What could spark the next stock-market selloff? Here’s what history tells us.

The S&P 500 has marched higher by nearly 30% over the past five months, prompting even bullish market strategists to entertain, or even welcome, the prospect of a “healthy” correction.

Most Read from MarketWatch

Renting is now cheaper than owning in all of America’s 50 biggest metro areas

Microsoft is already bigger than Apple, but its ‘iPhone moment’ could be coming

China faces a ‘lost decade’ if it fails to tackle its debts, says Ray Dalio

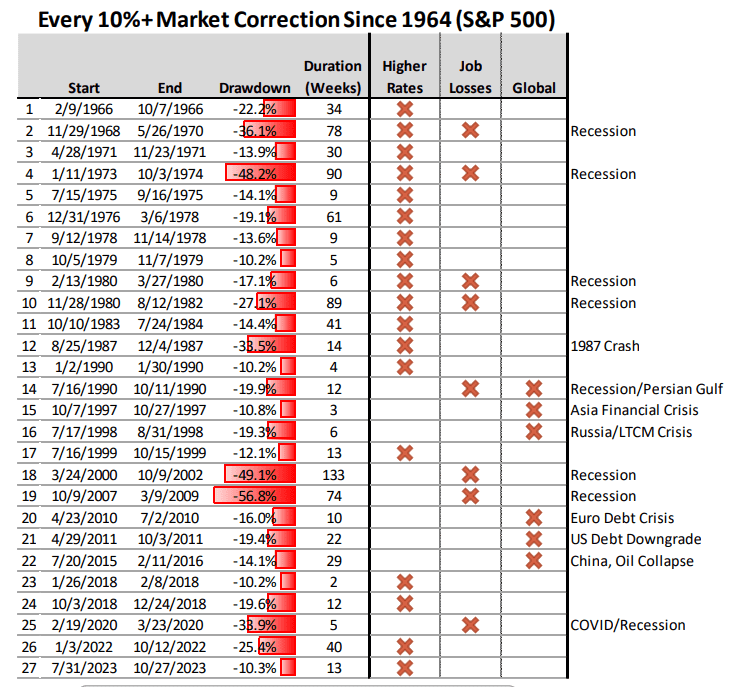

But typically market corrections don’t just happen — they need some kind of catalyst to set them in motion. To try and glean some insight into what might trigger the next double-digit pullback, a team of investment strategists led by Piper Sandler’s Michael Kantrowitz examined the 27 corrections of 10% or more for the S&P 500 that have occurred since 1964.

The team found that, without exception, each of these selloffs has been primarily driven by one of three things: rising unemployment, rising bond yields or some kind of global exogenous shock. Sometimes, it has been a combination, as was the case during the two equity-market corrections that occurred during 1980.

So, which is most likely to trigger the next 10% correction? According to Kantrowitz and his team, rising yields are the biggest threat to tranquil markets. Rising yields also caused the most recent correction, which ended on Oct. 27 with the S&P 500 down 10.3%.

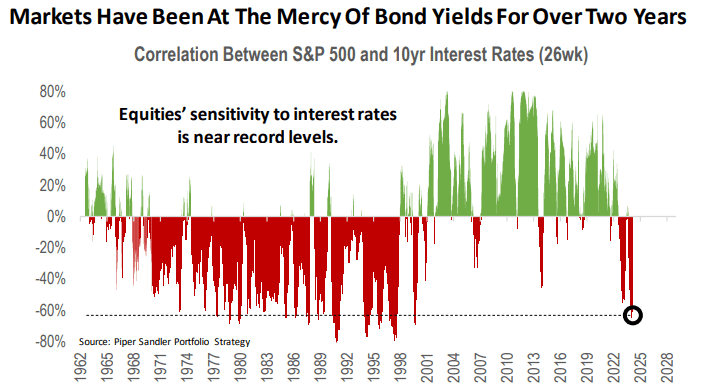

Over the past two years, equities’ sensitivity to higher yields has reached near-record levels last seen near the peak of the dot-com bubble on a rolling 26-week basis. This suggests stocks could still react negatively if long-term bond yields continue to climb, even though equities have been largely immune to the rebound in yields since the start of 2024.

“We’ve written a lot about how rate-sensitive equity markets are today. As such, the biggest risk that we see to equities in 2024 would be a rise in rates,” Kantrowitz and his team wrote.

Because of this, a modest rise in unemployment could actually help keep the rally going by guarding against higher yields. Bond yields, which move inversely to prices, often fall when the economy weakens as demand for defensive assets like bonds increases.

Stocks sold off for three straight months between August and October last year as Treasury yields pushed higher. The nadir of the selloff occurred just a few days after the 10-year Treasury yield peaked north of 5%, a 16-year high, according to FactSet data.

Treasury yields are creeping higher once again during the first quarter. But expectations that still-robust economic growth could help boost corporate earnings have helped to shield stocks, at least so far.

The yield on the 10-year Treasury note BX:TMUBMUSD10Y has gained 39 basis points since the beginning of the year to 4.252%, while the S&P 500 SPX has risen 9.4% since the beginning of the quarter and 26.7% since Oct. 27 to close at 5,218.19 on Monday.

The Nasdaq Composite COMP is up 9.6% since the beginning of the first quarter at 16,452.69 as of Tuesday’s close, while the Dow Jones Industrial Average DJIA has gained 1,670.79 points, or 4.5%, to 39,388.56.