Cracker Barrel Old Country Store Inc Reports Modest Revenue Growth Amidst Margin Pressures

Revenue: Cracker Barrel Old Country Store Inc (NASDAQ:CBRL) reported a marginal increase of 0.2% in total revenue for Q2 fiscal 2024 compared to the same quarter last year.

Comparable Store Sales: Restaurant sales saw a 1.2% increase, while retail sales experienced a 5.3% decrease from the prior year quarter.

Operating Income: GAAP operating income decreased to $30.8 million, or 3.3% of total revenue, compared to $39.0 million, or 4.2% of total revenue, in the prior year quarter.

Net Income: GAAP net income for the quarter was $26.5 million, a 13.0% decrease from the prior year quarter.

Earnings Per Share: GAAP earnings per diluted share were $1.19, a 13.1% decrease compared to the prior year quarter.

Dividend: The Board declared a quarterly dividend of $1.30 per share, payable on May 7, 2024.

Outlook: CBRL provided an updated fiscal 2024 outlook, noting potential impacts from ongoing inflation, low consumer confidence, and high interest rates.

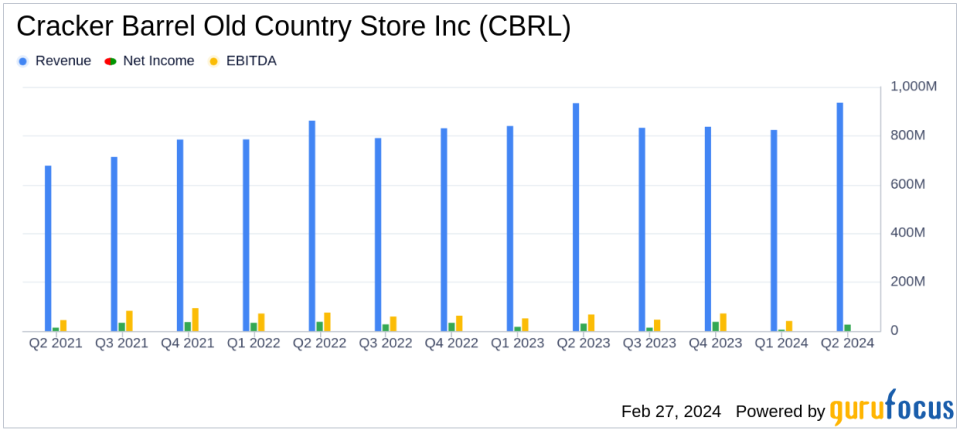

On February 27, 2024, Cracker Barrel Old Country Store Inc (NASDAQ:CBRL) released its 8-K filing, detailing the financial outcomes for the second quarter of fiscal 2024 ended January 26, 2024. The company, known for its full-service restaurants and gift shops across the United States, reported a slight increase in total revenue to $935.4 million, up 0.2% from the previous year. However, the company faced challenges with margins due to increased labor and operating expenses, which led to a decrease in both operating income and net income.

Financial Performance and Challenges

CBRL's restaurant sales showed resilience with a 1.2% increase, attributed to a 4.8% rise in menu pricing. However, the retail segment, which contributes about a quarter of the company's revenue, saw a 5.3% decline in comparable store sales. The decrease in GAAP operating income, from 4.2% to 3.3% of total revenue, was primarily due to higher labor and related expenses, as well as increased general and administrative expenses, partially offset by a lower cost of goods sold.

President and CEO Julie Masino commented on the quarter's results, highlighting the improvement in traffic trends and the company's strategic efforts.

While margins remain pressured, we were encouraged by the improvement in our traffic trend during the quarter, which we believe was supported by our investments in labor and advertising and our focus on the guest experience. Additionally, we continued to make progress on the development of our strategic transformation, and our teams are engaged in our efforts to improve our relevancy, deliver food and an experience that our guests love, and grow profitability."

Financial Metrics and Importance

Adjusted net income and earnings per diluted share also saw a decline, with adjusted net income at $30.5 million, a 7.4% decrease, and adjusted earnings per diluted share at $1.37, a 7.5% decrease from the prior year. These metrics are crucial as they reflect the company's profitability and earnings potential, which are key indicators for investors. The company's adjusted EBITDA of $63.7 million, a 5.9% decrease from the prior year, is another important measure of its operating performance and ability to generate cash flow.

The balance sheet shows a slight decrease in total assets from $2.26 billion to $2.19 billion year-over-year. The company ended the quarter with $12.6 million in cash and cash equivalents, a significant decrease from $49.4 million in the prior year. This reduction in liquidity is a point of interest for investors, as it could impact the company's ability to invest in growth or weather economic downturns.

Looking ahead, CBRL's management has provided an outlook for fiscal 2024, cautioning that macroeconomic conditions such as ongoing inflation, low consumer confidence, and high interest rates may adversely affect consumer behavior and the company's performance.

In conclusion, Cracker Barrel Old Country Store Inc's second quarter fiscal 2024 results reflect a company facing margin pressures amidst a challenging economic environment. While there was a modest increase in revenue, the decline in net income and earnings per share indicates areas where the company needs to focus its strategic efforts. Investors will be watching closely to see how CBRL navigates these challenges in the coming quarters.

Explore the complete 8-K earnings release (here) from Cracker Barrel Old Country Store Inc for further details.

This article first appeared on GuruFocus.