CRA International Inc (CRAI) Delivers Record Revenue in Fiscal 2023 Despite Net Income Dip

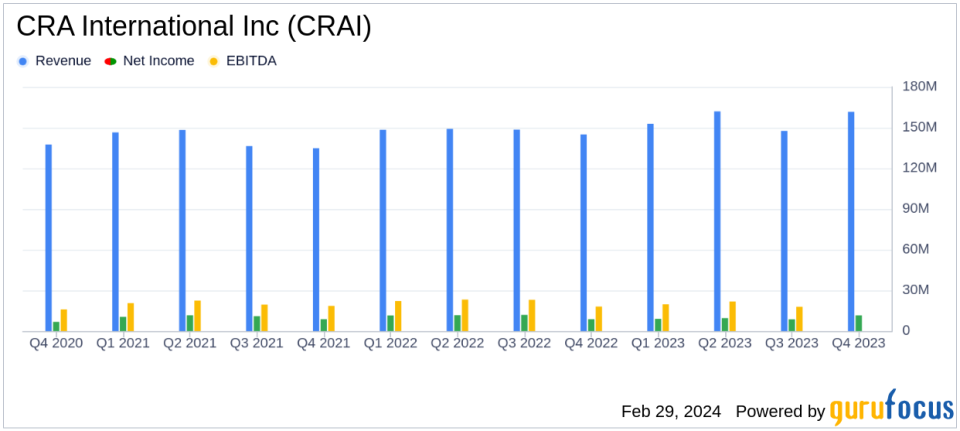

Revenue: Achieved record annual revenue of $624.0 million, up 5.6% year over year.

Net Income: Q4 net income rose 32.1% to $11.5 million; full-year net income fell 11.8% to $38.5 million.

Earnings Per Share (EPS): Q4 EPS increased 36.1% to $1.62; full-year EPS decreased to $5.39 from $5.91.

Non-GAAP EBITDA: Q4 saw a 16.7% increase to $19.0 million; full-year EBITDA declined 3.9% to $68.3 million.

Capital Return: Returned $42.2 million to shareholders in fiscal 2023 through dividends and share repurchases.

On February 29, 2024, CRA International Inc (NASDAQ:CRAI), a global leader in economic, financial, and management consulting services, released its 8-K filing, reporting financial results for the fourth quarter and full fiscal year ended December 30, 2023. The company, which primarily serves clients in the United States and the United Kingdom, saw a robust increase in Q4 revenue by 11.5% year over year to $161.6 million, driven by strong performance in its Antitrust & Competition Economics, Energy, and Forensic Services practices.

Financial Performance and Challenges

CRAI's record revenue for fiscal 2023 was a testament to its broad-based contributions and strong market presence. However, the company faced a decrease in GAAP net income by 11.8% for the full year, which was attributed to various factors including uncertain global macroeconomic conditions. Despite this, the fourth quarter showed a significant increase in net income, suggesting a resilient operational strategy.

Financial Achievements and Industry Significance

The company's financial achievements, particularly the growth in revenue and Q4 net income, underscore its competitive edge in the Business Services industry. The expansion of the share repurchase program by $35 million and the consistent payment of dividends reflect confidence in the company's financial health and commitment to shareholder returns.

Key Financial Metrics

CRAI's utilization rate stood at 73% for the fourth quarter, with a 6.9% increase in headcount year over year, indicating strategic investments in talent to support growth. The non-GAAP EBITDA margin for the full year was 10.9%, slightly down from 12.0% in the previous year, reflecting the company's operational efficiency amidst market challenges.

"Our fiscal 2023 financial performance demonstrates our continued strength in the marketplace," said Paul Maleh, CRAs President and CEO. "For full-year fiscal 2024, on a constant currency basis relative to fiscal 2023, we expect revenue in the range of $645 million to $675 million, and non-GAAP EBITDA margin in the range of 10.8% to 11.5%."

Analysis of Company's Performance

The company's performance in fiscal 2023, particularly the record revenue, is indicative of its robust service offerings and ability to adapt to dynamic market conditions. The increase in Q4 net income and EPS demonstrates operational leverage and effective cost management. However, the full-year decline in net income and EBITDA margin suggests that CRAI is not immune to broader economic pressures, which may continue to pose challenges in the upcoming fiscal year.

For more detailed financial information and the complete earnings release, please refer to the tables and commentary provided in the 8-K filing.

Value investors and potential GuruFocus.com members interested in CRA International Inc's financial trajectory are encouraged to visit GuruFocus.com for in-depth analysis and up-to-date information on CRAI and other compelling investment opportunities.

Explore the complete 8-K earnings release (here) from CRA International Inc for further details.

This article first appeared on GuruFocus.