Crestwood (CEQP) Signs Deal to Divest Stakes in All-Stock Deal

Crestwood Equity Partners LP CEQP signed an agreement with Energy Transfer LP ET to divest its stock in an all-equity transaction valued at $7.1 billion.

As of Mar 31, Crestwood’s market value was $2.6 billion, which makes it one of the largest publicly traded energy entities in the Houston area.

In recent years, the U.S. energy sector has witnessed intensified buying and selling after significant profits left producers exceptionally wealthy. The importance of pipeline networks continued to increase due to the need to connect remote wells to export facilities.

This is the latest merger agreement among pipeline operators this year. Notably, energy companies are acquiring stakes in pipeline companies to neutralize declines in their hydrocarbon businesses.

Per the terms of the deal, Crestwood common unitholders will receive 2.07 Energy Transfer common units for each of its common units. Once the deal closes, Crestwood unitholders will own 6.5% of Energy Transfer’s outstanding common units.

In the Williston Basin, Energy Transfer owns the Dakota Access Pipeline, which transports crude oil from North Dakota to Illinois. With the latest acquisition, the company will enhance its position in the Williston Basin in North Dakota, South Dakota and Montana, and in the Delaware basin in West Texas and New Mexico. Energy Transfer will also set foot in the Powder River Basin in Montana and Wyoming.

Crestwood’s system involves 2 billion cubic feet per day of gas gathering capacity and 340,000 barrels per day of crude oil gathering capacity. The acquisition will expand Energy Transfer’s assets. ET expects to achieve at least $40 million of annual run-rate cost synergies.

The transaction, subject to Crestwood’s unit holders’ and regulators’ approval, is expected to be completed in the fourth quarter of 2023.

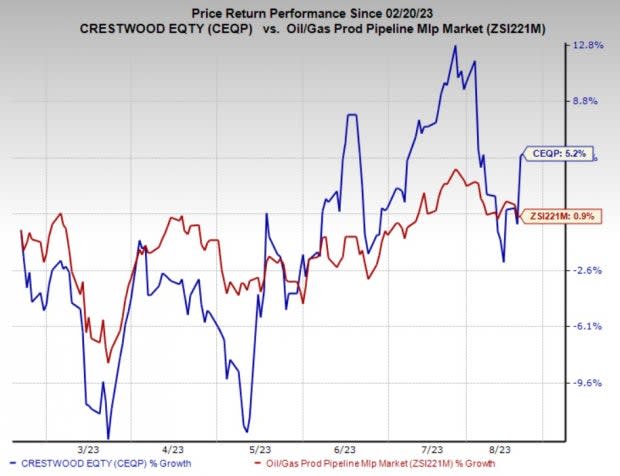

Price Performance

Shares of Crestwood have outperformed the industry in the past six months. The stock has gained 5.2% compared with the industry’s 0.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Crestwood currently carries a Zack Rank #2 (Buy).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dril-Quip Inc. DRQ is valued at more than $930 million. In the past three months, its shares have risen 17%.

The Zacks Consensus Estimate for Dril-Quip’s 2023 and 2024 earnings per share is pegged at 34 cents and 85 cents, respectively.

Evolution Petroleum EPM is worth $320 million. In the past three months, its shares have risen 24.9%.

The Zacks Consensus Estimate for EPM’s 2023 and 2024 earnings per share is pegged at $1.11 and $1.08, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dril-Quip, Inc. (DRQ) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

Crestwood Equity Partners LP (CEQP) : Free Stock Analysis Report