CPI Card Group Inc. (PMTS) Faces Headwinds as 2023 Earnings Reveal Sales and Net Income Decline

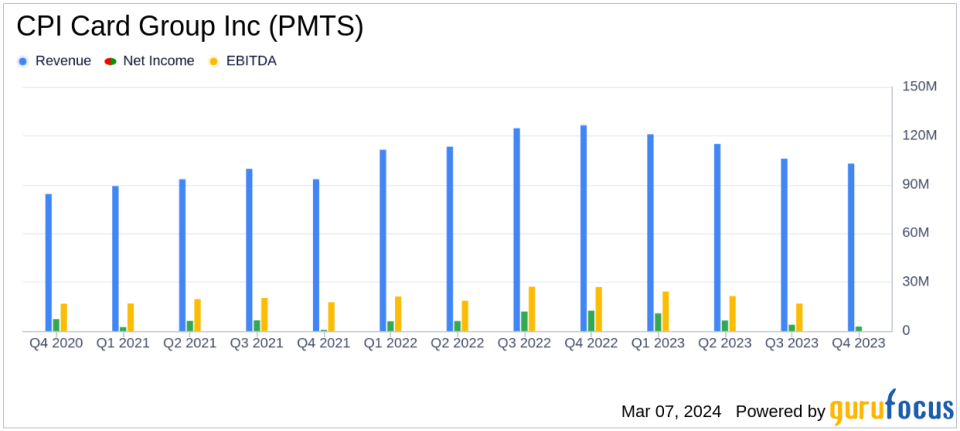

Net Sales: Decreased by 7% year-over-year to $444.5 million in 2023.

Net Income: Dropped by 34% to $24 million compared to the previous year.

Adjusted EBITDA: Fell by 8% to $89.5 million in 2023.

Free Cash Flow: More than doubled to $27.6 million from 2022.

Net Leverage Ratio: Remained relatively stable at 3.1x by year-end.

On March 7, 2024, CPI Card Group Inc (NASDAQ:PMTS), a leading payment technology company specializing in financial payment card solutions and services, released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, which operates primarily in the Debit and Credit segment, faced a challenging year with net sales decreasing by 7% to $445 million and net income falling by 34% to $24 million. Adjusted EBITDA also saw a decrease of 8% to $89 million. Despite these challenges, the company managed to more than double its Free Cash Flow to $27.6 million and maintained a stable Net Leverage Ratio of 3.1x.

Financial Performance and Challenges

CPI Card Group Inc (NASDAQ:PMTS) reported a significant decline in its fourth-quarter sales, with a 19% decrease in net sales to $102.9 million. This decline also led to a 78% drop in net income to $2.7 million and a 27% decrease in Adjusted EBITDA to $19.9 million. The company attributed these declines to cautious customer spending and a focus on managing inventory levels, as well as challenging comparisons to the prior year's record sales growth of 36%.

The company's full-year performance similarly reflected a downturn, with net sales falling by 7% to $444.5 million, net income decreasing by 34% to $24.0 million, and Adjusted EBITDA declining by 8% to $89.5 million. However, CPI Card Group Inc (NASDAQ:PMTS) did see some positive developments, with cash from operating activities increasing by 9% to $34.0 million and Free Cash Flow more than doubling from the previous year.

Financial Outlook and Management Commentary

Looking ahead to 2024, CPI Card Group Inc (NASDAQ:PMTS) anticipates a gradual market recovery and projects slight increases in both net sales and Adjusted EBITDA. President and CEO John Lowe commented on the company's resilience and focus on gaining market share through innovative solutions and leading customer service and quality. Lowe also highlighted the company's plans to expand into adjacent markets and offer additional products and services, including digital solutions.

"Fourth quarter business trends were largely in-line with expectations, as customers continued to prioritize managing inventory levels," said John Lowe, President and Chief Executive Officer. "We believe card issuance trends to consumers remain healthy and we will continue to focus on gaining market share through innovative solutions and leading customer service and quality."

The company's balance sheet showed an increase in cash and cash equivalents to $12.4 million, with a significant reduction in long-term debt. CPI Card Group Inc (NASDAQ:PMTS) also retired $17.1 million of Senior Notes during 2023 and repurchased shares of common stock in the open market.

Industry Position and Long-Term Growth

CPI Card Group Inc (NASDAQ:PMTS) remains a top payment solutions provider in the U.S., serving thousands of financial institutions. The company is a leader in eco-focused payment cards and instant issuance solutions for small and medium U.S. financial institutions. With a strong foundation for future growth, CPI Card Group Inc (NASDAQ:PMTS) is well-positioned to capitalize on long-term growth trends in the U.S. card market, driven by consumer card growth and the conversion to contactless cards.

For value investors and potential GuruFocus.com members, CPI Card Group Inc (NASDAQ:PMTS)'s commitment to innovation and market expansion, coupled with its strategic financial management, may present an opportunity for investment consideration as the company navigates through a challenging period towards anticipated growth in the coming year.

Explore the complete 8-K earnings release (here) from CPI Card Group Inc for further details.

This article first appeared on GuruFocus.