Coursera Inc (COUR) Reports Growth in Revenue and Positive Adjusted EBITDA for Q4 2023

Revenue Growth: Full year revenue increased by 21% to $635.8 million in 2023.

Net Loss Improvement: Net loss significantly reduced to $(116.6) million in 2023 from $(175.4) million in the prior year.

Adjusted EBITDA: Achieved positive Adjusted EBITDA of $5.7 million in Q4 and improved full year Adjusted EBITDA to $(10.0) million.

Free Cash Flow: Free Cash Flow turned positive to $7.9 million in 2023, a substantial improvement from $(53.3) million in the prior year.

Consumer Segment Growth: Consumer revenue up 22% with 6 million new registered learners.

Enterprise and Degrees Performance: Enterprise revenue grew by 15% and Degrees revenue increased by 12%.

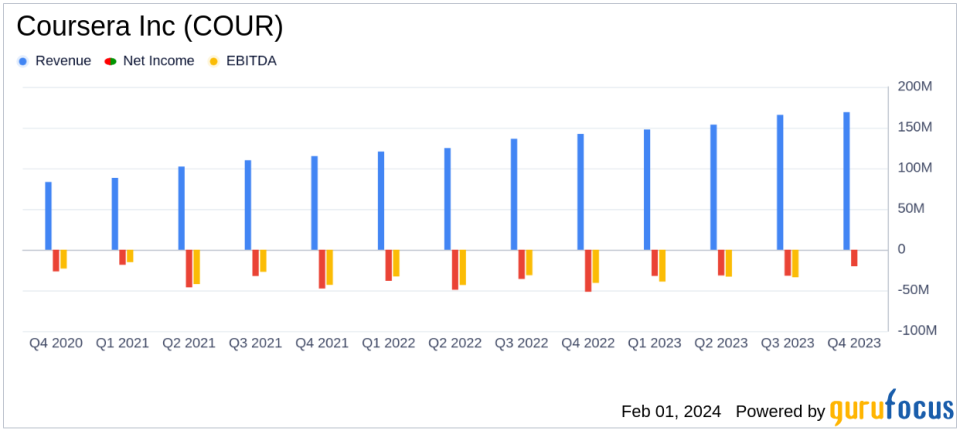

On February 1, 2024, Coursera Inc (NYSE:COUR) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its online learning platform that offers a broad catalog of content and credentials, reported a 21% year-over-year increase in full-year revenue, reaching $635.8 million. Coursera operates through three segments: Consumer, Enterprise, and Degrees, with the majority of its revenue stemming from the Consumer segment.

Financial Performance and Challenges

Coursera's financial performance in 2023 showed significant improvement, with a full-year revenue increase of 21% and a reduction in net loss from $(175.4) million in the prior year to $(116.6) million. The company's Adjusted EBITDA for the fourth quarter was positive at $5.7 million, compared to a negative $(5.8) million in the same quarter a year ago. This positive Adjusted EBITDA is a key milestone, indicating a potential trend towards profitability.

Despite these achievements, the company faced challenges, including a decrease in gross profit margin from 63% to 52% for the full year, reflecting a shift of expense from operating expense to cost of revenue associated with a contract extension with its largest industry partner. This margin compression underscores the importance of managing costs and optimizing partnerships for Coursera's future profitability.

Segment Highlights and Strategic Developments

The Consumer segment saw a 22% increase in revenue, driven by strong demand for Professional Certificates and new generative AI courses. The Enterprise segment grew by 15%, bolstered by the government and campus verticals, while the Degrees segment increased by 12%, reflecting growth in new students and program launches.

Coursera's strategic developments included the launch of new courses and partnerships, such as the Generative AI for Everyone course, which became the fastest-growing course of 2023. The company also expanded its Enterprise offerings with the Generative AI (GenAI) Academy and increased its AI-powered translation capabilities to 18 languages, enhancing accessibility for global learners.

"In 2023, we grew revenue 21% year-over-year and delivered positive Adjusted EBITDA for the first time in the fourth quarter," said Ken Hahn, Courseras CFO. "We have a consistent track record of growing with leverage, and our initial 2024 outlook anticipates a 550 basis point improvement in Adjusted EBITDA Margin to approximately four percent."

Financial Outlook for 2024

Coursera provided a financial outlook for the first quarter and full year of 2024, projecting revenue in the range of $730 to $740 million and Adjusted EBITDA between $26 to $32 million for the full year. The company expects Free Cash Flow to be at or above Adjusted EBITDA, indicating a continued focus on cash generation and operational efficiency.

For investors and potential GuruFocus.com members, Coursera's latest earnings report reflects a company on the rise, with growing revenue, improved net loss figures, and positive cash flow trends. These financial metrics, combined with strategic initiatives in content and platform development, position Coursera as a potentially attractive investment in the evolving online education industry.

For more detailed financial information and future updates, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Coursera Inc for further details.

This article first appeared on GuruFocus.