CPI data, Cisco shareholder meeting: What to know in markets Wednesday

It was another volatile trading session on Wall Street on Tuesday.

The S&P 500 (^GSPC) closed Tuesday’s session 0.04% lower, and the Dow (^DJI) fell 53.02 points. Meanwhile the Nasdaq (^IXIC) rose 0.16%.

On Wednesday, The Bureau of Labor Statistics will be releasing the Consumer Price Index (CPI) data for November. Market watchers will be paying close attention to the CPI data as it is often looked to as a key inflation gauge. Economists polled by Bloomberg are expecting an unchanged reading for the month of November after a +0.3% jump in October.

Citi stressed the importance of this month’s CPI reading because the Federal Reserve has turned “explicitly more data dependent,” the bank wrote. “Risks are more clearly tilted towards a significant market reaction in the event of an upside surprise to core CPI. Driven more by global developments than US data, markets are now pricing less than one full Fed hike in 2019.”

Nomura economists expect crude oil’s (CL=F) recent weakness to be a major headwind to November’s CPI report. “The recent sharp drop in crude oil prices should feed into November’s CPI report, likely

keeping headline CPI from rising. We expect headline CPI to be essentially unchanged in November, largely due to lower energy prices.”

Tech giant Cisco (CSCO) will be holding its annual shareholder meeting on Wednesday in San Jose, California, at 10 a.m. PST.

There are no notable corporate earnings reports scheduled for Wednesday.

And here’s what caught Yahoo Finance’s markets correspondent Myles Udland’s eye.

The stock market’s biggest competition is under your mattress

The post-crisis bull market was defined for investors by low interest rates and rising stock prices.

Pushing stock prices higher was a phenomenon known to investors as TINA — there is no alternative.

Low interest rates made the nominal yield on fixed income assets paltry and the zero interest rate policies pursued by central banks around the globe left cash yielding nothing.

But with the Federal Reserve raising interest rates three times so far in 2018 — and now seven times since the financial crisis — cash actually does present an alternative to investors for the first time in a decade.

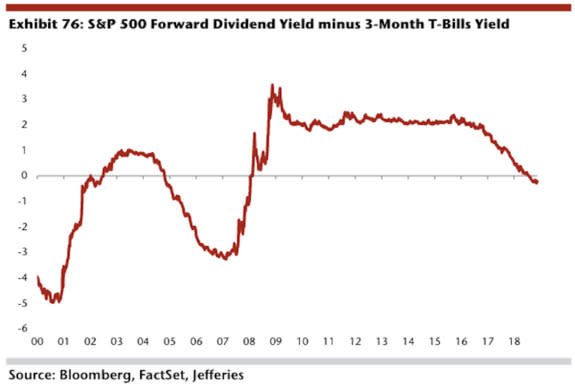

In its year-ahead equity outlook, Jefferies highlights the following chart, showing the yield on 3-month Treasury bills now exceeding the forward dividend yield for the S&P 500. Three-month bills are currently yielding about 2.4%; the S&P 500’s dividend yield is around 1.98%.

“The equity market is facing some competition from higher rates,” Jefferies wrote in its note. In other words, investors may serve themselves well by just sitting on cash and let it generate a risk-free return in an interest-bearing bank account.

Similarly, equity strategists at Goldman Sachs and Bank of America Merrill Lynch have characterized cash as “competitive.”

Markets continued their volatile trading on Tuesday with the major indexes again closing little-changed after a sharp move early in the session.

On Tuesday, it was a positive open that faded throughout the day with markets turning red after President Donald Trump saying in the Oval Office that he would welcome a government shutdown over funding for the border wall. On Monday, a quick sell-off during the morning hours was bought aggressively with stocks eventually closing in the green.

And with investors now seeing markets transition into the third straight month of heightened volatility, getting 2% for nothing continues to sound like a decent deal.

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

Why the Fed could surprise the world next week with no rate hike

Tobacco giant Altria makes massive bet on cannabis

Amazon is still king of the online grocery wars, survey finds