Criteo SA (CRTO) Posts Record Q4 2023 Results with Strong Profitability and Revenue Stability

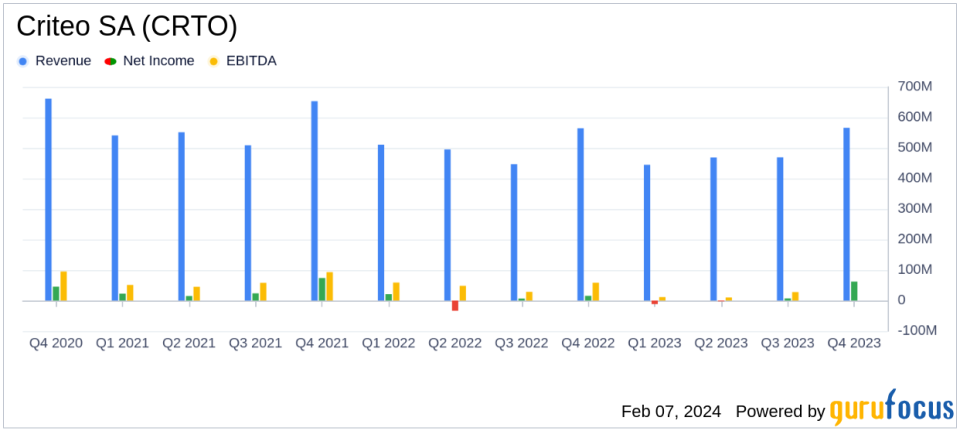

Revenue Stability: Q4 2023 revenue remained stable at $566 million, with a full-year total of $1.9 billion.

Gross Profit Growth: Q4 gross profit rose by 12% year-over-year to $277 million, contributing to a 9% increase for the fiscal year.

Net Income Surge: Net income for Q4 skyrocketed by 287% to $62 million, and an impressive 402% increase for the year.

Adjusted EBITDA and EPS: Adjusted EBITDA for Q4 climbed 33% to $139 million, with adjusted diluted EPS up by 81% to $1.52.

Free Cash Flow: Q4 free cash flow jumped 28% to $142 million, despite a 45% decrease for the fiscal year.

Share Buyback: CRTO deployed $125 million for share repurchases in 2023 and increased its buyback authorization by $150 million.

2024 Outlook: CRTO targets mid-single-digit growth in Contribution ex-TAC at constant currency for the fiscal year 2024.

On February 7, 2024, Criteo SA (NASDAQ:CRTO) released its 8-K filing, disclosing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The Paris-headquartered ad-tech company, renowned for its real-time digital advertising technology and cross-device marketing campaigns, reported a record fourth quarter with activated media spend increasing by 30% to $4.1 billion.

Financial Performance and Challenges

Criteo SA (NASDAQ:CRTO) demonstrated resilience in its Q4 2023 performance with a slight revenue increase to $566 million, while gross profit grew by 12% to $277 million, indicating a robust gross profit margin of 49%. The company's net income saw a substantial rise to $62 million, a 287% increase compared to the same period last year, reflecting strong profitability.

Despite these achievements, the company faced a 3% year-over-year decline in annual revenue, closing at $1.9 billion. This was accompanied by a 45% decrease in free cash flow for the fiscal year, which may pose challenges in sustaining investment and operational flexibility. However, the company's focus on cost efficiencies resulted in over $70 million in savings and a 30% adjusted EBITDA margin for the year.

Financial Achievements and Industry Impact

The company's financial achievements are particularly significant in the Media - Diversified industry, where competition is fierce and innovation is critical. Criteo SA (NASDAQ:CRTO)'s ability to maintain revenue stability and achieve double-digit growth in gross profit and net income highlights its competitive edge and operational efficiency.

Moreover, the company's share repurchase initiative and increased buyback authorization underscore a commitment to shareholder value. The strong performance in Retail Media, with a 29% year-over-year growth in Contribution ex-TAC at constant currency, reflects Criteo's strategic positioning and potential for future growth within the digital advertising market.

Key Financial Metrics and Commentary

Key metrics from the income statement, such as the 529% increase in diluted EPS to $0.88 for the fiscal year, and the 13% rise in adjusted EBITDA to $302 million, demonstrate Criteo's strong earnings power. The balance sheet shows a solid cash and cash equivalents position of $336 million, despite a 3% decrease from the previous year.

We achieved double-digit growth for the second consecutive year, with a historic milestone of crossing $1 billion in Contribution ex-TAC for the first time and Retail Media now surpassing $200 million in annual revenue, said Megan Clarken, Chief Executive Officer of Criteo. As we step into 2024, we look forward to harnessing the opportunities that lie ahead, and our commitment remains steadfast towards sustainable, profitable growth to drive shareholder value.

Analysis and Future Prospects

Criteo SA (NASDAQ:CRTO)'s performance in Q4 2023 and the fiscal year reflects a company that is adept at navigating the complexities of the digital advertising space. The company's strategic initiatives, such as the expansion of its platform adoption to 2,600 brands and 220 retailers, and its sustainability-linked credit facility, position it well for future growth.

Looking ahead, Criteo SA (NASDAQ:CRTO) is targeting mid-single-digit growth in 2024, with an adjusted EBITDA margin of approximately 29% to 30% of Contribution ex-TAC. This outlook, combined with the company's record performance and strategic investments, suggests a positive trajectory for Criteo in the coming year.

For a detailed understanding of Criteo SA (NASDAQ:CRTO)'s financials, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Criteo SA for further details.

This article first appeared on GuruFocus.