Crawford & Co (CRD.A) Reports Mixed Fourth Quarter and Robust Full Year 2023 Results

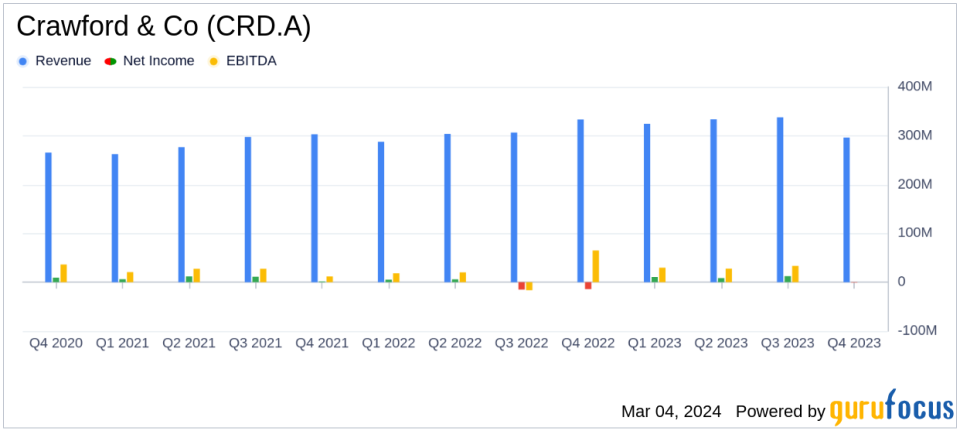

Annual Revenue Growth: Revenues before reimbursements increased by 7% year-over-year to $1.267 billion.

Full Year Net Income: Net income attributable to shareholders was $30.6 million, a significant improvement from a loss of $(18.3) million in 2022.

Earnings Per Share: Diluted earnings per share for CRD-A and CRD-B were $0.61 and $0.62, respectively, compared to a loss per share of $(0.37) in 2022.

Fourth Quarter Revenues: Revenues before reimbursements decreased by 8% to $296.1 million in Q4 2023 from $322.2 million in Q4 2022.

Adjusted EBITDA: Consolidated adjusted EBITDA for the full year was $118.7 million, or 9.4% of revenues, up from $94.7 million, or 8.0% of revenues, in 2022.

On March 4, 2024, Crawford & Co (NYSE:CRD.A) released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023. The company, a global leader in claims management and outsourcing solutions for the insurance industry, reported a year of record revenues despite a decline in fourth-quarter performance.

Company Overview

Crawford & Co operates through segments including North America Loss Adjusting, International Operations, Broadspire, and Platform Solutions, with the International Operations segment being the largest revenue contributor. The company's expansive network serves clients in over 70 countries, providing essential services to the property and casualty market.

2023 Performance Highlights

The full year 2023 was marked by a 7% increase in revenues before reimbursements, reaching $1.267 billion, and a turnaround to a net income of $30.6 million from a net loss in the previous year. The diluted earnings per share for both CRD-A and CRD-B showed a positive shift to $0.61 and $0.62, respectively. These achievements underscore the company's resilience and the effectiveness of its growth strategy.

However, the fourth quarter of 2023 presented challenges, with revenues before reimbursements falling by 8% to $296.1 million, and a net loss attributable to shareholders of $(0.8) million. This was attributed to benign weather activity leading to reduced weather-related revenue, contrasting with the previous year's severe weather events that drove significant revenue.

Financial Metrics and Importance

Key financial metrics such as the consolidated adjusted EBITDA increased to $118.7 million, or 9.4% of revenues, for the full year 2023, compared to $94.7 million, or 8.0% of revenues, in 2022. This metric is crucial as it reflects the company's operational efficiency and ability to generate earnings before interest, taxes, depreciation, and amortization.

Management Commentary

Mr. Rohit Verma, CEO of Crawford & Co, stated, "2023 was a strong year for Crawford with a record-setting consolidated revenue of $1.27 billion and enhanced margin performance." He acknowledged the impact of weather on Q4 performance but remained optimistic about the company's growth and margin expansion, highlighting a 38% increase in operating earnings from 2022.

Segment Performance

Despite the overall decline in Q4, the Broadspire and International segments experienced double-digit revenue growth. For the full year, North America Loss Adjusting and Broadspire segments reported revenue increases of 10.5% and 13.4%, respectively, contributing to the company's robust annual performance.

Balance Sheet and Cash Flow

Crawford & Co's cash and cash equivalents stood at $58.4 million as of December 31, 2023, with total debt decreasing to $209.1 million from $238.9 million at the end of 2022. The company's operations provided $103.8 million of cash during 2023, a significant improvement from the previous year.

The company's financial stability and strategic initiatives position it well for continued growth. Investors and stakeholders can look forward to Crawford & Co's continued efforts to enhance its brand presence and expand market share in the coming year.

For further details on Crawford & Co's financial performance, interested parties can join the conference call scheduled for March 5, 2024, or access the presentation on the investor relations section of the company's website.

Explore the complete 8-K earnings release (here) from Crawford & Co for further details.

This article first appeared on GuruFocus.