CRISPR (CRSP) to Report Q4 Earnings: What's in the Cards?

We expect investors to focus on the updates related to CRISPR Therapeutics AG’s CRSP pipeline candidates when it reports fourth-quarter 2022 results.

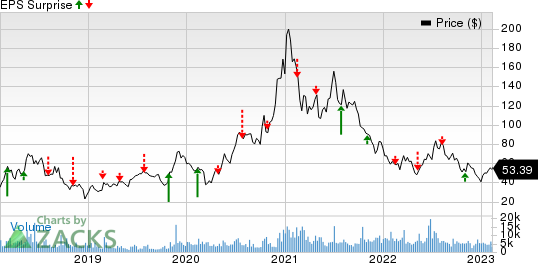

Shares of CRISPRTherapeutics have declined 13.8% in the past year compared with the industry’s decline of 9.1%.

Image Source: Zacks Investment Research

CRSP’s earnings surpassed expectations in only one of the trailing four quarters and missed thrice, the average negative surprise being 8.06%. In the last reported quarter, CRISPR Therapeutics’ earnings beat estimates by 2.61%.

CRISPR Therapeutics AG Price and EPS Surprise

CRISPR Therapeutics AG price-eps-surprise | CRISPR Therapeutics AG Quote

Let’s see how things have shaped up for the quarter to be reported.

Factors to Note

In the absence of an approved/marketed product in its portfolio, the focus of the fourth quarter earnings is anticipated to be on updates related to the pipeline of CRISPR Therapeutics.

CRISPR Therapeutics’ top line comprises grants and collaboration revenues earned by CRSP from its partnership with large-cap biotech Vertex Pharmaceuticals VRTX.

The company, in collaboration with Vertex Pharmaceuticals, is developing exagamglogene autotemcel (exa-cel, formerly CTX001), an investigational ex-vivo CRISPR gene-edited therapy in two separate phase III studies for sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT). Last November, CRSP and VRTX initiated a rolling biologics licensing application (BLA) submission seeking approval for exa-cel in SCD and TDT indications. Vertex Pharmaceuticals expects to complete the submission by the end of first-quarter 2023.A regulatory submission for exa-cel in both SCD and TDT indications has already been validated in Europe.

CRISPR and Vertex are also evaluating exa-cel in pediatric patients with TDT and SCD in two separate phase III studies.

CRISPR Therapeutics is also developing two gene-edited allogeneic cell therapy programs, chimeric antigen receptor T cell (CAR-T) candidates, CTX110 and CTX130, for hematological and solid tumor cancers.

Last December, management announced data from the phase I CARBON study, which evaluated CTX110 in relapsed/refractory B-cell malignancies. Data from the study showed the benefits of consolidation dosing with CTX110, including a further improvement in the efficacy profile in study participants. Based on these results, management started a phase II study evaluating the consolidation regimen of CTX110.

CTX130 is being evaluated in two ongoing independent early-stage studies to evaluate the safety and efficacy of several dose levels of the candidate in adults with solid tumors such as renal cell carcinoma (COBALT-RCC study) and certain T-cell and B-cell hematologic malignancies (COBALT-LYM study).

CRISPR is also advancing several next-generation CAR-T product candidates, namely — CTX112 targeting CD19 antigen and CTX131 targeting CD70 antigen. These candidates have been designed to enhance CAR-T potency. An early-stage study on CTX112 is expected to start in first-half 2023.

Activities related to the development of pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for CRISPR Therapeutics this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: CRISPR Therapeutics has an Earnings ESP of 0.00% as both the Zacks Consensus Estimate and Most Accurate Estimate are pegged at a loss of $2.32.

Zacks Rank: CRISPR Therapeutics currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks worth considering from the overall healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Arcus Biosciences RCUS has an Earnings ESP of +29.01% and a Zacks Rank #1.

Arcus Biosciences’ stock has declined 32.7% in the past year. Earnings of RCUS beat estimates in two of the last four quarters, missed the mark on one occasion and met the mark on another. On average, Arcus Biosciences witnessed a trailing four-quarter positive earnings surprise of 56.74%, on average. In the last reported quarter, RCUS’s earnings beat estimates by 14.29%.

Syndax Pharmaceuticals SNDX has an Earnings ESP of +4.39% and a Zacks Rank #1.

Syndax Pharmaceuticals’ stock has surged 70.0% in the past year. Syndax Pharmaceuticals beat estimates in three of the last four quarters while meeting the mark on one occasion. Syndax Pharmaceuticals has delivered an earnings surprise of 95.39%, on average. In the last reported quarter, SNDX reported an earnings surprise of 10.77%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report