Coupang Inc (CPNG) Reports Strong Q4 and Full-Year 2023 Financial Results

Q4 Revenue: $6.6 billion, a 23% increase year-over-year.

Full-Year Revenue: $24.4 billion, up 18% from the previous year.

Net Income: Q4 net income of $1.0 billion; Full-year net income of $1.4 billion.

Gross Profit Margin: Improved to 25.6% in Q4, a 160 basis points increase year-over-year.

Free Cash Flow: $1.8 billion for the full year, a significant improvement from the prior year.

Active Customers: Surpassed 21 million, a 16% increase year-over-year.

On February 27, 2024, Coupang Inc (NYSE:CPNG), a leading e-commerce company in Asia, released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its diverse product offerings ranging from apparel to electronics and food products, operates primarily through its Product Commerce and Developing Offerings segments, with the former being the major revenue generator.

Financial Performance Highlights

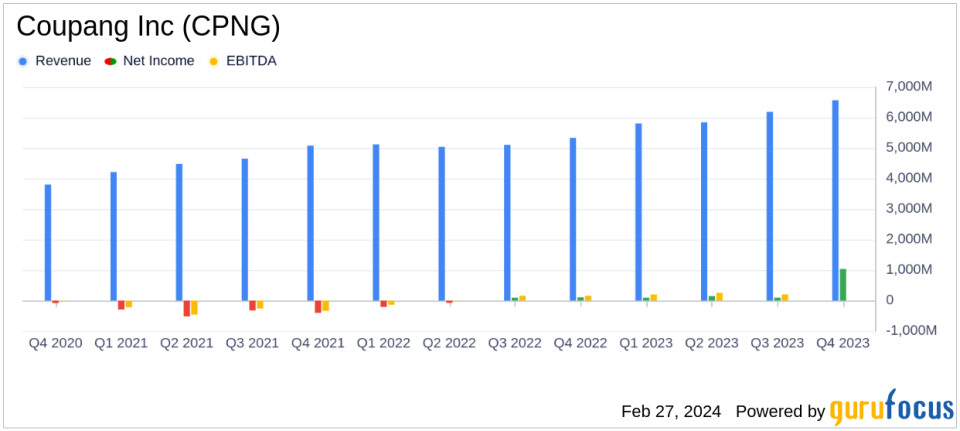

Coupang Inc's fourth quarter showed a robust increase in net revenues, reaching $6.6 billion, marking a 23% year-over-year growth. This growth was consistent even on an FX-neutral basis, with a 20% increase. The full-year revenues also saw a healthy rise to $24.4 billion, an 18% increase from the previous year. The company's gross profit for the quarter was notably strong at $1.7 billion, a 32% increase from the same period last year, leading to a gross profit margin of 25.6%.

The company's net income for the quarter was reported at $1.0 billion, with an adjusted net income of $137 million after accounting for non-cash tax benefits. For the full year, net income stood at $1.4 billion, with an adjusted figure of $465 million. The diluted earnings per share (EPS) for the quarter was $0.57, and the adjusted diluted EPS was $0.08. The full-year diluted EPS was $0.75, with an adjusted diluted EPS of $0.26.

Operational Success and Challenges

Coupang Inc's operational success was highlighted by the growth in its active customer base, which surpassed 21 million, a 16% year-over-year increase. The company's WOW membership program also saw a significant rise, reaching 14 million paid members, a 27% increase from the previous year. These figures underscore the company's ability to attract and retain customers, which is crucial for its long-term growth.

However, the company's Developing Offerings segment, which includes international expansion and services like Coupang Eats and Fintech, faced challenges as it reported a negative adjusted EBITDA of $150 million for the quarter, compared to negative $55 million in the prior year. This indicates that while the segment is growing rapidly in terms of revenue, it is still in an investment phase and not yet profitable.

Strategic Outlook and Management Commentary

Coupang's management remains optimistic about the company's future, emphasizing their commitment to customer satisfaction and long-term shareholder value. Founder and CEO Bom Kim highlighted the company's focus on providing value to customers, especially through the WOW membership program, which offered a record $3 billion in benefits and savings in the face of high inflation.

"Our accelerating growth in revenues, active customers, and WOW members reflect our unrelenting focus on creating 'wow' for our customers across selection, price, and service," said Bom Kim.

CFO Gaurav Anand expressed pride in the team's achievements and the opportunities ahead, particularly in expanding market share in Korea and Taiwan.

"While we are pleased with the progress we made this quarter, we see even greater opportunity in front of us, as we represent just a single digit share of the vast retail spend in Korea, and even smaller in Taiwan," said Gaurav Anand.

Conclusion

Coupang Inc's financial results for Q4 and the full year of 2023 demonstrate a company that is growing rapidly in revenue and profitability. The company's focus on customer satisfaction and expansion of its membership program are key drivers of this success. Despite the challenges faced by the Developing Offerings segment, the overall financial health of the company appears strong, with significant improvements in free cash flow and active customer growth. Investors and stakeholders can look forward to Coupang's continued pursuit of market share and customer-centric innovations in the coming year.

For a detailed analysis of Coupang Inc's financial results and strategic initiatives, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive coverage and expert insights.

Explore the complete 8-K earnings release (here) from Coupang Inc for further details.

This article first appeared on GuruFocus.