Crescent Capital BDC Inc Reports Solid Year-End Financials and Declares Dividends

Net Investment Income: $2.30 per share for the year ended December 31, 2023.

Net Income: $2.33 per share for the year ended December 31, 2023.

Net Asset Value (NAV): Increased to $20.04 per share as of December 31, 2023, from $19.70 at the end of the previous quarter.

Dividends: Declared a regular dividend of $0.41 per share and a supplemental dividend of $0.10 per share for Q4 2023.

Investment Portfolio: Grew to $1,582.1 million in fair value by the end of 2023.

Debt to Equity Ratio: Stood at 1.15x as of December 31, 2023.

Liquidity: $24.5 million in cash and cash equivalents, with $329.7 million of undrawn capacity on credit facilities.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

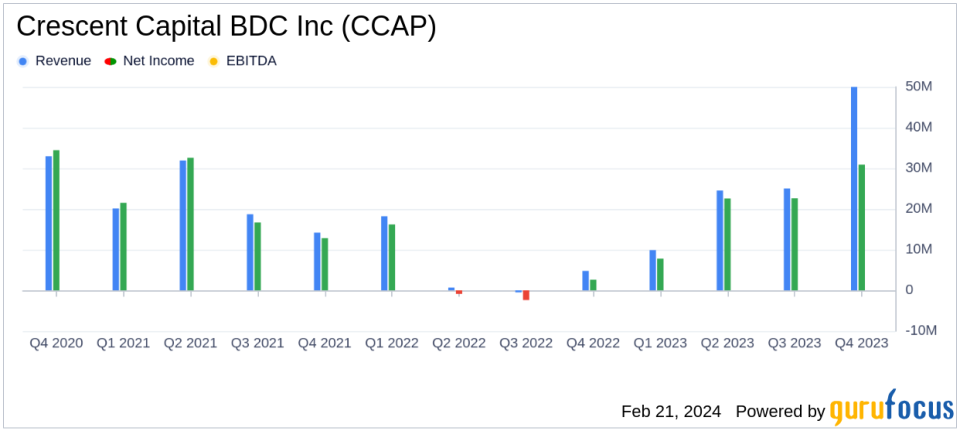

On February 21, 2024, Crescent Capital BDC Inc (NASDAQ:CCAP) released its 8-K filing, detailing its financial results for the year ended December 31, 2023. The company reported a net investment income of $2.30 per share and a net income of $2.33 per share for the year. For the fourth quarter, net investment income was $0.61 per share, with net income reaching $0.83 per share.

Crescent Capital BDC Inc is a business development company that aims to maximize returns to its stockholders through current income and capital appreciation. It invests primarily in secured and unsecured debt, as well as related equity securities of private U.S. middle-market companies.

Financial Performance and Portfolio Growth

The company's net asset value (NAV) per share increased to $20.04 at the end of December 2023, up from $19.70 at the end of the previous quarter. The Board declared a regular dividend of $0.41 per share for the first quarter of 2024 and a supplemental dividend of $0.10 per share for the fourth quarter of 2023.

CCAP's investment portfolio saw significant growth, with investments at fair value reaching $1,582.1 million, compared to $1,564.8 million in the previous quarter. The portfolio was diversified across various asset types, with a significant portion in unitranche first lien investments.

Income Statement and Balance Sheet Highlights

For the year, investment income increased to $184.1 million, up from $116.7 million in the previous year, largely due to a rise in benchmark rates, the acquisition of First Eagle Alternative Capital BDC, Inc. (FCRD), and organic growth. Total expenses for the year were $101.6 million, with interest and other debt financing costs rising to $58.7 million due to higher average debt and cost of debt.

The balance sheet showed total assets of $1,627.4 million and total net assets of $742.6 million as of December 31, 2023. The company's liquidity position was strong, with $24.5 million in cash and cash equivalents and significant undrawn capacity on its credit facilities.

Challenges and Outlook

While CCAP's performance indicates robust growth and a strong financial position, challenges such as market volatility, changes in interest rates, and the performance of portfolio companies could impact future results. The company's focus on middle-market investments requires careful monitoring of these entities' ability to meet their financial obligations, especially in an uncertain economic environment.

The company's debt to equity ratio of 1.15x reflects a moderate level of leverage, which could influence its ability to sustain dividends and navigate economic downturns. However, the high percentage of debt investments at floating rates (98.7%) positions CCAP to potentially benefit from rising interest rates.

CCAP's strategic investments and prudent financial management have positioned it well for continued growth. The company's focus on income-producing securities and disciplined investment process are key factors that contribute to its appeal to value investors. As Crescent Capital BDC Inc continues to navigate the complexities of the market, its ability to adapt and capitalize on opportunities will be critical to its ongoing success.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider attending the earnings conference call scheduled for February 22, 2024.

Explore the complete 8-K earnings release (here) from Crescent Capital BDC Inc for further details.

This article first appeared on GuruFocus.