Covenant Logistics Group Inc. Reports Fourth Quarter Earnings Amid Market Challenges

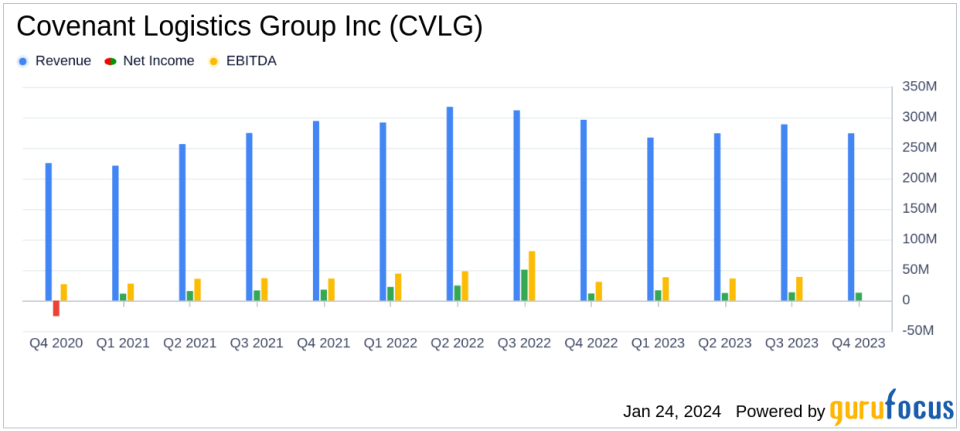

Revenue: Total revenue decreased by 7.5% year-over-year to $273.98 million in Q4 2023.

Net Income: Net income for Q4 2023 was $12.79 million, compared to $11.50 million in Q4 2022.

Earnings Per Share: Diluted EPS for Q4 2023 was $0.93, with adjusted EPS at $1.07.

Operating Ratio: Operating ratio improved to 94.8% in Q4 2023 from 96.3% in Q4 2022.

Dividends and Buybacks: CVLG increased its quarterly dividend and repurchased approximately 5% of its outstanding stock.

Acquisitions: Strategic acquisitions of Lew Thompson and Son Trucking, Inc. and Sims Transport Services, LLC contributed to diversification.

Capital Investments: Approximately $108 million invested in acquisitions, with significant capital expenditures in fleet optimization.

On January 23, 2024, Covenant Logistics Group Inc (NASDAQ:CVLG) released its 8-K filing, announcing financial and operating results for the fourth quarter ended December 31, 2023. The company, which provides truckload transportation and freight brokerage services, reported a decrease in total revenue to $273.98 million, down 7.5% from the same period in 2022. Despite the soft freight market, CVLG achieved its second-best adjusted earnings per diluted share in company history, with $1.07 adjusted EPS, showcasing the resilience and adaptability of its business model.

Performance Amid Market Softness

David R. Parker, Chairman and Chief Executive Officer of CVLG, expressed satisfaction with the company's performance, highlighting the success in navigating a challenging freight market. The company's strategic acquisitions and stock repurchase program at an average price of approximately $34 per share were notable achievements. The asset-based segments, which include Expedited and Dedicated truckload operations, contributed significantly to the quarter's revenue and operating income, despite a decline in total revenue.

Financial Highlights and Segment Performance

The asset-light segments, encompassing Managed Freight and Warehousing, faced revenue and operating income declines, particularly in the Managed Freight segment due to reduced project-related freight. However, the Warehousing segment saw revenue growth and improved margins from new customer startups and contractual pricing increases.

CVLG's equity method investment with Transport Enterprise Leasing (TEL) yielded a pre-tax net income of $4.7 million for the quarter, up from $3.9 million in the same quarter of the previous year. This increase was attributed to suppressed earnings in 2022 due to increased depreciation on high-mileage tractors.

Operational Efficiency and Cost Management

Paul Bunn, President and Chief Operating Officer, noted a decrease in truckload operating costs per mile, driven by fleet modernization and cost-saving initiatives. The company's efforts to reduce the average age of its fleet resulted in lower operations and maintenance expenses, while insurance and claims expenses also decreased due to fewer outside claims.

Tripp Grant, Chief Financial Officer, discussed capitalization, liquidity, and capital expenditures, emphasizing the company's strategic capital allocation. CVLG's net indebtedness increased to approximately $248 million, with net capital investments including acquisitions, fleet optimization, and returns to stockholders through dividends and stock repurchases.

Outlook and Strategic Direction

Looking ahead, CEO Parker remains optimistic about CVLG's ability to make incremental improvements and maintain resilience in a challenging freight market. The company anticipates continued difficult conditions in the first half of 2024, with expected revenue and earnings declines in the first quarter due to seasonality and other temporary factors. However, CVLG's strategic reallocation of assets and focus on high-performing, steady businesses are expected to yield stable earnings and improved returns on capital.

The company will host a conference call to discuss the quarter's results, providing further insights into its performance and strategic initiatives. Investors and analysts are encouraged to participate and access additional financial and statistical information on CVLG's investor relations website.

For value investors and potential GuruFocus.com members, Covenant Logistics Group Inc's latest earnings report demonstrates the company's ability to navigate market challenges effectively. With strategic acquisitions, operational efficiencies, and a focus on cost management, CVLG is positioned to continue delivering value to its shareholders.

For further details and analysis, readers are invited to visit GuruFocus.com, where they can explore comprehensive financial data and expert commentary on CVLG and other companies in the transportation industry.

Explore the complete 8-K earnings release (here) from Covenant Logistics Group Inc for further details.

This article first appeared on GuruFocus.