Coursera (NYSE:COUR) Exceeds Q4 Expectations But Quarterly Guidance Underwhelms

Online learning platform Coursera (NYSE:COUR) beat analysts' expectations in Q4 FY2023, with revenue up 18.8% year on year to $168.9 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $170 million was less impressive, coming in 0.8% below expectations. It made a GAAP loss of $0.13 per share, down from its loss of $0.04 per share in the same quarter last year.

Is now the time to buy Coursera? Find out by accessing our full research report, it's free.

Coursera (COUR) Q4 FY2023 Highlights:

Revenue: $168.9 million vs analyst estimates of $164.8 million (2.5% beat)

EPS: -$0.13 vs analyst estimates of -$0.20 (36% beat)

Revenue Guidance for Q1 2024 is $170 million at the midpoint, below analyst estimates of $171.3 million

Management's revenue guidance for the upcoming financial year 2024 is $735 million at the midpoint, beating analyst estimates by 1% and implying 15.6% growth (vs 21.5% in FY2023)

Full year 2024 EBITDA guidance well ahead ($29 million vs. expectations of roughly $11 million)

Free Cash Flow of $5.69 million, down 63.5% from the previous quarter

Gross Margin (GAAP): 52.9%, down from 61.8% in the same quarter last year

Paying Users : 142 million, up 24 million year on year (slight beat)

Market Capitalization: $2.92 billion

“We believe generative AI will unleash the next wave of innovation and productivity, but individuals and institutions will require high-quality education and training to adopt the technology quickly and safely,” said Coursera CEO Jeff Maggioncalda.

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

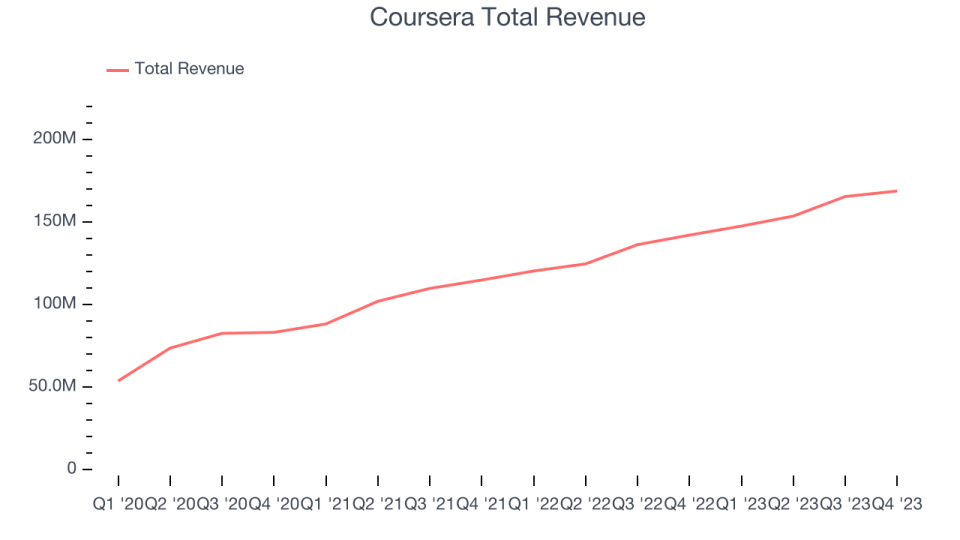

Sales Growth

Coursera's revenue growth over the last three years has been very strong, averaging 30.5% annually. This quarter, Coursera beat analysts' estimates and reported 18.8% year-on-year revenue growth.

