30-45 minutes of their time.”

Just how far in the future a “long time” proves to be could ultimately be the deciding factor in whether or not DoorDash proves Son and the Vision Fund famous rather than infamous. But then again, that’s kind of the Vision Fund’s point. Just as Son initially pitched investors to buy into looking at bets with a 300-year investment horizon, perhaps DoorDash just needs more time to make it all come together. Luckily, unlike WeWork, it’s attracting money from more than just SoftBank to get there.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Where SoftBank’s Vision Fund is deploying its $100 billion

Expert witnesses in Big Tobacco cases explain why Juul doesn’t have a ‘get out of jail free card’

Juul surpasses Facebook as fastest startup to reach decacorn status