CRH PLC (CRH) Reports Strong Revenue and Earnings Growth in Full Year 2023 Results

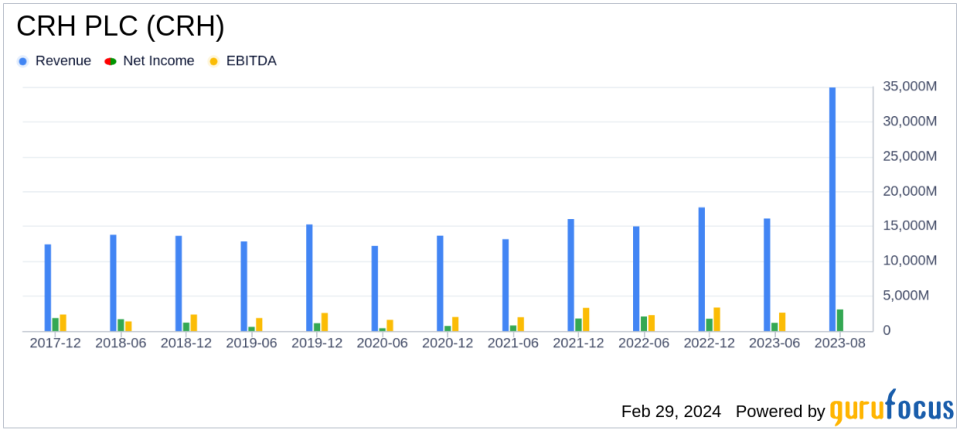

Revenue Growth: CRH PLC (NYSE:CRH) reported a 7% increase in total revenues, reaching $34.9 billion.

Operational Efficiency: Income from continuing operations margin improved by 60 basis points to 8.8%.

Profitability Surge: Net income from continuing operations climbed 14%, amounting to $3.1 billion.

EBITDA Performance: Adjusted EBITDA rose by 15% to $6.2 billion, with a margin expansion of 120 basis points.

Earnings Strength: EPS from continuing operations increased by 22% to $4.36, pre-impairment EPS up by 30%.

Cash Flow Improvement: Net cash provided by operating activities surged by 32%, totaling $5.0 billion.

Dividend Announcement: A new quarterly dividend of $0.35 per share, representing a 5% annualized increase.

On February 29, 2024, CRH PLC (NYSE:CRH), a global leader in building materials, released its 8-K filing, showcasing a year of robust financial performance. The company, known for its comprehensive range of building products and vertically integrated business model, has cemented its position as a top-tier provider in the construction industry, particularly in North America, which represents 59% of its sales.

Performance and Strategic Highlights

CRH's success in 2023 was underpinned by strong demand across its markets, effective pricing strategies, and the benefits of its customer-focused integrated solutions strategy. The company's performance was also bolstered by strategic acquisitions, including a $2.1 billion investment in the Texas market and a $0.7 billion agreement to acquire a majority stake in Adbri in Australia.

Chief Executive Albert Manifold commented on the year's achievements, stating:

"2023 marked another record year of financial delivery for CRH, supported by good underlying demand across our key end-use markets, further pricing progress and the continued benefits of our differentiated, customer-focused strategy... Despite continued inflationary cost pressures during 2023 we expanded our margins and delivered further growth in profits, cash generation and returns."

Financial Achievements and Importance

The company's financial achievements are particularly significant in the building materials industry, where margins can be sensitive to fluctuations in input costs and market demand. CRH's ability to expand margins and grow profits amidst inflationary pressures highlights its operational excellence and strategic foresight.

Income Statement and Balance Sheet Analysis

CRH's income statement reflects a solid increase in revenues and income from operations, with a notable 22% rise in EPS from continuing operations. The balance sheet remains strong, with a robust cash position of $6.4 billion, providing significant liquidity and financial flexibility for future growth initiatives.

Outlook and Capital Allocation

Looking ahead to 2024, CRH anticipates a favorable market environment with continued positive pricing momentum, supported by significant infrastructure investment and re-industrialization activities. The company expects net income to range between $3.55 billion and $3.80 billion, with an Adjusted EBITDA forecast of $6.55 billion to $6.85 billion.

CRH's disciplined approach to capital allocation is evident in its ongoing share buyback program and commitment to consistent long-term dividend growth. The company's strong investment-grade credit rating and strategic acquisitions position it well for sustained value creation.

For a detailed understanding of CRH PLC (NYSE:CRH)'s financial condition and performance, investors are encouraged to review the full 8-K filing and the upcoming Annual Report on Form 10-K.

Value investors and potential GuruFocus.com members seeking comprehensive insights into CRH PLC (NYSE:CRH)'s financials and future prospects are invited to explore the wealth of information available on GuruFocus.com.

Explore the complete 8-K earnings release (here) from CRH PLC for further details.

This article first appeared on GuruFocus.