Could Investing $20,000 in BigBear.ai Make You a Millionaire?

When investors think of artificial intelligence (AI) stocks, names like Palantir Technologies (NYSE: PLTR) and C3.ai (NYSE: AI) usually come to mind. And well they should. These sizable companies have been around for a while now and largely ushered in the era of AI. Smaller, younger players, such as BigBear.ai (NYSE: BBAI), didn't.

As veteran investors can attest, though, the younger and smaller a promising company is, the closer you are to "getting in on the ground floor."

It's an axiom that raises a question for investors considering a new position in BigBear.ai at this time. That is, could a $20,000 investment in this stock right now eventually grow to be worth a million (or more) dollars down the road?

The answer is yes -- it's not out of the realm of possibility. It's a "yes," however, that comes with a major footnote.

BigBear.ai is similar but also different

If you're not familiar with it, BigBear.ai is not unlike bigger rivals C3.ai and Palantir Technologies. All three companies provide platforms meant to help enterprises and institutions turn massive amounts of digital data into actionable information. You may know this science by its more common name -- artificial intelligence.

BigBear.ai is distinctly different from other names in the AI business, though, in a couple of ways.

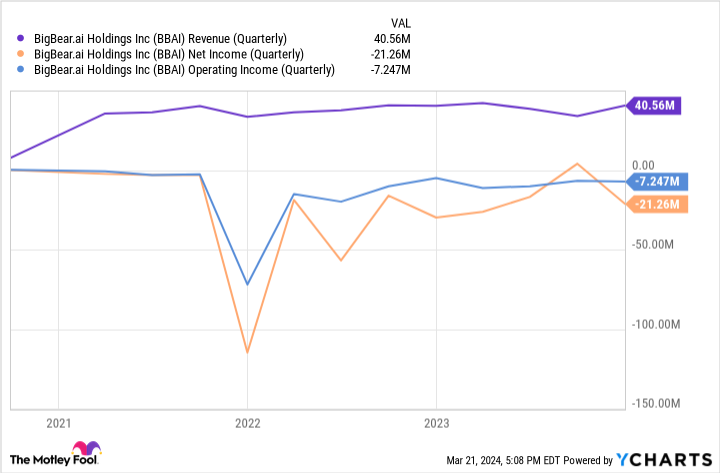

One of these ways is its size (actually, its lack of size). BigBear.ai only did $155 million worth of business last year. That's a pittance compared to Palantir's $2.2 billion and even less than much smaller C3.ai's top line of nearly $300 million for the past four reported quarters. In this same vein, while C3.ai and Palantir sport market caps of $3.5 billion and $55 billion (respectively), BigBear.ai is relatively tiny, with a market capitalization of only around $500 million.

Being small can have its advantages, though. That's this company's second key distinguishing factor. Smaller companies tend to be nimbler, faster-moving, and more capable of meeting the specialized needs of a potential customer. As an example, late last year, BigBear.ai unveiled technology that makes computer-aided engineering software AutoCAD more powerful by allowing it to simulate how a particular design should function if and when it is implemented.

Investing in BigBear.ai comes with risks

While agility has its clear upsides, so does the scale that BigBear.ai doesn't enjoy.

In some regards, its small lineup of offerings is so narrowly focused that it may not have a great deal of value outside of the company's core capabilities. These are government/defense, manufacturing and warehousing, and healthcare management solutions. That's why, rather than developing a new platform, it recently opted to enter the vision AI market (facial recognition, baggage screening, etc.) by acquiring a specialty company called Pangiam at a price of $70 million. A bigger AI outfit may have been able to build something similar at a lower cost.

In this same vein, would-be customers may be hesitant to do business with a smaller AI solutions provider when larger companies are out there; smaller companies also generate less consistent results. Underscoring this idea is the fact that last year's top line didn't grow at all. While this year's revenue is expected to grow at a pace of more than 30%, analysts expect BigBear.ai's sales growth to slow all the way down to less than 13% next year.

This kind of inconsistency can make it tough for shareholders to stick with a stock when the underlying company's foreseeable future starts looking a little rocky.

Nevertheless, there's reason for cautious hope here.

Weighing the real risks and plausible rewards of BigBear stock

As far as AI has come in just the past few years, it's still only scratched the surface of its potential. Precedence Research believes the worldwide AI industry is poised to grow at an annualized pace of 19% through 2032.

The numbers are even more promising when just talking about the software sliver of the artificial intelligence market (where BigBear.ai operates). Precedence expects this business to grow at a compound annual rate of 23% through 2032. If BigBear.ai's hyperfocused solutions end up being what institutions are willing to pay for -- once they finally figure out what it is they need -- this small company could end up winning more than its fair share of this growth.

But turning $20,000 worth of BigBear.ai stock into a million dollars or more? Never say never, but that's a stretch to be sure. It would require a return of at least 5,000% on your investment!

Oh, it's happened before, but only by pioneering companies like Apple and Amazon that were able to execute on a brilliant idea for years on end before any serious competitors stepped up. Both of these monster-sized companies also operate in businesses without a revenue ceiling even on the distant horizon. That's in contrast with the artificial intelligence industry, which has a clear size limit, even if it will be years until that limit is reached. BigBear.ai also already has bigger -- and in some ways better -- competition in place. These rivals aren't simply going to let this smaller company gain market share without eventually pushing back.

In other words, if you've got an extra $20,000 on your hands you'd truly like to turn into a seven-figure stash, there are better as well as lower-risk picks to take a shot on.

Still, if you've got a small portion of your overall portfolio's value and are ready to take a reasonable risk, you could certainly do worse than BigBear.ai.

Should you invest $1,000 in BigBear.ai right now?

Before you buy stock in BigBear.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and BigBear.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, and Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

Could Investing $20,000 in BigBear.ai Make You a Millionaire? was originally published by The Motley Fool