Guidance for the next quarter indicates Coursera is expecting revenue to grow 15.1% year on year to $170 million, slowing down from the 22.6% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to reach $735 million at the midpoint, representing 15.6% growth compared to the 21.5% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

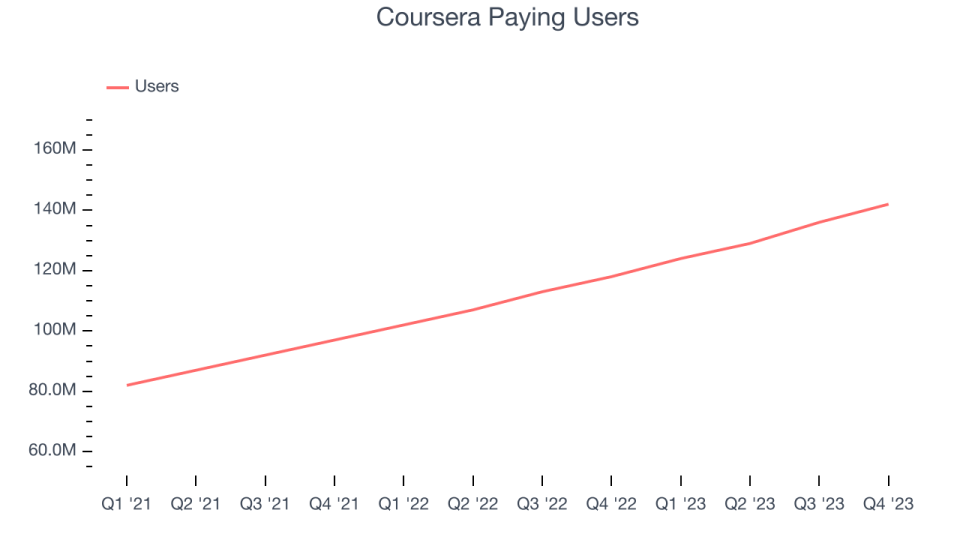

Usage Growth

As a subscription-based app, Coursera generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Coursera's users, a key performance metric for the company, grew 21.8% annually to 142 million. This is strong growth for a consumer internet company.

In Q4, Coursera added 24 million users, translating into 20.3% year-on-year growth.

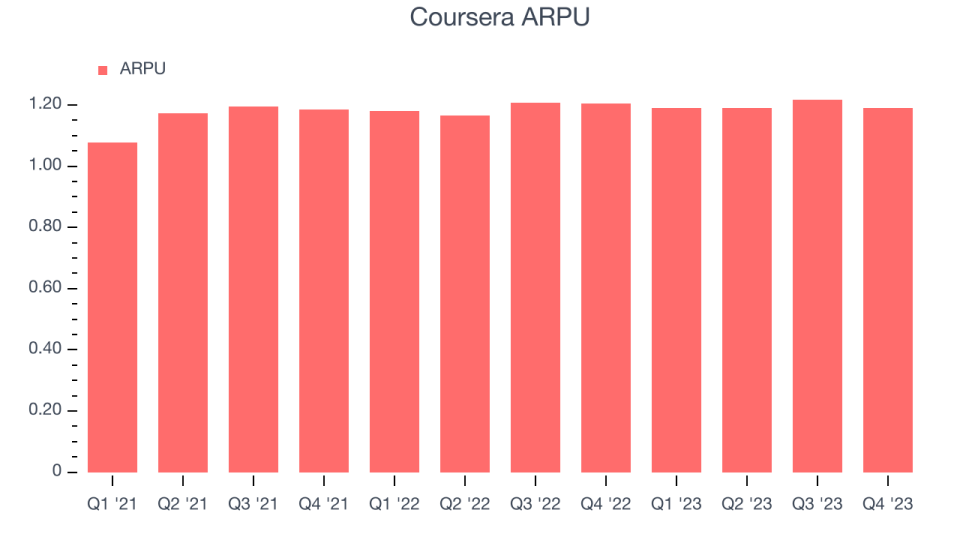

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Coursera because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Coursera's ARPU growth has been subpar over the last two years, averaging 1.8%. The company's ability to increase prices while steadily growing its users,however, shows that users still find value in its platform. This quarter, ARPU declined 1.3% year on year to $1.19 per user.

Key Takeaways from Coursera's Q4 Results

It was great to see Coursera's strong user growth this quarter. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, its revenue guidance for next quarter missed analysts' expectations, although a mitigating factor was that full year guidance was better than expectations and full year adjusted EBITDA guidance was way ahead. Zooming out, we think this was still a solid quarter, showing that the company is staying on track on the topline and outperforming on profits. The stock is up 3.5% after reporting and currently trades at $19.82 per share.

So should you invest in Coursera right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.