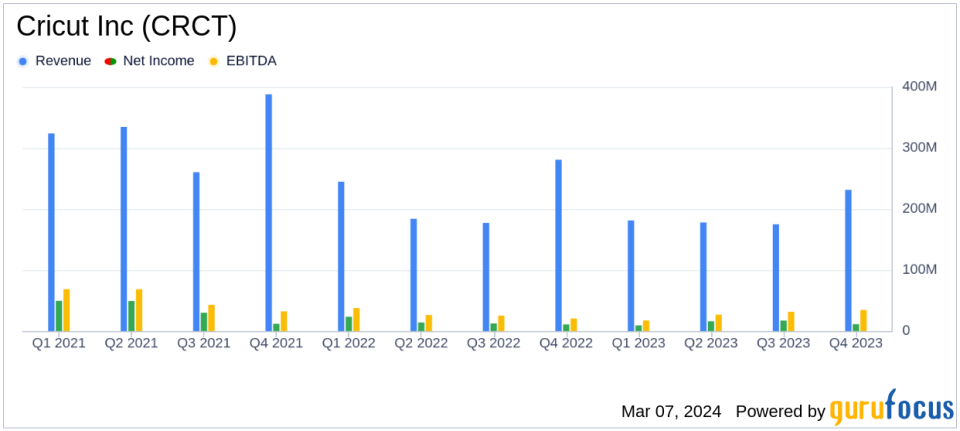

Cricut Inc (CRCT) Navigates Challenging Market with Profitable FY 2023 Despite Revenue Decline

Net Income: Achieved $53.6 million with a 7.0% margin in FY 2023.

Revenue: Reported a 14% decline in FY 2023 revenue, totaling $765.1 million.

Operating Cash Flow: Generated $288.1 million in cash from operations in FY 2023.

Subscribers: Paid subscribers increased to 2.77 million, a 6% growth over FY 2022.

Gross Margin: Improved to 44.9% in FY 2023 from 39.5% in FY 2022.

Stock Repurchase: Completed a $50 million stock repurchase program.

User Growth: Total user base grew to over 8.9 million, a 13% increase from FY 2022.

Cricut Inc (NASDAQ:CRCT) released its 8-K filing on March 5, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, known for its creativity platform that enables users to produce professional-looking handmade goods, faced a challenging year with a decline in sales but managed to maintain profitability and a strong cash flow.

Financial Performance and Challenges

Cricut Inc's revenue for FY 2023 was $765.1 million, a 14% decrease compared to the previous year. Despite this, the company delivered its seventh consecutive year of profitability, with net income of $53.6 million, representing a 7.0% margin. The decline in revenue was attributed to an 18% fall in Q4 sales and a full-year drop of 14%. CEO Ashish Arora acknowledged the disappointment in the sales figures but remained optimistic about the company's profitability and the positive impact of Q4 promotions, albeit smaller than expected.

"We moved through 2023 focused on profitability even as we navigated a dynamic consumer discretionary environment. We are encouraged by our 49% operating income increase in Q4 year over year and the positive uplift from our promotions in Q4. However, we were disappointed that sales fell in the quarter and full year by 18% and 14%, respectively. Our promotions uplift was smaller than we expected and is attributable in part to lower retailer inventory, but in hindsight, we could have conducted more aggressive marketing and promotions." - Ashish Arora, CEO of Cricut Inc.

The company's gross margin improved significantly to 44.9% in FY 2023 from 39.5% in FY 2022, reflecting a stronger pricing discipline and cost management. Operating income was $70.0 million, or 9.1% of total revenue, compared to $80.0 million, or 9.0% of revenue in FY 2022. The diluted earnings per share (EPS) was $0.24, down from $0.28 in FY 2022.

Financial Achievements and Importance

Despite the sales decline, Cricut Inc's financial achievements in FY 2023 are noteworthy. The company generated a robust $288.1 million in cash from operations, a significant increase from $118 million in 2022. This strong cash flow supports inventory needs and investments for long-term growth. Additionally, the company completed its $50 million stock repurchase program, underscoring its commitment to delivering shareholder value.

"Although sales were below expectations and the baseline run rate outside of promotional periods continues to be softer than we would have expected, I am encouraged by operating income, which rose 49% in Q4, and we achieved our 20th consecutive quarter of positive net income. We continue to produce strong cash flow on a yearly basis, which supports inventory needs and investments for long-term growth. In 2023, we generated $288 million in cash from operations, compared to $118 million in 2022." - Kimball Shill, CFO of Cricut Inc.

The company's ability to maintain a high gross margin and increase its operating income percentage, even with lower sales, demonstrates its resilience and operational efficiency. These financial achievements are particularly important for a hardware company like Cricut Inc, as they allow for continued investment in product development and market expansion, which are crucial for long-term success in the industry.

Key Financial Metrics and Analysis

Key financial metrics from Cricut Inc's earnings report highlight the company's performance and strategic focus areas:

Connected machine revenue decreased to $198.3 million in FY 2023 from $252.6 million in FY 2022.

Subscriptions revenue increased to $304.0 million in FY 2023, up from $272.3 million in FY 2022.

Accessories and materials revenue declined to $262.8 million in FY 2023 from $361.4 million in FY 2022.

International revenue grew to $155.2 million, accounting for 20% of total revenue, compared to $142.3 million or 16% of total revenue in FY 2022.

The increase in subscriptions revenue is a positive indicator of the company's growing user base and recurring revenue stream, which is vital for stability and predictability in financial performance. The decline in accessories and materials revenue, however, suggests a potential area for strategic focus and improvement.

Overall, Cricut Inc's financial performance in FY 2023 reflects a company that is navigating a challenging market with a strong focus on profitability and cash flow generation. While sales have declined, the company's operational efficiency and strategic initiatives, such as stock repurchases and segment reporting changes, position it for potential growth and success in the future.

For more detailed information and to access the full earnings report, visit Cricut Inc's investor relations website or follow the company's updates on the Cricut News Blog.

Explore the complete 8-K earnings release (here) from Cricut Inc for further details.

This article first appeared on GuruFocus.