Criteo SA CEO Megan Clarken Sells 5,442 Shares: An Insider Sell Analysis

In the dynamic world of the stock market, insider transactions often attract the attention of investors seeking clues about a company's future performance. Recently, Megan Clarken, the CEO of Criteo SA (NASDAQ:CRTO), sold 5,442 shares of the company, prompting a closer look at the implications of this insider activity.

Who is Megan Clarken?

Megan Clarken is a prominent figure in the digital advertising industry, serving as the Chief Executive Officer of Criteo SA. With a career spanning various leadership roles, Clarken has been instrumental in steering Criteo's strategic direction and growth. Her expertise in digital marketing and advertising technology has been a key factor in Criteo's success in the competitive ad-tech landscape.

About Criteo SA

Criteo SA is a global technology company that provides marketers with a comprehensive suite of advertising solutions. The company specializes in performance display advertising, leveraging large-scale data sets, sophisticated algorithms, and deep insights into consumer behavior to deliver targeted and effective advertising campaigns. Criteo's technology enables e-commerce companies to engage and convert online shoppers by displaying personalized ads across various devices and channels.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions can be a valuable indicator of a company's health and future prospects. When insiders buy shares, it is often interpreted as a sign of confidence in the company's growth potential. Conversely, insider selling can raise questions about the insider's belief in the company's future performance.

Over the past year, Megan Clarken has sold a total of 130,117 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that the insider may perceive the stock's current price as a favorable selling point or may be diversifying their investment portfolio for personal financial planning.

The insider transaction history for Criteo SA shows a trend of more insider selling than buying over the past year, with 25 insider sells and only 1 insider buy. This trend could indicate that insiders, on the whole, have been more inclined to sell their shares than to acquire more.

On the day of Clarken's recent sale, shares of Criteo SA were trading at $24.79, giving the company a market cap of $1.392 billion. The price-earnings ratio of 224.36 is significantly higher than the industry median of 17.52 and above the company's historical median, suggesting a premium valuation compared to its peers.

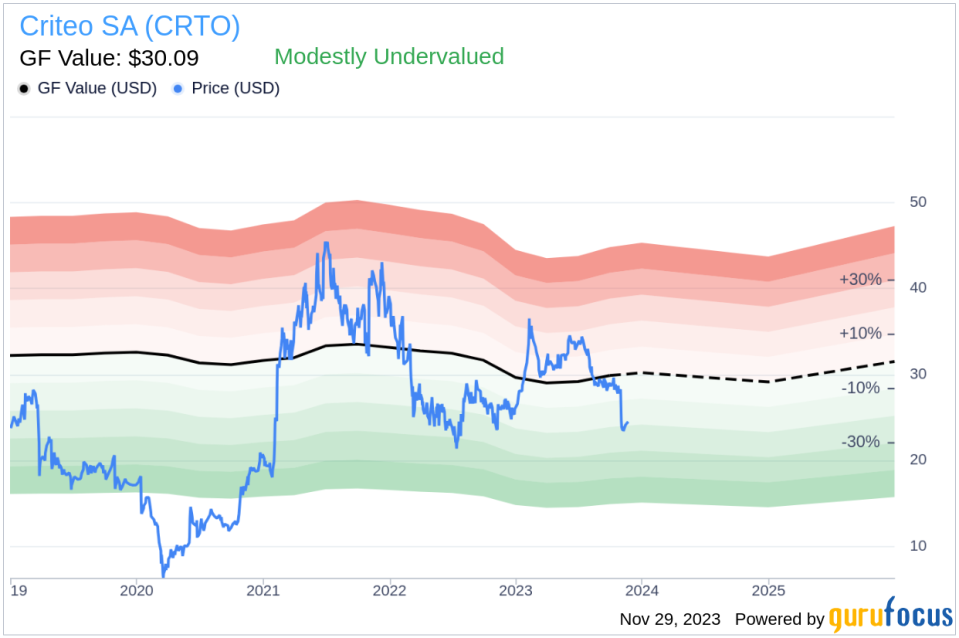

However, with a price of $24.79 and a GuruFocus Value of $30.09, Criteo SA has a price-to-GF-Value ratio of 0.82, indicating that the stock is modestly undervalued based on its GF Value. This discrepancy between the high price-earnings ratio and the GF Value assessment could be a point of analysis for investors considering the stock's true worth.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. This comprehensive approach to valuation aims to provide a more nuanced view of a stock's intrinsic value.

The insider trend image above provides a visual representation of the selling and buying activities of insiders, which can be a useful tool for investors trying to gauge market sentiment.

The GF Value image offers insight into how the stock's current price compares to its estimated intrinsic value, helping investors determine if the stock is overvalued, fairly valued, or undervalued.

Conclusion

While insider selling can be interpreted in various ways, it is essential for investors to consider the broader context of the company's performance, industry trends, and market conditions. Megan Clarken's recent sale of Criteo SA shares may raise questions, but the stock's modest undervaluation according to the GF Value suggests potential for future growth. Investors should conduct their due diligence, considering both insider activity and comprehensive valuation metrics, before making investment decisions.

As with any investment, it is crucial to look beyond a single factor such as insider selling and consider a holistic view of the company's financial health, competitive position, and growth prospects. Criteo SA's future performance will ultimately be determined by its ability to innovate and adapt in the ever-evolving digital advertising space.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.